AbstractAs the world is increasingly interconnected, everyone shares the responsibility of securing cyberspace.

Newton Lee

Computer scientist and author

Corporations and government agencies worldwide seek to ensure that their networks are safe from cyber-attacks, and startups are being launched to take advantage of this expanded market for cybersecurity products, services, and solutions. The cybersecurity market is inherently global; therefore, cybersecurity startups must globalize to survive. With this article, we fill a gap in the literature by identifying the factors that make a technology startup valuable to specific stakeholders (e.g., investors, customers, employees) and by providing a tool and illustrating a process to describe, design, challenge, and invent the actions that should be performed to globalize a cybersecurity startup early and rapidly for the purpose of increasing its value. The development of the tool builds on recent advances in the resource-based literature, the review of the literature on born-global firms and business model discovery processes, and the experience gained operating the Lead to Win ecosystem. This article will be of interest to entrepreneurs and their venture teams, investors, business development agencies, advisors, and mentors of cybersecurity startups as well as researchers who develop tools and approaches that are relevant to technology entrepreneurs.

Introduction

Technology startups that globalize early and rapidly are more willing to change and more capable of adapting to uncertain environments (Sapienza et al., 2006), are worth more (Chetty & Campbell-Hunt, 2004), grow revenue and employment faster (Andersson et al., 2004; Gabrielsson & Manek Kirpalani, 2004; Gabrielsson et al., 2004), and bring more cash into a local economy from outside their borders (Poole, 2012). But, how can entrepreneurs discover the actions that should be carried out to make their startups valuable by globalizing early and rapidly? Although the perceived benefits from globalization are known, an approach to systematically describe, design, challenge, and invent the actions that should be performed to make a technology startup valuable by globalizing it early and rapidly is not available.

This article makes two contributions. First, it combines the ex-ante value of a resource and born-global literature streams in the development of a tool that can help technology startups increase their value. Second, the article provides entrepreneurs with a means to identify the specific and concrete actions that should be performed to globalize their startups early and rapidly.

In the remainder of this article, we first identify what makes a technology startup valuable and what enables a technology startup to globalize early and rapidly. Then, we develop a tool, the Global Value Generator, we illustrate the process to generate the actions that can help globalize a technology startup, and we identify generic examples of the actions that 12 existing cybersecurity startups have carried out to globalize. The last section provides the conclusions.

To Make a Technology Startup Valuable

We identify the conditions that make a technology startup valuable to a stakeholder ex-ante (i.e., value of the startup is based on forecasts and not the results of the startup’s performance). Traditionally, the resource-based literature posits that superior performance over other firms is a direct result of the access to and use of superior resources (Barney, 1991; Peteraf, 1993; Simon et al., 2007).

Schmidt and Keil (2012) develop a theory that identifies the ex-ante conditions under which firms attribute value to a resource. They highlight the crucial difference between the ex-ante value of a resource (i.e., value before a decision to acquire or build the resource is made) and the ex-post value of a resource (i.e., value after the performance of the resource is known). Schmidt and Keil also identify four conditions that make a resource valuable to a firm ex-ante: i) the firm’s ex-ante market position; ii) its ex-ante resource base, which allows for complementarities; iii) its position in inter-organizational networks; and iv) the prior knowledge and experience of its managers.

We apply the logic that Schmidt and Keil (2012) used to examine the ex-ante value a firm allocates to a resource for the purpose of examining the ex-ante value a stakeholder allocates to a technology startup. A stakeholder is an individual or organization that can potentially make cash or in-kind contributions to the startup. In-kind contributions can include access to resources and people.

We postulate that, to increase its ex-ante value to a stakeholder, a technology startup must act to:

- Increase spread: Increase the spread between customers’ willingness to pay for its product and the cost of the product

- Increase demand: Increase the demand for its product

- Increase complementarity: Increase the demand for the stakeholder’s products complemented by the startup’s product

- Increase privileged information: Establish a position in inter-organizational networks that improves the volume, variety, velocity, and veracity of privileged information that is accessible

- Increase judgment: Attract individuals who have the requisite experience and knowledge to create value for the startup

A stakeholder, while making decisions about the value of a startup, will develop forecasts for the results from the five actions identified above. The results of carrying out these five actions will determine how much value a stakeholder attributes to a technology startup. The value of a startup is idiosyncratic to the stakeholder; even when all stakeholders have the same information they will attribute different values to the startup.

A key result of applying Schmidt and Kiel (2012) is that the ex-ante value of a technology startup is driven by forecasts of product market value creation that is made possible by the startup’s existence, not just the startup’s ability to generate profitable revenue. Forecasts of “increased spread” and “increased demand” express the startup’s ability to increase its revenue. Forecasts of “increased complementarity”, “increased privileged information”, and “increased judgment” express other components of product market creation that the startup is expected to enable.

To Enable Early and Rapid Globalization in a Technology Startup

We reviewed the born-global literature to identify the factors that enable a technology startup to globalize early and rapidly. We found that startups that globalize early and rapidly tend to take the following actions:

- Use the Internet intensively (Jaw & Chen, 2006; Maltby, 2012, Tanev, 2012; Yoos, 2013)

- Partner with companies with a global footprint (Lemminger et al., 2014; Nummela et al., 2014)

- Have top managers with international experience (Hutchinson et al., 2007; Kudina et al., 2008; Poole, 2012; Sapienza et al., 2006; Spence & Crick, 2009)

- Trade control for growth (Spence & Crick, 2009)

- Develop niche products with global appeal (Spence & Crick, 2009; Chetty & Campbell-Hunt, 2004; Hutchinson et al., 2007; Kudina et al., 2008)

- Initially focus on selling in the lead market for their technology regardless of geographic location (Knight et al., 2004; Spence & Crick, 2009)

- Develop a strong brand identity (Hutchinson et al., 2007)

- Identify international opportunities (Karra et al., 2008)

- Focus on customers with overseas operations (Kudina et al., 2008)

We reduce this born-global literature into its individual constituents and postulate that the factors that enable a technology startup to globalize early and rapidly are:

- Niche market on 2+ continents: address the needs of one niche market with technology development, sales channels, and online business processes on at least two continents

- 2+ Global customers: sell to at least two customers that have global footprints

- 1+ global partner: partner with at least one organization that has a global footprint

- Top manager experience on 2+ continents: ensure that the top management team has work experience and networks on at least two continents

- Stakeholders on 2+ continents: attract customers, partners, investors, and board of directors members who are based on at least two continents

- Memberships in commerce organizations on 2+ continents: maintain active memberships in commerce organizations (e.g., chambers of commerce) on at least two continents, and publish press releases that originate from those continents

Global Value Generator and Search Process

Table 1 provides a tool in the form of a matrix that combines the five factors that enable a technology startup to be valuable and the six factors that enable a technology startup to globalize early and rapidly.

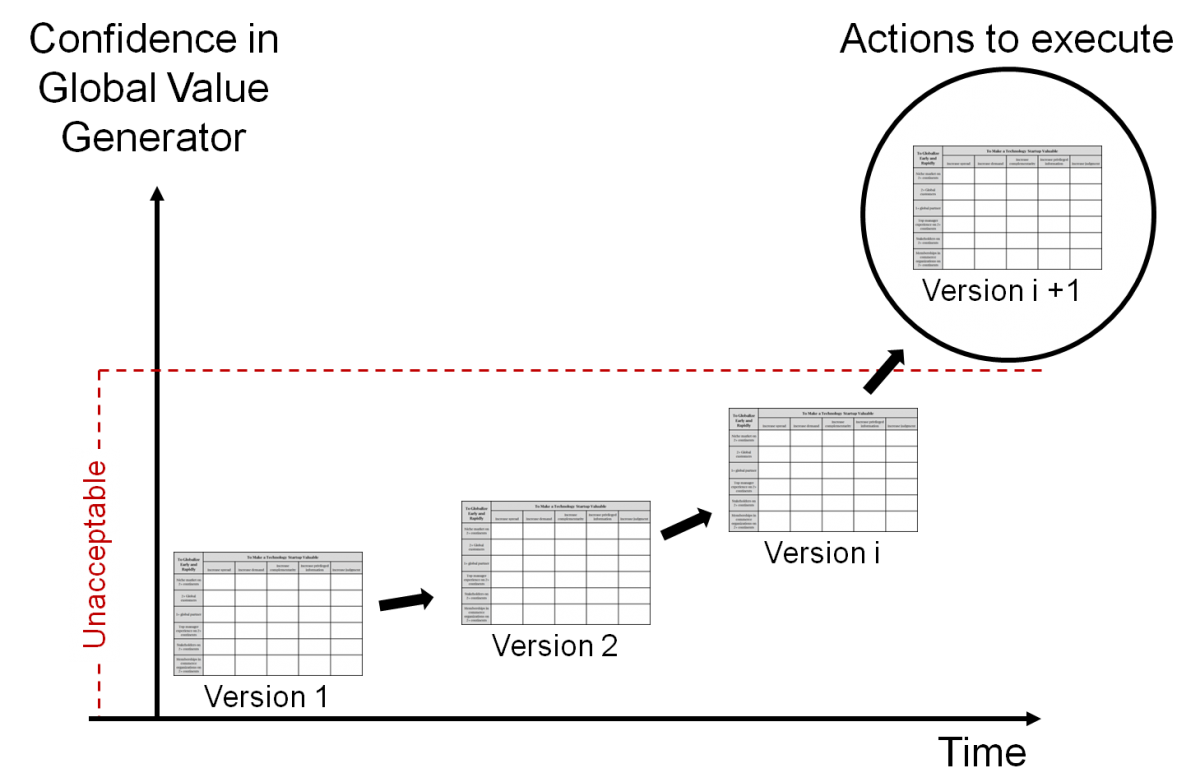

We believe that the Global Value Generator shown as Table 1 can be used by entrepreneurs to anchor the search for actions illustrated in Figure 1. The purpose of the search is to identify and test the specific and concrete actions that a technology startup should carry out to make it valuable by globalizing early and rapidly.

The discovery of the actions to increase the value of a technology startup by globalizing early and rapidly should be a disciplined process that is carried out during the early stage of a startup’s lifecycle. Muegge (2012) argues that a disciplined discovery process is one that is designed to enable opportunities for learning to arise and has a work plan that results in specific deliverables.

Each cell in Table 1 identifies assertions about the actions that should be carried out. Each assertion included in one of the cells in Table 1 is a cause-effect statement about what a technology startup will do to globalize early and rapidly and what will happen to the factors that drive value as a result. The structure of the statement is as follows: If a startup does “X” to globalize early and rapidly, then “Y” will be the value result). Each statement must be clear, short, simple, and concise. The assertions build on prior knowledge, logical inference, and informed, creative imagination.

Table 1. Global Value Generator

|

To Globalize Early and Rapidly |

To Make a Technology Startup Valuable |

||||

|

Increase spread |

Increase demand |

Increase complementarity |

Increase privileged information |

Increase judgment |

|

|

Niche market on 2+ continents |

|

|

|

|

|

|

2+ Global customers |

|

|

|

|

|

|

1+ global partner |

|

|

|

|

|

|

Top manager experience on 2+ continents |

|

|

|

|

|

|

Stakeholders on 2+ continents |

|

|

|

|

|

|

Memberships in commerce organizations on 2+ continents |

|

|

|

|

|

Figure 1 illustrates the search process anchored around the use of the Global Value Generator. The first step is to populate the cells in Table 1 with initial assertions. Then, in the second step, new assertions are added and existing assertions are modified, detailed, or eliminated. In the third step, a lean process is used to test the assertions. This process should be a quickly iterating cycle that continuously states and validates assertions with stakeholders and learns from the past. Assertions that stakeholders validate can be refined. Assertions that stakeholders do not validate are modified or eliminated. The fourth step is to identify a set of actions that, as a whole, will produce requisite results at an acceptable level of confidence.

The process illustrated in Figure 1 allows a technology startup to describe the actions they take in their globalization process, as well as design, challenge, and invent specific and concrete actions. Muegge (2012) provides the rationale for using a disciplined model discovery process such as the one illustrated in Figure 1. He emphasizes that discipline has two components: intent and structure. Technology entrepreneurs should deliberately identify and undertake activities to acquire new information, test assumptions, and uncover new options and organize discovery-driven activities as a project, with beginning and end points in time, specific deliverables, and a work plan to produce those deliverables.

Figure 1. Illustration of the disciplined discovery process that leads to the identification of actions to globalize early and rapidly

Examples of Actions Cybersecurity Startups Carry Out to Globalize

The websites of 12 cybersecurity startups that are based in North America and have been operating for five years or less were examined for the purpose of providing generic examples of the actions that firms that operate in the cybersecurity market carry out to globalize early and rapidly. The startups were identified by two experts who work to secure the networks of the federal government of Canada and have experience with suppliers of cybersecurity products and services. We made no attempt to select startups judged to be successful because of these actions.

For each startup, we first used the information provided on its website to infer the actions undertaken to globalize and then these actions were organized into the cells included in the Global Value Generator (Table 1). This activity resulted in 12 matrices: one for each startup. Finally, we collapsed the information in the cells of the 12 matrices into the cells of one matrix.

The 12 startups examined currently operate in the following eight cybersecurity product markets:

- Total cybersecurity solutions for specific global industries such as aerospace and defense

- Digital identity and information security and assurance

- Automated threat forensics and dynamic malware protection

- Secured distribution

- Integrated products and services

- Password-protected login security

- Simulation software and associated design, testing, and certification services

- Training, consultancy, and project management

Table 2 provides the information that was collapsed from the 12 matrices (i.e., the actions we inferred that the startups carried out to globalize). The sole purpose of producing Table 2 was to provide generic examples of actions undertaken by cybersecurity startups to globalize. The decisions as to the cells where these examples are shown in Table 2 were made by the authors solely for the purpose to illustrate what the high level results of a discovery process may look like.

Table 2. Examples of actions a cybersecurity startup may carry out to increase its value by globalizing early and rapidly

|

To Globalize Early and Rapidly |

To Make a Technology Startup Valuable |

||||

|

Increase spread |

Increase demand |

Increase complementarity |

Increase privileged information |

Increase judgment |

|

|

Niche market on 2+ continents |

Target a niche market where customers have a distinct set of cybersecurity needs and are willing to pay a premium price |

Use the Internet as a global sales channel to double product demand |

Develop a product that complements products offered by incumbents |

Engage with members of virtual communities that attract customers and competitors |

|

|

2+ Global customers |

Target customers with a global footprint that are willing to pay a premium to solve their cybersecurity problems |

Target customers that are members of global supply chains and use their networks to identify the need for security solutions of their partners |

Develop security solutions that add value to a customer’s products or services that are sold worldwide |

Establish relationships with organizations that provide information to customers |

Create a network of evangelists among global customers |

|

1+ global partner |

Actively participate in the development of global standards on security requirements with global partners |

Target partners with a global footprint to increase global demand for startup’s product |

Target partners who would benefit from the complementarity of the startup’s product or service |

Use connections to partners to increase access to privileged information |

Seek partners with global reach |

|

Top manager experience on 2+ continents |

Use top management's intercontinental experience and networks to decrease the cost of rapid globalization |

Use top management's intercontinental experience and networks to increase demand |

Use top managers with experience in the market whose products/services the startup complements |

Use top management's intercontinental networks to increase the access to privileged information |

Attract top managers with intercontinental work experience in cybersecurity-related fields |

|

Stakeholders on 2+ continents |

Use stakeholders' intercontinental experience and networks to decrease the cost of rapid globalization |

Use stakeholders' intercontinental experience and networks to increase demand |

Use stakeholders on different continents to identify the geo-political differences that could shape the development of complementary products and services |

Use stakeholders' intercontinental networks to increase the access to privileged information |

Attract Board of Directors members with knowledge and expertise in cybersecurity-related fields on different continents |

|

Memberships in commerce organizations on 2+ continents |

Create exposure in worldwide media renowned for cybersecurity coverage to increase customers’ willingness to pay |

Create exposure in worldwide media renowned for cybersecurity coverage to increase global demand |

Use memberships to identify partners and complementary products and services |

Use memberships in commercial associations to increase access to privileged information |

Attract Board of Directors members who are also active in commerce organizations |

The objective of an entrepreneur using the tool introduced in Table 1 as part of a disciplined discovery process is to identify a set of actions that are specific and concrete. By specific actions, we mean those that apply to a particular cybersecurity startup and are not generic like those provided as examples in Table 2. By concrete actions we mean those that are results oriented, not abstract.

Conclusion

The main motivation for writing this article was to provide a tool that can help entrepreneurs discover the actions that they should carry out to increase the ex-ante value of their cybersecurity startups through early and rapid globalization. The tool was developed by leveraging a recent theoretical advance in resource-based theory (Schmidt & Keil, 2012), a review of the born-global literature, research on business model discovery (Muegge, 2012), and the experience gained operating the Lead to Win ecosystem (Bailetti & Bot, 2013).

In this article, five factors that make a technology startup valuable were identified by applying the logic that Schmidt and Kiel (2012) used to advance the resource-based theory. Moreover, six factors that enable a technology startup to globalize early and rapidly were identified from a literature review. These factors were combined into the Global Value Generator, a tool structured as a matrix that can be used to describe, design, challenge, and invent the specific and concrete actions that a cybersecurity startup should perform for the purpose of increasing its value by globalizing early and rapidly. The Global Value Generator needs to be used as part of disciplined discovery processes such as the one described by Muegge (2012). The tool can be used to complement the various business model frameworks proposed in both the management literature and consulting organizations.

We offer three questions to anchor future research efforts. The first research question is: What are the specific actions to globalize early and rapidly that have the greatest effect on the value of the cybersecurity startups? The relationship between the specific actions to globalize and the value of the startup needs to be examined empirically. This effort requires that a myriad of definitional issues be resolved and will take years to complete.

The second question is: What actions to globalize early and rapidly are unique to cybersecurity startups? The objective of this research would be to identify the specific actions that startups that depend on the existence of a global resource such as cyberspace need to do that other born-global firms do not. For example, cybersecurity startups can and perhaps should issue specific “threat-scapes” for the global markets they target. This action would be unique to cybersecurity firms. Managerial judgment and imagination about how a cybersecurity startup can help create value for customers worldwide may be key factors that drive its value.

The third research question is: How can business development agencies improve the support they provide to cybersecurity ventures? Hundreds of incubators and accelerators for startups operate worldwide. They address the needs of startups that operate in many different product markets. The objective of this research would be to identify the tools, processes, simulations, and so on required to better support the startups that operate in the cybersecurity domain. For example, what can business development agencies do to support startups that wish to issue threat-scapes for global markets, improve their managerial judgment, and imagine solutions to specific cybersecurity problems of customers worldwide?

References

Andersson, S., Gabrielsson, J., & Wictor, I. 2004. International Activities in Small Firms: Examining Factors Influencing the Internationalization and Export Growth of Small Firms. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration, 21(1): 22-34.

http://dx.doi.org/10.1111/j.1936-4490.2004.tb00320.x

Bailetti, T., & Bot, S. D. 2013. An Ecosystem-Based Job-Creation Engine Fuelled by Technology Entrepreneurs. Technology Innovation Management Review, 3(2): 31-40.

http://timreview.ca/article/658

Barney, J. B. 1991. Firm Resources and Sustained Competitive Advantage. Journal of Management, 17(1): 99-120.

http://dx.doi.org/10.1177/014920639101700108

Chetty, S., & Campbell-Hunt, C. 2004. A Strategic Approach to Internationalization: A Traditional versus a "Born-Global" Approach. Journal of International Marketing, 12(1): 57-81.

http://dx.doi.org/10.1509/jimk.12.1.57.25651

Gabrielsson, M., & Manek Kirpalani, V. H. 2004. Born Globals: How to Reach New Business Space Rapidly. International Business Review, 13(5): 555-571.

http://dx.doi.org/10.1016/j.ibusrev.2004.03.005

Gabrielsson, M., Sasi, V., & Darling, J. 2004. Finance Strategies of Rapidly-growing Finnish SMEs: Born Internationals and Born Globals. European Business Review, 16(6): 590-604.

http://dx.doi.org/10.1108/09555340410565413

Hutchinson, K., Alexander, N., Quinn, B., & Doherty, A. M. 2007. Internationalization Motives and Facilitating Factors: Qualitative Evidence from Smaller Specialist Retailers. Journal of International Marketing, 15(3): 96-122.

http://dx.doi.org/10.1509/jimk.15.3.96

Jaw, Y.-L., & Chen, C.-L. 2006. The Influence of the Internet in the Internationalization of SMEs in Taiwan. Human Systems Management, 25(3): 167-183.

http://iospress.metapress.com/content/18x6y4kt4e414m20/

Karra, N., Phillips, N., & Tracey, P. 2008. Building the Born Global Firm: Developing Entrepreneurial Capabilities for International New Venture Success. Long Range Planning, 41(4): 440-458.

http://dx.doi.org/10.1016/j.lrp.2008.05.002

Knight, G., Madsen, T. K., & Servais, P. 2004. An Inquiry into Born-Global Firms in Europe and the USA. International Marketing Review, 21(6): 645-665.

http://dx.doi.org/10.1108/02651330410568060

Kudina, A., Yip, G. S., & Barkema, H. G. 2008. Born Global. Business Strategy Review, 19(4): 38-44.

http://dx.doi.org/10.1111/j.1467-8616.2008.00562.x

Lemminger, R., Svendsen, L., Zijdemans, E., Rasmussen, E., & Tanev, S. 2014. Lean and Global Technology Start-ups: Linking the Two Research Streams. The ISPIM Americas Innovation Forum 2014. Montreal, Canada.

Maltby, T. 2012. Using Social Media to Accelerate the Internationalization of Startups from Inception. Technology Innovation Management Review, 2(10): 22-26.

http://timreview.ca/article/616

Muegge, S. 2012. Business Model Discovery by Technology Entrepreneurs. Technology Innovation Management Review, 2(4): 5-16.

http://timreview.ca/article/545

Nummela, N., Saarenketo, S., Jokela, P., & Loane, S. 2014. Strategic Decision-Making of a Born Global: A Comparative Study From Three Small Open Economies. Management International Review, 54(4): 527-550.

http://dx.doi.org/10.1007/s11575-014-0211-x

Peteraf, M. A. 1993. The Cornerstone of Competitive Advantage: A Resource-Based View. Strategic Management Journal, 14(3): 179-191.

http://dx.doi.org/10.1002/smj.4250140303

Poole, R. 2012. Global Mindset: An Entrepreneur's Perspective on the Born-Global Approach. Technology Innovation Management Review, 2(10): 27-31.

http://timreview.ca/article/617

Sapienza, H. J., Autio, E., George, G., & Zahra, S. A. 2006. A Capabilities Perspective on the Effects of Early Internationalization on Firm Survival and Growth. Academy of Management Review, 31(4): 914-933.

http://dx.doi.org/10.5465/AMR.2006.22527465

Schmidt, J., & Keil, T. 2012. What Makes a Resource Valuable? Identifying the Drivers of Firm-idiosyncratic Resource Value. Academy of Management Review, 38(2): 206-228.

http://dx.doi.org/10.5465/amr.10.0404

Sirmon, D. G., Hitt, M. A., & Ireland, R. D. 2007. Managing Firm Resources in Dynamic Environments to Create Value: Looking Inside the Black Box. Academy of Management Review, 32(1): 273-292.

http://dx.doi.org/10.5465/AMR.2007.23466005

Spence, M., & Crick, D. 2009. An Exploratory Study of Canadian International New Venture Firms' Development in Overseas Markets. Qualitative Market Research: An International Journal, 12(2): 208-233.

http://dx.doi.org/10.1108/13522750910948798

Tanev, S. 2012. Global from the Start: The Characteristics of Born-Global Firms in the Technology Sector. Technology Innovation Management Review, 2(3): 5-8.

http://timreview.ca/article/532

Yoos, S. 2013. Market Channels of Technology Startups that Internationalize Rapidly from Inception. Technology Innovation Management Review, 3(10): 32-37.

http://timreview.ca/article/618

Keywords: born global, cybersecurity, globalization, startups