“There is a great satisfaction in building good tools for other people to use.”

Freeman Dyson

Abstract

This article summarizes the author’s recent research into the fit between software-as-a-service (SaaS) tools and the requirements of particular business units. First, an overview of SaaS is provided, including a summary of its benefits to users and software vendors. Next, the approach used to gather and analyze data about the SaaS solutions offered on the Force.com AppExchange is outlined. Finally, the article describes the managerial implications of this research.

Introduction

SaaS is software that is deployed over the Internet to be run on local machines. This is a cloud-based software distribution model in which vendors host applications and manage their infrastructure and online delivery to customers. SaaS has become popular recently, in part due to advances in software and hardware that make this approach feasible, but also because of reduced cost and increased availability of bandwidth. As a result, it is now affordable for companies to acquire the level of connectivity required to allow online applications to perform well.

SaaS provides a number of benefits to both consumers and vendors. For customers, SaaS relieves them of the frustration of high up-front costs and vendor lock-in associated with the traditional software buying cycle, in which the purchase of software licenses is followed by time-consuming and expensive upgrades. Instead, SaaS give customers greater control over their software expenditures through flexible payment models, such as monthly subscriptions, “pay per use” or “pay per transaction” models, or payments linked to the achievement of business goals. SaaS provides greater accessibility and mobility. It also makes IT administration considerably easier and cheaper since the service typically includes maintenance and perhaps support as well. A company can rapidly scale up or down to meet changing demands. There is also no client/server installation or maintenance, even for upgrades, which happen frequently and automatically at the host side. It also provides companies with greater freedom to switch to another provider.

For vendors, SaaS provides a predictable and steady revenue stream that can be reliably forecasted. The ability to closely monitor a customer’s usage also provides insights into further development and sales opportunities. Also, since the software is hosted by the vendor, it is easier to deploy small, incremental upgrades and defect fixes compared with rolling out patches to on-premise software.

Today, SaaS provides alternatives to on-premise software in most industries and there are many applications available to support business activities across various business units, including sales, marketing, support, project management, finance, human resources, and information technology. However, it can be difficult for users to find the tools that are best suited to the requirements of their specific department and industry. While the wide availability of SaaS solutions means that users benefit from a variety of options to choose from, there is an accordingly large increase in the time required to research the right tool for a specific business requirement.

This article summarizes recent research by the author to analyze the factors that differentiate various SaaS supplier offerings so that potential customers can save time finding suitable tools to meet their needs. This research is relevant to business system managers and IT managers who are responsible for providing their organization with high-value products and applications that are adaptable and cost-effective. It will help them identify the applications that will promote efficiency and productivity within their organization. This research is also relevant to SaaS vendors because it will help them identify areas of saturation and opportunity within the market, as well as informing their sales strategy.

Research Approach and Findings

As part of the author's Master’s thesis in the Technology Innovation Management program in Ottawa, a study was conducted of 431 SaaS firms active within the Force.com cloud-based platform for SaaS business applications. Force.com allows external developers to create add-on applications that integrate into the main SalesForce application and are hosted on SalesForce.com's infrastructure. The directory of applications built for SalesForce by third-party developers is known as the AppExchange. At the time the data were gathered, the AppExchange offered more than 1000 SaaS applications.

The study used a data-mining technique to extract patterns from the data, which in this case were keywords relating to the different types of SaaS offers available and their relevance to the functions of different business units. The business units studied were sales, marketing, product management, support and maintenance, project management, human resources, finance, and information technology.

The data-mining technique began with the selection of keywords related to the functions of a firm’s different business units. The extensive search process for selecting keywords included both functional and non-functional criteria. Functional criteria cover the major functions for which the department would use the software application, including keywords such as “sales pipeline” and “lead scoring” for sales software. On average, 14 functional criteria keywords were selected for each business unit in the study. Non-functional criteria include the add-on benefits of the software application, including its price, level of support, popularity, and user rating.

Next, data were gathered from each of the 431 webpages of businesses within the AppExchange section of Force.com. The data included information relating to the non-functional criteria, such as the product name, the product or firm’s website, and the application’s price, popularity, support options, and user rating.

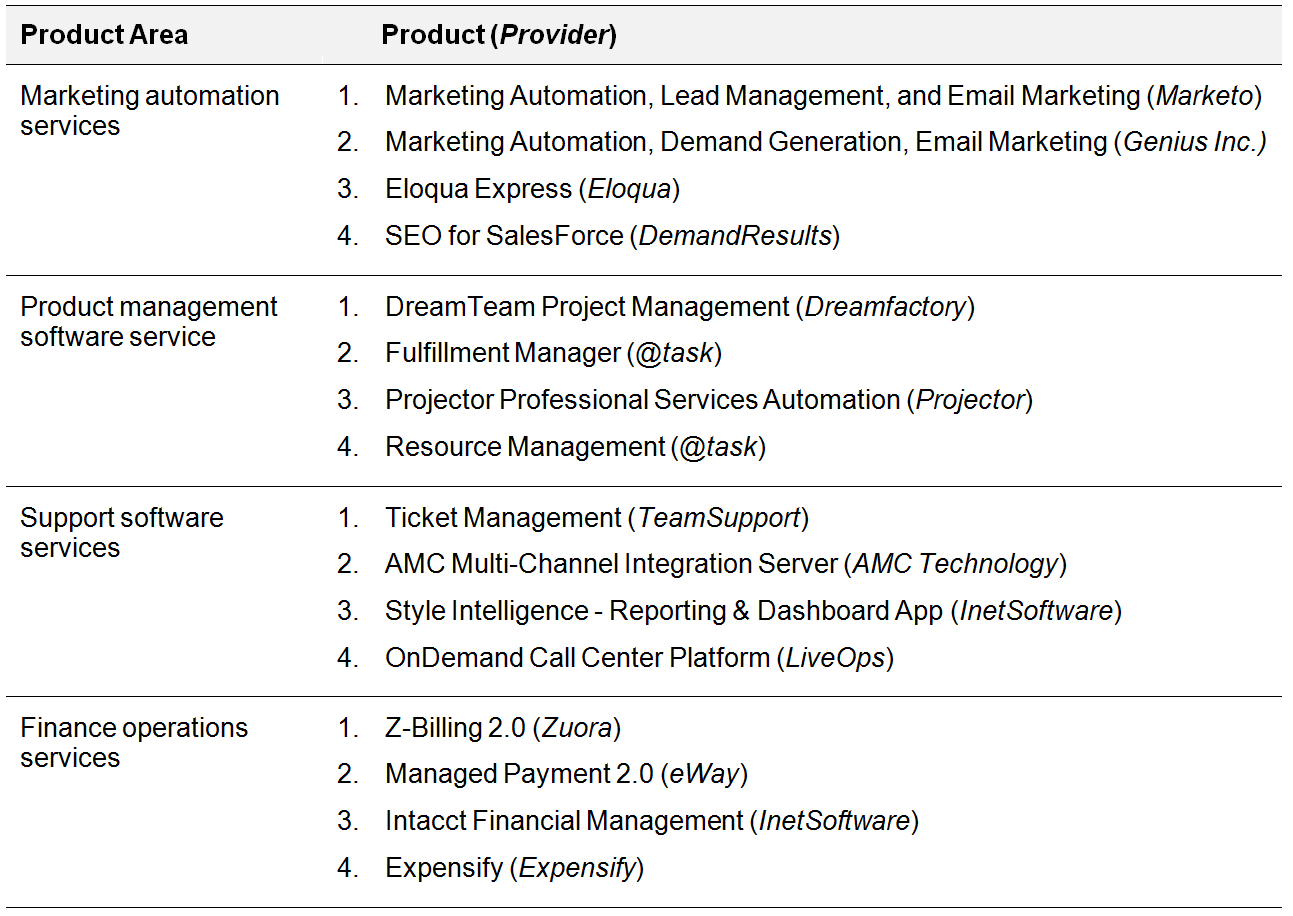

After all the product names and their corresponding websites were gathered and documented, a keyword search tool was used to assess the content of each website against the selected keywords (functional criteria). The results indicate the level of fit between a particular offer and a business unit’s requirements. Table 1 provides a sample of the results by listing the top products for each cluster, or product area.

Table 1. Top Products by Cluster

General Managerial Insights

The detailed research results identified the firms that offer SaaS solutions best suited to the needs of relevant business units. Here, the general managerial insights from this research are summarized:

-

Marketing solutions in the AppExchange are plentiful. Solutions offering marketing automation and integrated marketing communication are highly rated, supported, and popular. Relationship marketing solutions are highly rated but are not popular.

-

There are not many SaaS products designed specifically for sales in the AppExchange; most products in the AppExchange are marketing solutions. However, quote management solutions are popular. Together, quote generation and tracking form one cluster because they share related functions within quote management software.

-

Support and maintenance SaaS tools have average ratings and not many reviews, perhaps because most support and maintenance software is built in-house. Also, users may not be ready to take advantage of the support and maintenance SaaS tools available

-

Most support services, helpdesk, and customer services tools share the same feature sets, but are used in different ways. Support services tools are mainly used by customers and include ticket management and workflow features. Helpdesk tools are used by both customers and internal users; the user interface is very important in this context. Customer service tools can be used by many business units other than support and maintenance and related products are accordingly flexible.

-

There is room for SaaS vendors to provide product management software tools for comparing pricing, functionality, and benefits.

-

The popularity of tools for support services and marketing automation may be related to the maturity of this development area. In contrast, most products for human resources are poorly rated or unpopular. Relative to the other offer types, this is a new development area for SaaS tools on Force.com

Conclusion

Users and software providers are realizing the benefits of SaaS, as shown by the popularity of applications in the Force.com AppExchange. The research summarized in this article examined the fit between SaaS tools and the requirements of particular business units. The results will save time for potential customers looking for solutions to fit their needs, and they suggest areas of opportunity where SaaS providers may wish to focus product development efforts.