AbstractFinancial institutions must be able to deliver an easy to navigate, a seamless digital platform that goes far beyond a miniaturized online banking offering.

Jim Marous

Digital Banking Report

With the emergence of new technologies, banks and financial services around the globe are taking advantage. The rapid development of information technology, internet connectivity, and smartphones has influenced the banking and financial services sector. The combination of financial technology (FinTech) and blockchain is deliberately transforming digital banking services. This study explores the intervention of FinTech and blockchain technologies in digital banking and financial services. The present study shows that FinTech and blockchain have a strong influence on the digitalization trends. The research focuses on processes of modernization in banking and financial services in addition to particular focus on the community.

Introduction

New technologies are emerging and changing all over the world. The accessibility of an internet connection with smartphone-enabled services has made simple access to high-speed technological advancements for a wide range of people. The notion of Industry 4.0 (Brettel et al.; Davies 2015; Sheng, 2018; Mekinjić, 2019; Badr Machkour, 2020; Yulius et al. 2020) indicates major renovations to the economy and society at large, with technological changes around the globe reforming internal and external application models for favorable interactions in the digital process.

Reconstructing the banking and financial sector entails the interconnection of financial technology (FinTech) and blockchain technologies (Badr Machkour, 2020). FinTech is regarded as one of the most significant financial industry revolutions. It has progressed at a breakneck pace, thanks in part to the sharing economy, favorable legislation, and advances in information technology (Lee, 2018). Finance and technology have been involved in a long-term process of FinTech development based on new technologies (Arner et al., 2016). Mobile and digital payment systems remain the key vessel for fintech. The number of FinTech companies is increasing swiftly worldwide, offering service options in numerous areas, such as payment systems, asset management, credit solutions, and insurance services. This technology is well-designed to support businesses adapt to guidelines efficiently and resourcefully (Karaçallık, 2018).

Blockchain distributed ledger technologies have many features to offer emerging financial services. Blockchain is starting to influence internet communications. Networks can transform how things work and are a very close part of the digital technologies that are renovating most industries. Blockchain technology will change the banking and finance sector to a great extent as information technology has enabled peer-to-peer (P2P) communications as well as mass media communications. Blockchain allows the public to send and receive money instantly, securely, and at a low-cost transfer fee for fast transactions without third-party interventions, which reduces or removes the chances of hacking. Digitalization of the banking and financial service is incomplete with other components of the fourth industrial revolution: blockchain networks and financial technology companies' preparation for the digital platform and other services. Digitalized banking services strongly scrutinize old tradition-based business models and processes with faster response times and proficiencies in offering safe and simple payment transactions (Mekinjić, 2019).

The research objective of the study is to better understand FinTech and blockchain technologies. This paper outlines how FinTech and blockchain are being adopted by the banking and finance industry and are set to grow significantly in the upcoming years. The study uses a literature review to identify the driving forces that are causing this development and promoting their spread.

Our research question for this paper is: How are FinTech and blockchain technologies influencing the banking and financial services industries?

We conducted a literature review to identify the influence of FinTech and blockchain in digital banking and financial services. The study aims to identify the driving forces that impact their development and promotion. We develop a classification system for FinTech and blockchain to categorize technological advancement, benefits, and challenges in banking and finance.

Explorations in Financial Technology (FinTech)

FinTech has changed its competition and collaboration with banks over the past decades. FinTech companies now play a significant part in the digital finance economy. The banking industry proceeds at the forefront of digital innovation. Digital finance has a high potential to provide reasonable, useful, and secure banking services to individual users (Ozili, 2018). With digital banking innovations being offered by banks, digital finance has started providing better services for users. Digitalization has changed the current economic system with today's technologies (North, 2020). FinTech providers are developing new services and products in the financial services sector to aggregate the functions of banks to their customers (Ozili, 2018). If successful, this will surely change the existing business landscape of financial services.

Revolutionizing payments and deposits

FinTech firms have presented mobile wallet solutions for reliable payments, with high speed, and easy accessibility. FinTech provides an online platform that can electronically increase the convenience of access to such services. An e-wallet makes payment transactions directly to transfer cash from one wallet to another, simply with the mobile number as the key identifier. There are no required account details to transfer funds.

The new lending model

FinTech solutions are more equipped than banks and other lending institutions at providing quick access to reserve cash and loans to those with low or no income (Ozili, 2018). A peer-to-peer (P2P) digital lending platform acts as an exchange between shareholders and debtors. An individual with chargeable money can lend it straight to an insolvent through a digital platform and earn interest on it.

Investments on digital advice platform

FinTech has also changed the traditional financial investment advisory position. Digital finance reshapes the finance industry by producing an outcome that was forecast by the financial system. FinTech companies in this position can deliver high-tech advisory associated with the money through a digital platform, while helping customers to invest in financial products. These online platforms are usually known as Robo-advisors and digital advice platforms, since they promote investments on automatic mode.

Future of FinTech in Banking Services

The banking and finance industry is a dynamic industry with strong competition for products and services. Accordingly, banks are persistently determined to grow and transform to avoid being outstripped by their competitors. Presently, the contest is for a digital banking structure that allows services to be offered by digital signals. This is possible as digital transformation has been giving rise to new products and services in electronic payment systems (Karaçallık, 2018). Digitalized banking practices undoubtedly carry with them new entities and forecasts for growing new banking services and increasing business performances, including bank profits. Banks of the future aim to become effective technologically prepared branches with no more bottlenecks, and where services will be provided through self-service machines. Online services will focus on consumers, who are the primary service goal of the bank.

The primary focus of banks that need to implement widespread digital transformation is to familiarize their current services with new practices of industry processes, with an outline of services based on the formation of applied ethical thinking. Digital bank branches of the future must deal with customers in a banking atmosphere based on innovations that will provide customers with quick access to the information they require. The future of banking will be enabled by digital technology to transform traditional banking to digital banking. The banking and client relationship will remain in focus (Mekinjić, 2019). Meanwhile, digital banking platforms allow customers access to all online banking services with a collection of digital banking solutions (North, 2020).

The use of digital technology has prompted traditional banks and other financial institutions, which have traditionally been on the front lines, to upgrade their skills and knowledge (Iman, 2019). The flourish of financial technology in the last few years has transformed regular transactions. It facilitates cash-driven nations to move toward becoming cashless. FinTech clients therefore must modify their values and morals due to adopting new digital practices (Pousttchi, 2018).

Payment Services

FinTech in banking services has mainly affected payments and the mode by which transactions are executed. It is designed to encourage customers to switch to electronic banking, mobile banking, and digital payment services to eradicate the need to visit bank buildings for such tedious tasks. FinTech aims for the banking sector to reshape profit-making conditions for industries and produce new revenue channels through online payments.

Improved Customer Services

FinTech creates innovative goods and services to meet customer demands that aren't being met by traditional financial institutions (Pousttchi, 2018). The pledge of FinTech performers is to implement business practices that are accountable for protecting consumers. FinTech aims to deliver bank customers continued access to financial services. The banking sector thus needs to focus on confirming safer transactions, since their customers' data privacy is liable to hacks.

Smart Solutions

FinTech has started to offer effective and dynamic solutions for banks and financial service providers, such as loans, remittances, insurance, and transfers. Financial services and banks are experiencing the ever-increasing necessity of achieving results that are strong, rapid, and flexible. The finance sector is being entrusted by FinTech companies to respond to market and technology disruption and concentrate on customer services.

Enhanced Reachability

FinTech in banking places focus on data analytics to control for providing personalized financial products and services to consumers that ensures complete execution over the internet and smartphone devices. The banking industry is focusing on exploiting the latest technologies to renovate their policies. Open banking solutions are essential protocols and tools used to build software and applications. They add to designating the significance of FinTech in banking and financial services.

Blockchain and Big Data

A parallel technology performs the best parts of FinTech. Blockchain technology supports having a distributed peer-to-peer network amongst all the counterparts in a transaction series, without trusted party intervention or centralized control. Blockchain technology will assist in reducing frauds and phishing attacks, and make safer transactions. Big data with machine learning and artificial intelligence will be used to support the spectator’s risks in digital payment systems for their effectiveness in banking practices, user prerequisites, and personalized product and service offerings (North, 2019).

Blockchain Technology

Blockchain technology is now considered for its impact on banking and financial services in a general context with other industries and sectors. Blockchain technology is decentralized, transparent, anonymous (or pseudonymous), and immutable. Blockchain uses encryption technology to form digital currencies, a favourable new medium of exchange that is safer and better than physical cash. Blockchain is the underlying technology that maintains digital transaction ledgers today. Blockchain technology has found applications in almost across many industries in recent years, from manufacturing to supply chain management to financial services. Blockchain technology has the opportunity to disrupt the financial services sector in various ways. This technology can undeniably reduce issues, disorders, and setbacks in many aspects of financial technology services. We therefore see blockchain as a promising technology to resolve significant problems in the banking and finance sector that have been for many years impeding the industry (Nasscom, 2020).

Identity Theft

A serious issue with the banking and finance industry is identity theft. Blockchain can stamp out problems with identity theft in financial services. The technology protects digital individualities within a distributed ledger system that enables actual entities to engage in network-based transactions. Blockchain promises to allow two parties that do not trust or even know each other to nevertheless make safe trusted transactions over an irreversible network without trusted party interventions needed to confirm user identity, and thus with no identity theft option.

Fraud detection and Anti-money laundering

In most cases, using transactional logs, time-series data, a location-based strategy, and transaction terms passing relational data are required to identify fraud detection, for example, with money laundering (Krishnapriya, 2020). Financial fraud and money laundering have a global impact and are one of the main obstacles to the industry. Distributed ledger solutions can be responsible for fraud prevention competencies with financial services looking for ambiguous financial transactions that cover exchanges between multiple parties, with differences in currency denominations and settlement time.

Auditing and accounting

Effective and consistent recordkeeping, auditing, and accounting have been another set of hinderances for the banking and financial sector for many years. Blockchain technology offers disruptive innovation using a distributed ledger system protected by cryptography that can make financial statement audits and financial reporting transparent in real-time and remove outdated information. Blockchain technology fundamentally transforms the nature of accounting and auditing in current business services.

Operational inefficiencies

Blockchain transactions use a cryptographic protocol. This transforms the effective functioning of the banking and finance industry, as the banking sector has faced slow timelines for transaction clearance and settlement, with high operation costs. Blockchain systems can increase the transaction speed remarkably. Blockchain eliminates the use of multiple ledgers, intermediaries, and transactions that take much time, are expensive, and with high transaction failure rates. Distributed ledger networks that use cryptocurrencies guarantee faster cross-border transaction clearing. Transaction time can take less than ten minutes, which is implausible in contrast with the typical one- to two-week clearance time in previous methods.

Banking product and Service innovation

Banks for the most part have presently failed to make innovative products and services. Yet now there is a new way to give increased value to their clients through digital asset exchange with great service offerings delivered by blockchains. Distributed ledger technology has the potential to solve ongoing problems with business services by allowing multiple banks to make significant contributions to their banking customers. Banks may also give those customers the option to gradually exchange multiple other financial assets on or through a blockchain network.

Future of Blockchain in Digital Banking

Blockchain as an underlying technology will continue to impact the financial technology landscape as it continues to disrupt the banking and financial sector. Preferred mechanisms, such as consensus-building, distributed ledger databases, and cryptographic hashes of every block are now available. This enables blockchain solutions to generate a powerful new form of data sharing, eliminating third-party invention, improving the ease of asset transfer, and speeding up reconciliation processes. Blockchain in banking can help deliver faster payments to customers through trained banking systems.

Blockchain technology processes such as cross-border payments will be made more and more convenient. In recent years, the global banking industry has been experimenting with the adoption of blockchain technologies to deal with many use cases in financial services: peer-to-peer lending, peer-to-peer insurance, real-time payments, cross-border payments, trade finance, auditing, compliance reporting, and core banking solutions. It started with bitcoin cryptocurrency and has changed into a technology that can transform many settlement patterns in the banking sector. Forecasts about the average cost savings of financial transactions are promising. Traditionally, settlements have been complicated due to many trusted parties, which makes them measured. Settlement is exposed to a possibility for fraud and high operational risk. Blockchain technology implementation in this field could not only decrease settlement costs, but also improve safety and proficiency.

The future for blockchain technology acceptance appears set to involve visualizing business models that include connected producer-consumer networks and programming code arrangements on trade incentives to ensure governance, along with rapid and growing adoption (Doshi, 2021).

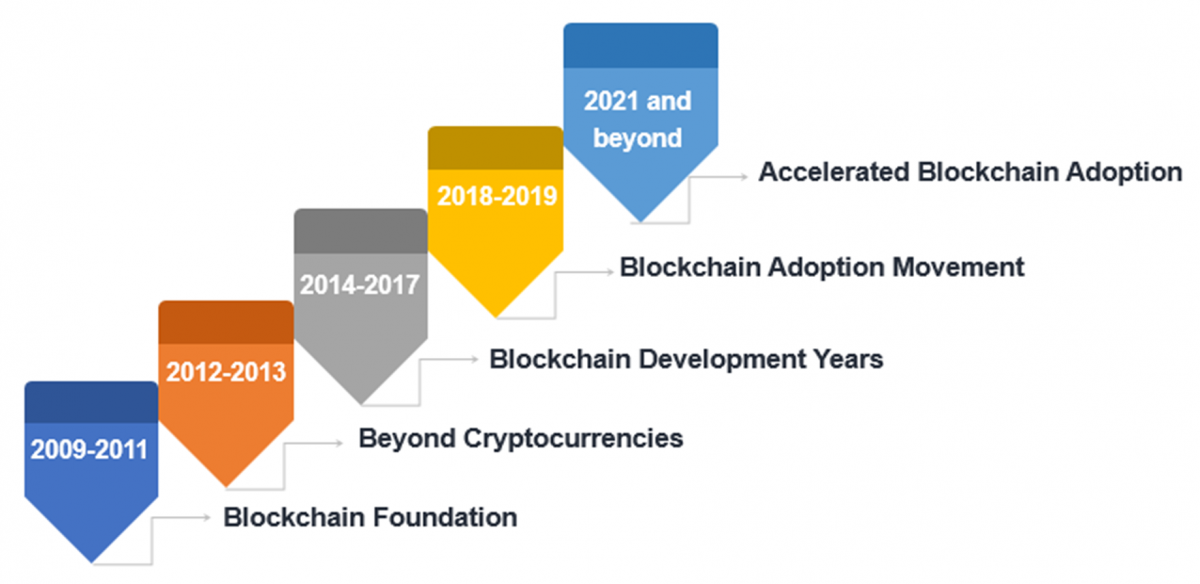

Figure 1. Blockchain adoption

While multiple industries use blockchain technology, the banking industry has been among the top positions for adoption. Nearly thirty percent of institutions in the banking sector are currently using blockchain technology to make a new digital platform in financial services (Source?). Banks started investing vast amounts of money in research and development processes for blockchain-based solutions to resolve their disputes. Hence, the entry of blockchain in the banking sector is seen as having the potential to solve many problems and issues in financial services and make the banking system more transparent and reliable (Bitdeal, 2020). Blockchain is particularly a digital platform for disruptive innovation, which means its impact can possibly spread far outside of revitalizing financial services (Doshi, 2021).

Decentralized Finance (Defi)

Blockchain technology adoption in the banking sector and the decentralization of financial services are influencing new digital forms of banking. Decentralized finance (DeFi) has the prospect of disrupting the traditional financial system because of its external financial tools and controlled regulatory governance. DeFi confronts the current financial system and offers more open transparency than the traditional institutions (Stably, 2019). The modern financial system is centralized. It would be challenged by a globally enabled safer system with lower-cost transactions. In the current system, the chief monetary authorities issue currency that drives the financial plan for the government, banks, trades, and businesses.

Cryptocurrency is the leading-edge digital offering of an industry (finance) that has been around since the outset of time. The first generation of DeFi applications have depended on trust from the majority to use as a security and safeguard mechanism. Henceforth, cryptocurrency wallets became the gateway for all digital asset activities. The DeFi community has been considering techniques through provisions to owners by polling their choices, thus familiarizing them with a broader selection of DeFi use cases. Cryptocurrencies are bringing money online and giving people ways to make money on decentralized applications. The fact that decentralized finance and the future of money lies in the hands of anybody who can code or download applications is fascinating for observers (Bharadwaj, 2020).

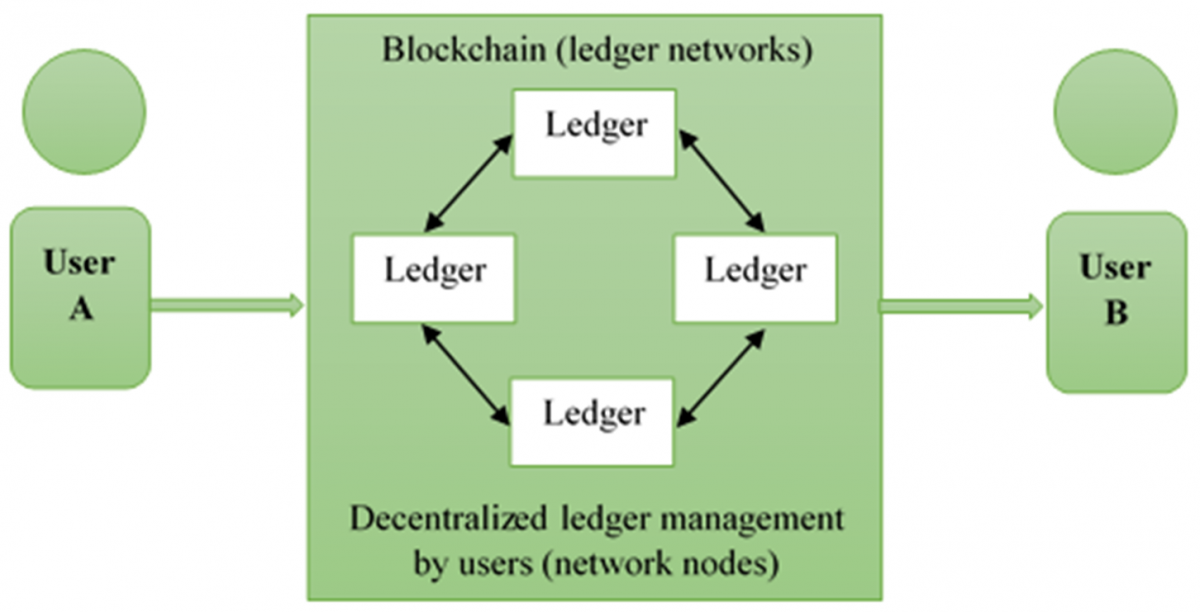

Figure 2. Decentralized payment system

Source: Author’s elaboration

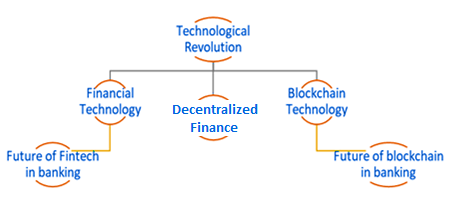

Figure 3. Conceptual framework of the study

Source: Author’s elaboration

Discussion

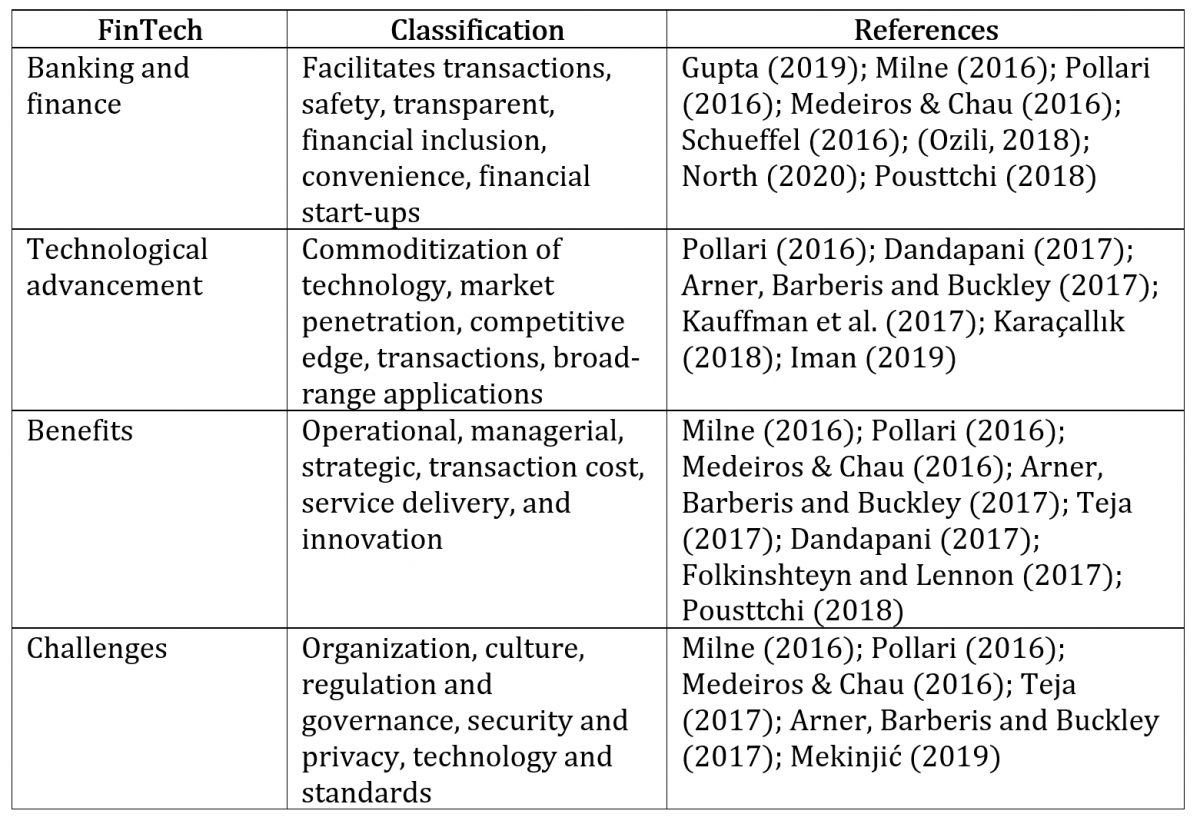

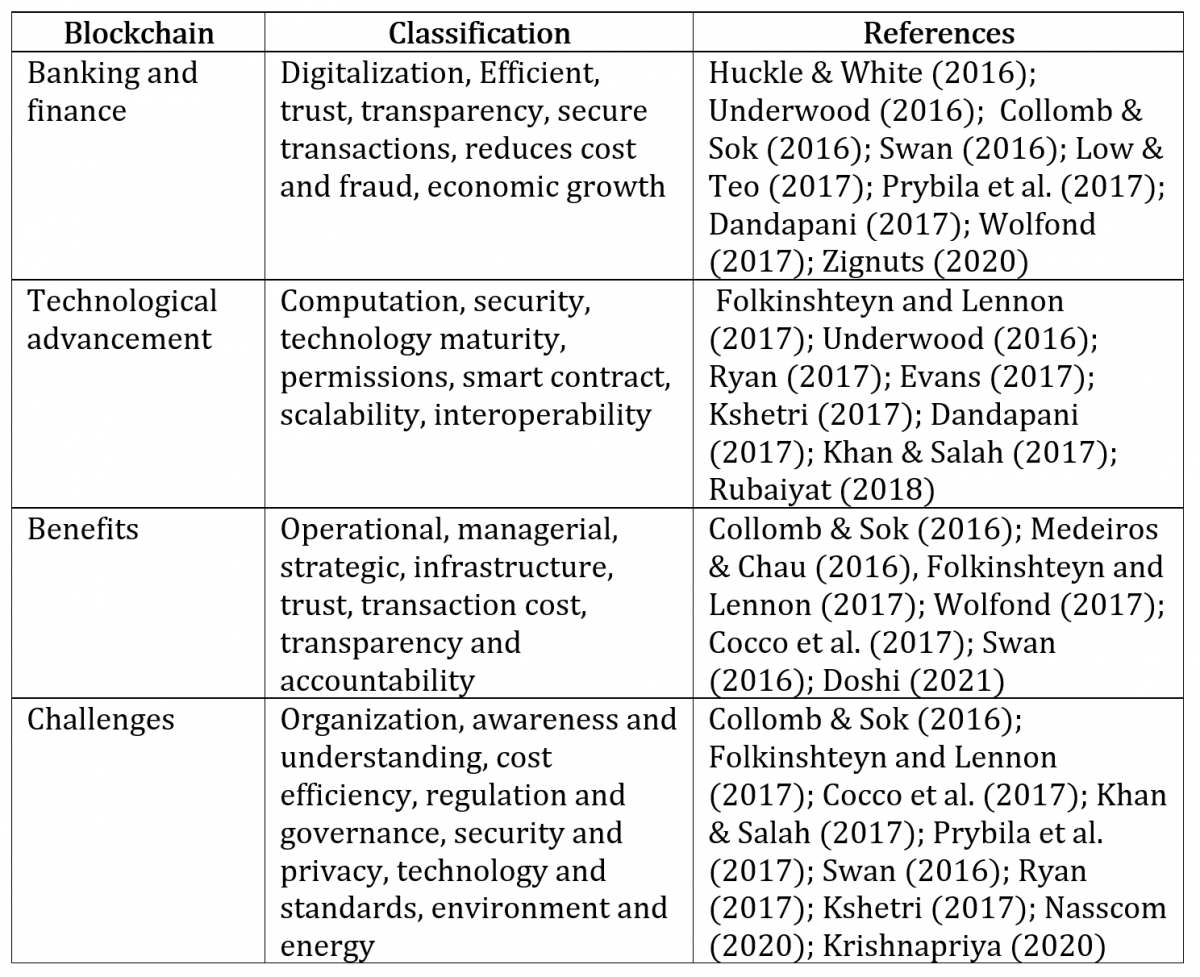

Tables 1 and 2 outline studies that have been done on banking and finance, technological advancements, benefits, and challenges associated with the intervention of FinTech and blockchain technologies in the banking and financial services sector (Hershkovitz, 2021). When it came to categorising articles about FinTech and blockchain, we used a systematic technique this investigation.

Classification of FinTech in Banking and Finance

Table 1. Classification of FinTech

FinTech is mostly still start-up technology, providing industrial-based business services that are already delivered by several conventional financial services, such as banks, insurance, and asset management companies. FinTech in the banking and finance industry usually provides services through applications, products, business models, and business processes. The banking sector's major object niche areas for FinTech are commercial and consumer lending and payments.

Technological advancement

Digital technology is growing in both developed and developing countries. It has gradually progressed from internet banking to mobile banking and is now heading in a new direction toward banking. A new technology landscape is taking shape, with an increase in the use of smartphones, telecommunications, and data services at reasonable costs. This brings with it secure electronic commerce platforms and the introduction of new market actors with increased consumer awareness and possibilities in the financial sector.

Benefits

The development of FinTech suggests unrelenting progress in financial services. FinTech provides banks with high-value benefits from a business perspective in operational, managerial, and strategic areas, along with lower transaction costs, better service delivery, and innovation. FinTech offers customers better service, lower prices, more choices, simpler transaction chains, and operational costs that are more efficient due to flows of information.

Challenges

This review identified challenges related to FinTech services. Coordination amongst competing financial institutions involves resistance to agreeing on standards, rules, and regulations of access to banking platforms. To improve a system’s stability, a company needs a proficient technology infrastructure, flexibility, and security. This means that companies interested in learning about FinTech and investing in new technology should be aware of their operational concerns. Another major challenge for FinTech is collaboration. The task of finding a new and perfect companion for every new enterprise may be challenging and time-consuming.

FinTech provides digital banking services more efficiently (Yulius et al., 2019). A systematic approach manages the pressure between the difficulty of innovation and how modern companies address technological advances (Wonglimpiyarat, 2017). Digitalized banking and financial services choose from payment systems, insurance, loans, and investments to the community through digital services.

FinTech applies technology to provide innovation and improved financial services (Mohanasundaram et al., 2021). Technology-focused FinTech start-up increase these stages to form innovative business models with advanced security, promotional features, access, and new consumer profiling techniques. FinTech companies have significantly improved competitive pressure by directly fetching with the customer. Many FinTech companies still rely on banks to store data and process payments, and users often create FinTech transactions from an account with a financial institution. Incumbents large and small are embracing digital transformation across the value chain to strive with FinTech and big techs (Erik et al., 2021).

The new design of P2P lending and borrowing from FinTech companies generates revenue by associating lenders and borrowers through charges from all interested parties devoid of any investment funds. The technology acceptance of innovative business products and services comes from users, while the regulations supporting them aim to confirm safe transactions on such electronic platforms. Using these services, banks and other financial institutions have made it possible for their consumers to carry out a variety of payment activities. The technology that penetrates payments has been beneficial and disruptive in evaluating other business areas of banks. Payments have been disrupted due to the availability of smartphone devices connected to various data networks, as well as a wide range of innovative products and applications made available by FinTech to divert consumer attention away from traditional banking services and toward electronic platforms. Banks should there take efforts on all the core competent areas for having advantages above FinTech.

Classification of Blockchain in Banking and Finance

Table 2. Classification of Blockchain

Banking and finance

Blockchain technology is in the initial stage of disrupting banking and finance. It is a powerful technology that enables cryptocurrencies, anonymity (or pseudonymity), and security. Distributed ledgers can possibly save banks billions in cash by intensively reducing processing costs. The ongoing implementation of blockchain technology is on a pace to increase banks’ profitability and value. All large banks and financial services are now trying out blockchain, in use cases such as for recordkeeping, money transfers, and other back-end functions (Hershkovitz, 2021). Blockchain will deeply impact the financial services sector by creating a decentralized database of digital assets.

Technological advancement

Using blockchain helps an organization to become more transparent, decentralized, efficient, and secure with reduced costs, and adherence to regulatory processes. With end-to-end encryption, blockchain technology creates an unalterable record of transactions, thereby preventing or lowering theft and other unlawful fraudulent conduct. The advances of blockchain technology have contributed a great deal to changing traditional banking services. However, the promising characteristics of blockchain are still not widely applied to real-time implementations. The strengths and advantages of blockchain applications are still being developed.

Benefits

Blockchain technology provides banks with business perspective benefits such as operational, managerial, strategic, and infrastructure. Blockchain enhances the accuracy of recordkeeping, increases transparency, reduces fraud, improves privacy, enables identity management, trust, enhanced efficiency of financial services, and depends on less physical infrastructure needed for the transfer of goods and services. Blockchain likewise provides superior security similar to keeping data in a database in a way that protects the central database from attacks (Park & Park, 2017). According to Wamba et al. (2019), blockchain technology’s transparency strongly predicts behavioral intent to utilize blockchain technology. Transparency is supported since the transactions are shared across all nodes, which fosters confidence in a community of users (Osmani et al., 2020).

Challenges

Blockchain technology adopters should be clear that it is still in a major stage of development with as of yet very few standards and regulations. Blockchain requires computing power, expensive IT infrastructure, transaction security, and still has regulatory difficulties. Identity verification, scalability, energy consumption, consensus mechanism, adoption cost, and set-up are more time-consuming to implement blockchain technology in the banking sector.

The banking industry has long been seen as a pillar of stability in the economy, but it is now experiencing massive change. Blockchain technology is a way to encrypt all kinds of transactions to protect the identities and integrity of all parties involved. In the existing financial infrastructure, banks are interested in figuring out how blockchain may help address problems. Distributed ledgers are no longer exclusive to cryptocurrencies like bitcoin and ethereum. The immutability of distributed ledgers mean there are several simultaneous versions of the truth shares in a network for each transaction.

Blockchain technology is being used to improve consumer experience, restructure market activities, and streamline product features in the global economy. Eventually, blockchain will allow for more secure and cost-effective exchange of products and services. Banks and financial institutions can use blockchain technology to cut costs and boost speed when making bank-to-bank and international payment transfers. The formation of a decentralized client identity system may also be supported by blockchain technology, though this is also in its early conceptual stages (Hershkovitz, 2021). Blockchain has proven to have beneficial applications in several industries, with banks verifying their progressive interest in adopting this technology.

Conclusion

This paper conducted a literature review of FinTech and blockchain in the banking and finance sector. It found that banks and financial institutions are undergoing massive transformation to keep up with digital technological change. The research concluded that FinTech will lead to major changes in investment standards that offer excellent customer information backed by blockchain technology. Based on equity and decentralization, blockchain in FinTech can provide a much more effective banking alternative than we have currently. This study thus contributes to raising awareness about the blockchain-based community of FinTech that enables fast money transfers, top-notch security, and clear financial tracking.

The necessity for technological transformation, collaboration, and business savings will bring traditional banks to the digital banking portal. Banking and financial services are always looking for advanced technology to improve client experiences. The development of new technologies and increasing consumer expectations are driving needs in the financial sector, while digital transformation is crucial to increasing consumers. Financial technology developments will likely bring about massive changes in business and financial services. Blockchain technology still faces several challenges today, while it is still the most promising technology in the banking and financial sector. Blockchain is not perceived as a competing tool for central bank or cryptocurrencies. Thus, the future for blockchain technology can only get brighter.

There are certain limitations to this study. Future researchers need to rectify the errors in adopting blockchain technology and fintech in digital banking services by collecting the relevant sources related to cryptocurrencies in various industries in support of blockchain and fintech solutions. Based on the findings of this study, future researchers should attempt to develop a new conceptual model and conduct systematic research for business applications.

References

Ariss, R.R. 2008. Financial Liberalization and Bank Efficiency: Evidence from post-war Lebanon. Applied Financial Economics, 18(11): 931-946. DOI: https://doi.org/10.1080/09603100701335408

Arner, D.W., Barberis, J., & Buckley, R.P. 2017. FinTech, Reg Tech, and the Reconceptualization of Financial Regulation. Northwestern Journal of International Law & Business, 37: 371-413.

Arner, D.W., Barberis, J.N., & Buckley, R.P. 2016. The Evolution of FinTech: A New Post Crisis. Geo. J. Int’l L, 47: 1271. DOI: https://doi.org/10.2139/ssrn.3211708

Badr, M.A.A. 2020. Industry 4.0 and its Implications for the Financial Sector. Procedia Computer Science, 177: 496-502. DOI: https://doi.org/10.1016/j.procs.2020.10.068

Bharadwaj, C. 2020. A Beginner's Guide to What is Decentralized Finance (DeFi). Appinventive. Accessed online at: https://appinventiv.com/blog/decentralized-finance-defi-guide/

Bitdeal. 2020. How Blockchain Technology Helps in Rebuilding the Banking Sectors? Accessed online at: https://www.bitdeal.net/blockchain-in-banking

Brettel, M., Friederichsen, N., & Keller, M. 2014. How Virtualization, Decentralization and Network Building Change the Manufacturing Landscape: An Industry 4.0 perspective. International Journal of Mechanical, Industrial Science and Engineering, 8: 37-44. DOI: https://doi.org/10.5281/zenodo.1336426

Chirag. 2021. A Beginner’s Guide to what is Decentralized Finance (DeFi). Accessed online at: https://appinventiv.com/blog/decentralized-finance-defi-guide

Cocco, L., Pinna, A., & Marchesi, M. 2017. Banking on Blockchain: Costs Savings Thanks to the Blockchain Technology. Future Internet, 9(3): 25. DOI: https://doi.org/10.3390/fi9030025

Collomb, A., & Sok, K. 2016. Blockchain/Distributed Ledger Technology (DLT): What Impact on the Financial Sector. DigiWorld Economic, 103:93.

Dandapani, K. 2017. Electronic Finance - Recent Developments. Managerial Finance, 43(5): 614-626. DOI: https://doi.org/10.1108/MF-02-2017-0028

Davies, R. 2015. Industry 4.0 Digitalisation for Productivity and Growth. European Parliament PE, European Parliamentary Research. Service: 1-10.

Doshi, R. 2021. Blockchain Adoption Journey and Impact on Financial Services Industry. Accessed online at: https://www.infosys.com/insights/ai-automation/blockchain-adoption-journ...

Erik, F., Jon, F., Leonardo, G., Harish, N., & Matthew, S. 2021. Fintech and the Digital Transformation of Financial Services: implications for market structure and public policy. Monetary and Economic Department, BIS Papers, 117: 1-64. Available online at: https://www.bis.org/publ/bppdf/bispap117.pdf

Evans, G.L. 2017. Disruptive Technology and the Board: The Tip of the Iceberg 1. Economics and Business Review, 3(17): 205-223. DOI: http://dx.doi.org/10.18559/ebr.2017.1.11

Folkinshteyn, D., & Lennon, M. 2017. Braving Bitcoin: A Technology Acceptance Model (TAM) Analysis. Journal of Information Technology Case and Application Research, 184(4): 220-249. DOI: http://dx.doi.org/10.1080/15228053.2016.1275242

Gupta, S. 2019. How Technology is Redefining the Financial Services Industry - As we know it today. ReLakhs Financial Services. Accessed online at: https://www.relakhs.com/fintech-financial-services-industry/

Hershkovitz, S., 2021. Banks in a Blockchain Future. Crowd Sourcing Week. Available online at: https://crowdsourcingweek.com/blog/banks-in-a-blockchain-future/

Huckle, S., & White, M. 2016. Socialism and the Blockchain. Future Internet, 8(4):49. DOI: https://doi.org/10.3390/fi8040049

Iman, N. 2019. Traditional Banks Against Fintech Start-ups: A field investigation of a regional bank in Indonesia. Bank and Bank Systems, 14(3): 20-33. DOI: http://dx.doi.org/10.21511/bbs.14(3).2019.03

Karaçallık, D. 2018. Effects of Digital Transformation on Fintech Systems.

Kauffman, R.J., Kim, K., Lee, S.Y.T., Hoang, A.P., & Ren, J. 2017. Combining Machine-Based and Econometrics Methods for Policy Analytics Insights. Electronic Commerce Research and Applications, 25: 115-140. Available online at: https://ink.library.smu.edu.sg/sis_research/3729/

Khan, M.A., & Salah, K. 2017. IoT Security: Review, Blockchain Solutions, and Open Challenges. Future Generation Computer Systems, 82: 395-411. DOI: https://doi.org/10.1016/j.future.2017.11.022

Krishnapriya, G. 2020. Identifying Suspicious Money Laundering Transaction Based on Collaborative Relational Data Screening Model Using Decision Classifier in Transactional Database. Journal of Critical Reviews: 5472-5475. DOI: https://doi.org/10.1109/WICOM.2007.1340

Kshetri, N., 2017. Blockchain's Roles in Strengthening Cybersecurity and Protecting Privacy. Telecommunications Policy, 41(10): 1027-1038. DOI: https://doi.org/10.1016/j.telpol.2017.09.003

Lee, I. 2018. Fintech: Ecosystem, Business Models, Investment Decisions, and Challenges. Business Horizons, 61(1): 35-46. DOI: 10.1016/j.bushor.2017.09.003

Low, K.F.K., & Teo, E.G.S. 2017. Bitcoins and Other Cryptocurrencies as Property? Law, Innovation & Technology, 9(2): 235-268. DOI: 10.1080/17579961.2017.1377915

Medeiros, M. & Chau, B. 2016. Fintech - Stake a Patent Claim? Intellectual Property Journal, 28(3): 303-314. Available online at: https://www.proquest.com/scholarly-journals/fintech-stake-patent-claim/d...

Mekinjić, B. 2019. The impact of Industry 4.0 on the Transformation of the Banking Sector. Journal of Contemporary Economics, 1: 8-17. DOI: http://dx.doi.org/10.7251/JOCE1901006M

Milne, A. 2016. Competition Policy and the Financial Technology Revolution in Banking. Digi World Economic Journal, 103: 145-161.

Mohanasundaram, T., Sathyanarayana, S., & Rizwana, M. 2021. Disruptions on India's Fintech landscape: The 5G wave. ITM Web of Conferences: 37. DOI: http://dx.doi.org/10.1051/itmconf/20213701008

Nakamoto, S. 2008. Bitcoin: A Peer-to-Peer Electronic Cash System. Available online at: https://bitcoin.org/bitcoin.pdf

Nasscom, C. 2020. Blockchain in Fintech: 5 Financial Services Inefficiencies that Blockchain Can Resolve. Available online at: https://community.nasscom.in/communities/emerging-tech/blockchain/blockc...

North, R. 2018. Evolution of Financial Technology (Fintech) Ecosystem in India. Enterprises Edges.

North, R. 2019. Future of FinTech in Shaping Banking and Financial Services. Enterprises Edges.

North, R. 2020. What is the impact of digital banking services in today's world? Enterprises Edge.

Osmani, M., El-Haddadeh, R., Hindi, N., Janssen, M., & Weerakkody, V. 2020. Blockchain for next Generation Services in Banking and Finance Cost, Benefit, Risk and Opportunity Analysis. Delft University of Technology, 34(3): 884-899. DOI: https://doi.org/10.1108/JEIM-02-2020-0044

Ozili, P.K. 2018. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Review: 329-340. Available online at: https://doi.org/10.1016/j.bir.2017.12.003

Pollari, I. 2016. The Rise of Fintech: Opportunities and Challenges. Jassa-the Finsia Journal of Applied Finance, 3: 15-21.

Pousttchi, P. 2018. Exploring the digitalization impact on consumer decision-making in retail banking. Electronic Markets, 28(3): 265-286. DOI: 10.1007/s12525-017-0283-0

Prybila, C., Schulte, S., Hochreiner, C., & Weber, I. 2017. Runtime Verification for Business Processes Utilizing the Bitcoin Blockchain. Future Generation Computer Systems, 107(3): 816-831. DOI: https://doi.org/10.1016/j.future.2017.08.024

Rrustemi, J. 2020. Facebook’s Digital Currency Venture Diem: the new Frontier ... or a Galaxy far, far away? Technology Innovation Management Review. DOI: doi.org/10.22215/timreview/1407

Rubaiyat, T. 2018. Blockchain Technology and the Future of Banking. The Financial Express.

Ryan, P. 2017. Smart Contract Relations in e-Commerce: Legal Implications of Exchanges Conducted on the Blockchain. Technology Innovation Management Review, 7(10): 14-21. DOI: http://doi.org/10.22215/timreview/1110

Sandner, P.G., & Block, J. 2011. The Market Value of R&D, Patents, and Trademarks. Research Policy, 40(7): 969-985. DOI: http://dx.doi.org/10.1016/j.respol.2011.04.004

Schueffel, P. 2016. Taming the Beast: A Scientific Definition of Fintech. Journal of Innovation Management, 4(4): 32-54. http://dx.doi.org/10.2139/ssrn.3097312

Sheng, A. 2018. From Industrial 4.0 to Finance 4.0. The Star. Available online at: https://www.thestar.com.my/business/business-news/2018/05/26/from-indust...

Stably. 2019. Decentralized Finance vs. Traditional Finance: What You Need to Know. Medium. Available online at: https://medium.com/stably-blog/decentralized-finance-vs-traditional-fina...

Swan, M. 2016. The Future of Brain-Computer Interfaces: Blockchaining Your Way into a Cloudmind. Journal of Evolution & Technology, 26(2): 60-81.

Teja, A. 2017. Indonesian Fintech Business: New Innovations or Foster and Collaborate in Business Ecosystems? The Asian Journal of Technology Management, 10(1): 10-18. DOI: http://dx.doi.org/10.12695/ajtm.2017.10.1.2

Underwood, S. 2016. Blockchain beyond Bitcoin. Communications of the ACM, 59(11): 15-17. DOI: 10.1145/2994581

Wamba, S.F., Jean Robert, K.K., Ransome, E.B., & John, G.K. 2019. Bitcoin, Blockchain and Fintech: a systematic review and case studies in the supply chain. Production Planning & Control, 31(2-3): 115-142. DOI: https://doi.org/10.1080/09537287.2019.1631460

Wolfond, G. 2017. A Blockchain Ecosystem for Digital Identity: Improving Service Delivery in Canada's Public and Private Sectors. Technology Innovation Management Review, 7(10): 35-40. DOI: http://doi.org/10.22215/timreview/1112

Wonglimpiyarat, J. 2017. FinTech banking industry: A systemic approach. Foresight. 19: 590-603. DOI: https://doi.org/10.1108/FS-07-2017-0026

Yulius, K., Ninuk, M., & Lena, E. 2019. Fintech in the Industrial Revolution Era 4.0, International Journal of Research Culture Society, 3(9): 53-56.

Zignuts. 2020. How is Blockchain Revolutioning Banking and Financial Markets. Available online at: https://www.zignuts.com/blockchain-technology-banking-financial-markets/

Keywords: Blockchain Technology, decentralized finance, digital banking, FinTech