AbstractValue equals benefits received for burdens endured.Leonard L. Berry,Distinguished professor of marketing,Texas A&M University

To scale company value rapidly, a new company needs to develop value propositions for diverse parties, customers, investors, partners, suppliers, employees, and other resource owners, as well as align these value propositions with its scaling objectives. The purpose of this paper is to examine the relationships between value propositions for a diverse set of parties, and efforts from a new company to scale company value rapidly. We review the value proposition literature and then examine the relationships between 19 assertions about value propositions, as well as six stable topics that best describe the SERS corpus, which is comprised of 137 assertions about scaling companies early, rapidly, and securely. Conducting a topic model of eight topics led to six stable topics: Fundraise, Enable, Position, Communicate, Innovate, and Complement. We find that of the 19 assertions about value propositions, four are connected to Complement, four to Innovate, one to Position, one to Fundraise, and one to Communicate. A total of eight assertions about value propositions are not connected to any of the six stable topics. This paper contributes to our understanding of how a new company scales company value rapidly, adding an application of topic modelling to perform small-scale data analysis. The findings are expected to be relevant to entrepreneurs and new companies worldwide.

I. Introduction

A new company committed to scaling their company value rapidly must develop value propositions for diverse parties. This includes not just identifying value propositions for customers, but also aligning these value propositions with scaling initiatives, and activities that the new company carries out to scale rapidly. This is reported as a major challenge worldwide, which we surmise is one of the main reasons why most new companies do not scale their company value rapidly.

Managing the value proposition-scaling relationship in a new company context is so far little understood. Even when companies try to shape multiple value propositions, they tend to align them only on a single customer value proposition, yet with little connection to their overall scaling objectives for the short-, mid- and long-term. Thus, many new companies do not scale because they were not in the first place designed to scale in the initial stages of their existence. Interestingly, regional business incubators and accelerators spend significant efforts helping new companies to develop their customer value propositions. These efforts, however, have not resulted in the launch of many companies that can scale company value (Ratte, 2016).

The objective of this paper is to examine the extant value proposition literature and put forward our beliefs about how value propositions relate to scaling new company value rapidly. We conceptualize the management of the value proposition-scaling relationships as being like the management of part-whole relationships (Van de Ven, 1986), wherein value propositions are the parts and scaling company value is the whole.

There is abundant literature on customer value propositions. Unfortunately, this literature is not clear on how new companies should (i) align value propositions for customers, investors, resource owners, and other relevant stakeholders, (ii) align multiple value propositions for diverse parties with specific scaling objectives, and (iii) configure internal and external resources to deliver their portfolio of value propositions.

For our research, we first used the Latent Dirichlet Allocation (LDA) algorithm (Silge & Robinson, 2017: 90) to extract topics in a collection of assertions about what a new company needs to do to scale company value rapidly. Then we described how assertions about value propositions relate to the stable topics. The collections of assertions are included in the Assertions Inventory maintained by the Scale Early, Rapidly and Securely (SERS) community. The SERS community is comprised of researchers and practitioners worldwide, who are committed to produce, disseminate, and evolve high quality resources about scaling companies (https://globalgers.org/). Each assertion is a clear and concise statement that describes an abstract company action, which can be detailed and then implemented to produce outcomes aimed at significantly increasing the value of the new company rapidly. Each statement is transparent, traceable, and regionally inclusive.

The remainder of the article gathers and provides lessons learned from reviewing the value proposition and scaling company value literature streams, describes the method used, presents the results, and provides conclusions.

II. Literature review

Value propositions

“Value proposition” is one of the most widely used terms in business (Payne et al., 2017; Anderson et al., 2006). According to Webster (2002), a value proposition should be the company’s single most important organizing principle. Lanning (2000), however, argues that “value proposition” as a term “is frequently tossed about casually and applied in a trivial fashion rather than in a much more strategic, rigorous and actionable manner.”

Much of the older literature adopts a one-sided perspective stressing that value is predetermined by the supplier, and then delivered to customers (Kowalkowski, 2011). Few researchers, however, have emphasized the importance of considering the broad range of stakeholders involved in the value creation process (Gummesson, 2006; Mish & Scammon, 2010; Frow & Payne, 2011).

Several excellent literature review papers on this topic have been published recently (Payne et al., 2017; Goldring, 2017; Eggert et al., 2018; Wouters et al., 2018). Payne et al. (2017) define a customer value proposition as, “a strategic tool facilitating communication of an organization’s ability to share resources and offer a superior value package to targeted customers” (Payne et al., 2017). For Skålén et al. (2015), value propositions are “promises of value creation that build upon configuration of resources and practices.” These definitions emphasize the need for companies’ value propositions to consider stakeholder reciprocity, as well as how different actors work together by sharing resources to initiate an offer (Ballantyne et al., 2011; Truong et al., 2012).

Eggert et al. (2018) emphasize that in business-to-business (B2B) markets a value proposition not only communicates value, but also requires the reciprocal engagement of all relevant actors. The study by Wouters et al. (2018) supports the findings of Eggert et al. (2018) and focuses on new technology companies. It argues that such new companies should have at least two value propositions for their business customers: the typical value proposition based on an innovative offer, and a leveraging assistance value proposition, which should convey what the customer company will get in return for providing support and resources. This insight suggests an opportunity to extend the research domain by studying the development of explicit value propositions for other relevant stakeholders, such as investors and external resource owners. The work by Payne and Frow (2014) suggests a process of deconstructing an exemplar organization’s value proposition in order to provide an understanding of value elements and resource configurations that could inform the practices of other companies seeking to improve their value propositions.

Value propositions for new companies that wish to scale company value rapidly

There is little systematic knowledge about the factors that enable new companies to scale company value rapidly. For example, extant literature could not explain the high international growth of a representative sample of Canadian companies (Keen & Etemad, 2012). Unfortunately, most existing research does not differentiate between “growing” and “scaling” a business. Neither does it emphasize the need to align a company’s value propositions with its scaling objectives. Such alignment implies the need to incorporate scale up objectives into companies’ business models, via the configuration of resources and activities that not only create value for customers, but that also allows companies to capture part of that value and distribute it to key resource owners (Teece, 2010; Zott & Amit, 2007). Business models should be examined in terms of scalability, meaning, “the extent to which a business model design may achieve its desired value creation and capture targets when user/customer numbers increase and their needs change, without adding proportionate extra resources” (Zhang et al., 2015).

Recent studies have advanced an explicit link between the growth orientation of new technology companies and the novelty and attractiveness of their value propositions. According to Rydehell et al. (2018), finding new and innovative ways to offer value to customers is important to achieving high sales growth, as well as rapid geographic expansion to new markets. Malnight et al. (2019), suggest that companies pursue high growth by: creating new markets, serving broader stakeholder needs, changing the rules of the game, redefining the playing field, and reshaping their value propositions. Unfortunately, these insights are difficult to operationalize in a real-life company context.

Resource-based view

The resource-based view of the company (Wernerfelt, 1984) has become influential in understanding how companies attain competitive performance gains based on their resources and capabilities (Alvarez & Barney, 2002). According to Srivastava et al. (2001), “Resource-based view research must always endeavour to identify precisely what customer value in the form of specific attributes, benefits, attitudes and network effects is intended, generated and sustained.” Clulow, Barry and Gerstman (2007) examine whether the key resources that hold value for a company also hold value for the company's customers. These studies focus on customer value only and adopt a static perspective regarding resource configuration. This perspective does not help in explaining how new companies can combine internal and external resources to shape value propositions that align with their business strategies.

Later developments of the theory attempted to explain how companies could do that in situations of rapid and unpredictable change (Teece et al., 1997; Eisenhardt & Martin, 2000). This work complemented the resource-based view of a company by focusing on the role of dynamic capabilities, that is, the main routines that allow a company to change and reconfigure its resources when the opportunity or need arises (Eisenhardt & Martin, 2000; Van de Wetering et al., 2017). Previous studies have discussed specific dynamic capabilities routines, such as reconfiguring, learning, integrating, and coordinating (Teece et al., 1997), as well as sensing the environment to seize opportunities and reconfigure assets (Teece, 2007).

According to Van de Wetering et al. (2017), dynamic capabilities are comprised of five dimensions: (i) sensing, (ii) coordinating, (iii) learning, (iv) integrating, and (v) reconfiguring. The authors used these dimensions to develop a strategic alignment model between information technology resource flexibility and the dynamic capabilities of a sample of 322 international companies. Information technology resource flexibility was defined as the degree of decomposition of an organization’s IT resource portfolio into loosely coupled subsystems that communicate through standardized interfaces. It was conceptualized as having four dimensions: (i) loose coupling, (ii) standardization, (iii) transparency, and (iv) scalability. Van de Wetering et al. (2017) suggest a positive correlation between a company’s degree of aligning information technology resource flexibility and dynamic capability dimensions, and a company’s performance.

III. Method

We first use the Latent Dirichlet Allocation (LDA) algorithm (Blei et al., 2003; Blei, 2012) to build a topic per assertion model, and a keywords per topic model, both modeled as Dirichlet distributions. We then describe the connections between the stable topics and (i) the keywords, as well as (ii) the value proposition assertions included in the corpus.

LDA considers every assertion to be a mixture of topics, and every topic to be a mixture of words. Words can be shared between topics and the topics can be shared among assertions. LDA identifies combinations of words that tend to appear together in a way that suggests that specific topics are latently present in the corpus of assertions. In addition, LDA organizes the corpus by clustering the assertions that correspond to each topic. The assertions in each cluster are ranked in terms of the degree of their association with each topic. The topical organization of the assertions enables the thematic substantiation of the topics through a closer examination of the assertions (Boyd-Graber et al., 2017).

Assertions about how a new company can scale company value rapidly

The core team of the SERS community has developed and maintains an inventory of assertions about what companies should do to scale early, rapidly, and securely. The inventory currently includes 137 assertions. The assertions make explicit what is understood about increasing the value of a new company from examining: (i) 733 articles published in 99 peer-refereed academic journals since 2007, (ii) Companies from 22 countries that have increased their company value to over $1 billion USD since January 1, 2010, and (iii) Experience gained while applying the assertions to increase company value.

Topic model

Topic modeling was done using Orange 3.24.1 (Orange, 2020) to extract latent topics from the corpus comprised of 137 assertions and investigate the relationship between the 19 specific value proposition assertions and the topics extracted from the corpus. Each topic represents a set of words extracted from the 137 assertions. The topic-word connection is based on how well the word fits with the topic, while the topic-assertion connection is made based on what topics the assertion addressed. The number of topics used to produce the topic model ranged from 3 to 10. The decision on the number of topics of the final model was made by the authors of the paper based on the joint assessment of the weights of the assertions per topic.

Topic stability

Topic stability was determined by running the final model four times, manually assessing the consistency of topics appearing across the four model runs and topic quality (Xing & Paul, 2018). For each topic, we determined that a topic was stable if five or more keywords appeared repeatedly in the four runs of the final model, and if the weights of the keywords were greater than 2. Topic quality was determined based on a joint judgment of the paper’s authors.

Relationship between value proposition assertions and topics

For each topic (regardless whether stable or unstable), the assertions were categorized by topic loading into (i) Equal or greater than 0.6, and (ii) Less than 0.6.

Labelling and describing topics

To label and succinctly describe the topics, we used keywords and assertions with a topic loading greater than 0.6, along with our expertise in examining the content of the text documents (that is, assertions) associated with specific topics.

IV. Results

Corpus

The corpus is comprised of 137 assertions that are expressed using 2,591 keywords. On average, each assertion has 19 words. Of the 137 assertions, 19 refer to value propositions. Appendix A identifies the 19 value proposition assertions that were derived from articles discussed in the Literature Review section.

Number of topics

The topic modeling analysis iterated between three and ten topics. The authors decided that the best model was the one that had eight topics because the number of assertions that had topic loadings greater than .6 was at least 3 for each of the four model runs, and the results made the most sense in the context of the research topic.

Keyword distribution of four runs of the final topic model

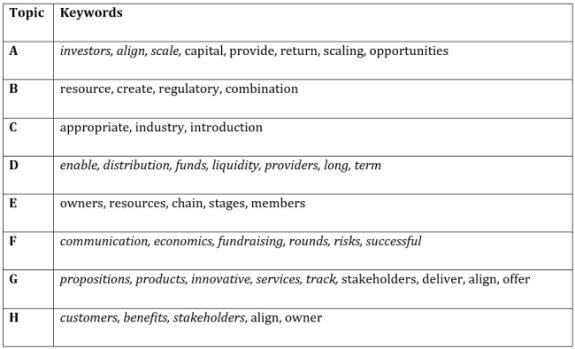

Table 1 provides the keyword distribution for eight topics resulting from four runs of the topic model. Each run provided slightly different results in terms of the composition, ordering, and ranking of words. This is due to the probabilistic nature of the LDA method, which requires performing and comparing multiple runs using the same number of topics.

In Table 1, the rows show the keywords associated with each topic. The keywords appeared in all four runs of the topic model. The keywords shown in plain text appeared in 3 of the 4 runs of a topic model. The other keywords are not shown.

Table 1. Distribution of keywords that appeared at least three times in the four runs of the topic model

Six of the eight topics (that is, Topics A, D, E, F, G, and H), were deemed to be stable because at least five keywords appeared three or four times during the four runs of the model, and each had a weight greater than 2. Stable topics

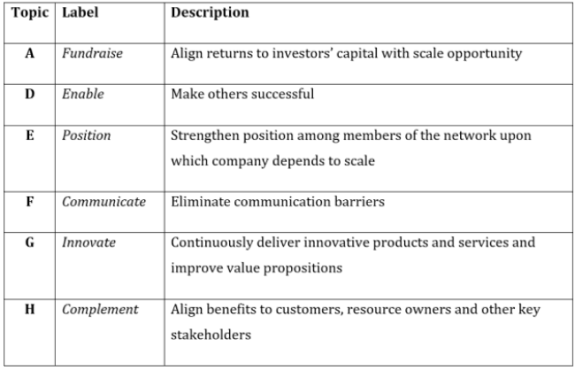

Labelling and describing topics

Table 2 provides the topic labels and succinct descriptions of the six topics deemed to be stable. Each topic description built on the keywords shown in Table 1.

Table 2. Topic labels and succinct descriptions

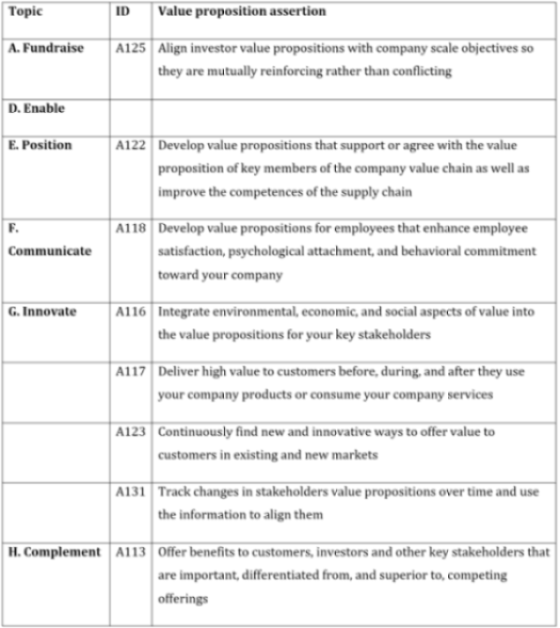

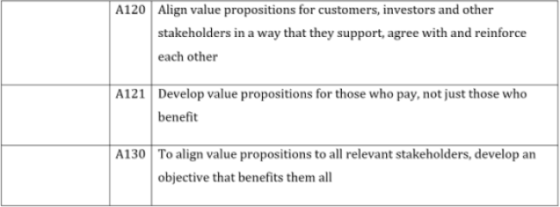

Relationship between 19 value proposition assertions and topics

Table 3 provides the 11 value proposition assertions found to be connected to the six stable topics. A value proposition was connected to a topic if its topic loading was equal to or greater than 0.6.

Table 3. Value proposition assertions connected to stable topics

V. Discussion

The topic model results suggest that the initiatives that new companies carry out to scale company value rapidly, can be organized into six topics: Fundraise (align returns to investor capital with scale opportunity); Enable (make others successful); Position (strengthen position among members of the network upon which a company depends to scale); Communicate (eliminate communication barriers); Innovate (continuously deliver innovative products and services and improve value propositions), and Complement (align benefits to customers, resource owners and other key stakeholders).

The 11 value proposition assertions are connected to five of the six stable topics. By “connected”, we mean that a value proposition has a topic loading equal to or greater than 0.6. Of the 11, eight value proposition assertions are connected to two topics: Complement and Innovate. The four value proposition assertions connected to the Complement topic focus on aligning value propositions across parties, and offering benefits to multiple parties, not just customers.

The topic Innovate includes four value proposition assertions that focus on 1) integrating social impact aspects of value into the value propositions for all parties, 2) delivering high value to customers before, during, and after they use products or consume services, 3) innovating to create new value; and 4) tracking value propositions.

The value proposition assertion for employees is connected to Communicate, for investors relates to Fundraising, and for value chain members with Positioning.

VI. Conclusions

We reviewed the literature on value propositions and found that there is a need for a better understanding of how new companies manage the relationships between their value propositions to diverse parties, as well as what their initiatives are to scale company value rapidly.

We used topic modelling to examine the relationship between 19 assertions about value propositions and topics extracted from a corpus comprised of 137 assertions about how new companies scale rapidly.

We argue that entrepreneurs should use a multi-party perspective to develop value propositions for their new companies, beyond just a customer value proposition perspective. We also argue that initiatives to scale company value rapidly can be organized into six main topics, and that value propositions to multiple parties are connected to five of these six topics.

The paper’s methodology also contributes to the literature on topic modeling. First, it demonstrates how practical insights can be extracted from a small data set, and second it offers a process to measure topic stability for more robust modeling, which researchers can use in future studies.

Acknowledgements

We wish to sincerely thank Professor Michael Weiss and Mr. Daniel Craigen of Carleton University’s Technology Innovation Management program, Eduardo Bailetti, CEO of ScaleCamp, and Rahul Yadav, a graduate student in the Technology Innovation Management program for their various contributions to this paper.

References

Alvarez, S., Barney, J. 2002. Resource‐based theory and the entrepreneurial firm. Ch. 5 in: Strategic entrepreneurship: Creating a new mindset, Hitt, M., Ireland, R., Camp, M, & Sexton, D., Eds. Blackwell Publishing: 87–105.

Anderson, J., Narus, J., Van Rossum, W. 2006. Customer VPs in business markets. Harvard Business Review, 84(3): 91–99.

Ballantyne, D., Frow, P., Varey, R., Payne, A. 2011. VPs as communication practice: Taking a wider view. Industrial Marketing Management, 40: 202–210.

Blei, D. 2012. Probabilistic Topic Models. Communications of the ACM, 55 (4): 77–84.

Blei, D., Ng, A., & Jordan, M. 2003. Latent Dirichlet Allocation. Journal of machine Learning research, 3: 993–1022.

Boyd-Graber, J., Hu, Y. and Mimno, D. 2017. Applications of topic models. Foundations and Trends® in Information Retrieval, 11(2-3): 143-296

Eggert, A., Ulaga, W., Frow, P., Payne, A. 2018. Conceptualizing and communicating value in business markets: From value in exchange to value in use. Industrial Marketing Management, 69: 80–90.

Eisenhardt, K., Martin, J. 2000. Dynamic capabilities: what are they? Strategic Management Journal, 21(10–11): 1105–1121.

Frow, P. & Payne, A. 2011. A stakeholder perspective of the value proposition concept. European Journal of Marketing, 45(1/2): 223–240.

Goldring, D. 2017. Constructing brand VP statements: a systematic literature review. Journal of Marketing Analytics, 5(2): 57–67.

Gummesson, E. 2006. Many to many marketing as grand theory. In R. F. Lusch & S. L. Vargo (Eds.), The service dominant logic of marketing. Armonk: M. E. Sharpe, pp. 339–353.

Keen, C., Etemad, H. 2012. Rapid growth and rapid internationalization: the case of smaller enterprises from Canada. Management Decision, 50(4): 569–590.

Kowalkowski, C. 2011. Dynamics of value propositions: Insights from service-dominant logic. European Journal of Marketing, 45(1/2): 277–294.

Lanning, M. 2000. Delivering profitable value: A revolutionary framework to accelerate growth, generate wealth, and rediscover the heart of business. Cambridge, MA: Perseus Press.

Mish, J., & Scammon, D. L. 2010. Principle-based stakeholder marketing. Journal of Public Policy & Marketing, 29(1): 12–26.

Malnight, T., Buche, I., Dhanaraj, Ch. 2019. Put Purpose at the CORE of Your Strategy. Harvard Business Review, 97(5): 70–78.

Orange (2020): https://orange.biolab.si/

Payne, A., Frow, P., Eggert, A. 2017. The customer VP: evolution, development, and application in marketing. Journal of the Academy of Marketing Science, 45(4): 467–489.

Payne, A., Frow, P. 2014. Deconstructing the value proposition of an innovation exemplar. European Journal of Marketing, 48(1/2): 237–270.

Ratté, S. 2016. The Scale Up Challenge: How Are Canadian Companies Performing? Business Development Bank of Canada: https://www.bdc.ca/en/about/sme_research/pages/the-scale-up-challenge.aspx

Rydehell, H., Löfsten, H., Isaksson, A. 2018. Novelty-oriented value propositions for new technology-based companies: Impact of business networks and growth orientation. The Journal of High Technology Management Research, 29(2): 161–171.

Skålén, P., Gummerus, J., von Koskull, C., Magnusson, P. 2015. Exploring value propositions and service innovation: A service-dominant logic study. Journal of the Academy of Marketing Science, 43(2): 137–158.

Srivastava, R., Fahey, L., Christensen, H. 2001. The resource-based view and marketing: the role of market-based assets in gaining competitive advantage. Journal of Management, 27: 777–802.

Teece, D. 2010. Business models, business strategy and innovation. Long Range Planning, 43(2–3): 172–194.

Teece, D. 2007. Explicating dynamic capabilities: the nature and microfoundations of (sustainable) enterprise performance. Strategic Management Journal, 28(13): 1319–1350.

Teece, D., Pisano, G., Shuen, A. 1997. Dynamic Capabilities and Strategic Management. Strategic Management Journal, 18(7): 509–533.

Truong, Y., Simmons, G., Palmer, M. 2012. Reciprocal value propositions in practice: Constraints in digital markets. Industrial Marketing Management, 41(1): 197–206.

Van de Ven, A.H. 1986. Central problems in the management of innovation. Management science, 32(5): 590-607.

Van de Wetering, R., Mikalef, P., Pateli, A. 2017. A strategic alignment model for IT flexibility and dynamic capabilities: Toward an assessment tool. Proceedings of the Twenty-Fifth European Conference on Information Systems (ECIS): Guimarães, Portugal.

Webster, F. 2002. Market-driven management: How to define, develop and deliver customer value (2nd ed.). Hoboken: John Wiley & Sons.

Wernerfelt, B. 1984. A resource-based view of the firm. Strategic Management Journal, 5(2): 171–180.

Wouters, M., Anderson, J., Kirchberger, M. 2018. New-Technology Startups Seeking Pilot Customers: Crafting a Pair of VPs. California Management Review, 60(4): 101–124.

Xing, L. & Paul, M. 2018. Diagnosing and Improving Topic Models by Analyzing Posterior Variability. The Thirty-Second AAAI Conference on Artificial Intelligence (AAAI-18): 6005-6012.

Zhang, J., Lichtenstein, Y., Gander, J. 2015. Designing scalable digital business model. Business models and modelling, Advances in Strategic Management, 33: 241-277

Zott, C., Amit, R. 2007. Business model design and the performance of entrepreneurial companies. Organization Science, 18: 181–199.

Appendix A. Value proposition assertions in the SERS dataset that were examined

|

ID |

Value proposition assertion |

|

A113 |

Offer benefits to customers, investors and other key stakeholders that are important, differentiated from, and superior to, competing offerings |

|

A114 |

Develop value propositions that enhance your customers’ and suppliers’ outcomes, marketing strategies, and competitive advantages |

|

A115 |

Incorporate elements of value into your value propositions to consumers that address four kinds of needs: functional, emotional, life changing, and social impact. |

|

A116 |

Integrate environmental, economic, and social aspects of value into the value propositions for your key stakeholders |

|

A117 |

Deliver high value to customers before, during, and after they use your company products or consume your company services |

|

A118 |

Develop value propositions for employees that enhance employee satisfaction, psychological attachment, and behavioral commitment toward your company |

|

A119 |

The required investment and the resulting most significant stakeholder benefits should be quantified in specific, measurable, attainable, relevant, and time-bound terms |

|

A120 |

Align value propositions for customers, investors, and other stakeholders in a way that they support, agree with, and reinforce each other |

|

A121 |

Develop value propositions for those who pay, not just those who benefit |

|

A122 |

Develop value propositions that support or agree with the value proposition of key members of the company value chain, and improve supply chain competences |

|

A123 |

Continuously find new and innovative ways to offer value to customers in existing and new markets |

|

A124 |

Continuously create new markets and serve broader stakeholder needs |

|

A125 |

Align investor value propositions with company scale objectives so they are mutually reinforcing rather than conflicting |

|

A126 |

Recognize what new companies that are scaling rapidly do, assimilate the lessons learned, and apply them to develop and implement your company value propositions |

|

A127 |

Learn from value propositions of companies that have grown early, rapidly, and securely and apply them to differentiate your company |

|

A128 |

To align the value propositions for customers, investors, and resource owners, make explicit the benefits: (i) an investor gains by the presence of the customer and resource owner, (ii) a customer gains by the presence of the investor and the resource owner, and (iii) the resource owner gains by the presence of the customer and the investors |

|

A129 |

To align value propositions for customers, investors, and resource owners, co-create a unique combination of resources that did not previously exist |

|

A130 |

To align value propositions to all relevant stakeholders, develop an objective that benefits them all |

|

A131 |

Track changes in stakeholders value propositions over time and use the information to align them |

Keywords: scaling company value, scaling objectives, topic modeling, topic stability, value proposition