1. Introduction

A “cluster” is a concentration or agglomeration of an industry that develops over time based on geographical proximity, in a way that boosts competition and collaboration that results in innovation. The process of clustering potentially creates greater economic benefits through higher productivity, better knowledge management, and entrepreneurial opportunities (Chuluunbaatara et al., 2014). The significance of economic and industrial clusters in regional and even national development has therefore become the object of a new economic theory (Porter, 1990) being taught now in business disciplines.

The Information Technology (IT) industry in India, one of the major contributors to the country’s growth story. It is organized in a few strong and dominant clusters across the country. As a proportion of national GDP, India’s IT industry revenues have grown from 1.2% in FY1998, to an estimated 9.5% in FY2015 (IBEF, 2016). India is the world's largest IT sourcing destination, accounting for approximately 55%of the US$ 185-190 billion global services sourcing business in 2017-18 (IBEF, 2019). In 2016, four Indian firms were listed among the top 10 technology outsourcing companies in the world [1]. The seven big IT clusters accounted for 96.55% of software exports by Software Technology Parks in India (STPI) in 2016-17, according to the 2016-17 STPI annual report. The emergence, growth, and success of these big IT clusters (one of them is an early entrant, and the remaining six are late movers) have been the focus of some recent studies (Khomiakova, 2007; Rao & Balasubrahmanya, 2017).

However, there are several other late mover IT clusters that have not experienced similar growth. Why do some of the late mover IT clusters in India succeed while some fail to take off? There is a need to address this question to aid firms and policy makers. This paper therefore investigates the clear distinctions between successful and not so successful IT clusters, in order to point out factors impeding the successes of later moving Indian IT clusters.

This paper uses a case study method in examining a single cluster using multiple data sources and methods. The case of Gujarat State IT clusters was carefully chosen because it ranks number one in India for ease of doing business [2]. Some recent studies have identified Gujarat IT cluster as one of the next emerging clusters. Gujarat has many of the enabling factors identified as important for becoming the next successful entrant in the IT industry. These include –a historical and growing concentration of innovative high-tech firms from diverse industries with software needs, temperate climate, entrepreneurial culture, connections between local entrepreneurs and MNCs, supportive state and local government policies, and established connections with the Indian diaspora. These factors are discussed in section four. However, despite these favorable conditions, India’s State of Gujarat has not been able to make a mark in the IT industry. This paper uses both primary and secondary data to probe into the factors and contexts that have hindered the successes of late mover IT clusters despite an economically favorable environment, using Gujarat IT clusters as a case study.

The remainder of the paper is organized into six sections. The next section reviews the literature pertaining to models and success factors of clusters in general and IT clusters in particular. The third section traces both the growth models in the Indian IT sector from its inception to its current status with several prominent clusters. The research gap and methodology section four presents a framework explaining the models, activities, success factors, and performance of IT clusters. Application of the framework to the Gujarat case is presented in the fifth section. Key insights in general and specific to the case are summarized in section six. The seventh section concludes with suggestions for future research.

2. Models of cluster formations

In order to understand IT clusters in India, it is essential to examine cluster formations in general. Several researchers have explained cluster formation models.

Bathiet’s study has been used to explain four models of regional development and growth (Rao & Balasubrahmanya, 2017). The first export model is a cluster created by a multiplier process that creates further growth mainly driven by exports. This model is limited in terms of innovation, interaction between economic agents within and outside the region and its absorptive capacity. The second model is the innovative milieu approach in which the actors establish linkages with economic agents in global markets and thereby develop absorptive capacity to acquire valuable information and resources from external sources that they can use. The third model is the super-cluster model in which larger groups based on multiple smaller clusters are formed. This type of formation depends on changes in supply and demand conditions in global markets for technologies, as well as the amount of spatial transaction costs that arise out of servicing clients in distant places. Pre-requisites for such a model are a strong mix of interregional and international transaction networks, and a high level of absorptive capacity. The fourth model is “local buzz and global pipelines”. This model differs from the other three in terms of emphasis on “relational proximity” as a source of competitive advantage, rather than spatial proximity. In this model, there is a “thick web of local interactions, process of learning and knowledge creation” that is linked to a global pipeline. Boja (2011) classified clusters into horizontal and vertical clusters. Vertical clusters have a vertical chain of production while horizontal clusters have similar outputs using inputs

Markusen (1996) identified three types of industrial clusters. First, a hub-and-spoke industrial district, comprising several small firms revolving around one or more dominant, externally oriented firms. Second, a satellite platform, with an assemblage of unconnected branch plants embedded in external organization links, located in a geographical area that benefits from governmental facilities or low-cost supplies and workforce. And third, a state-anchored district, focused on one or more public-sector institutions that dominate the region and the economic relation between cluster members. The next section explains how the above model characteristics apply to IT clusters.

2.1 IT clusters

This section provides a literature review of the models and success factors of IT clusters. IT clusters represent an important type of technology cluster and on the global stage represent many of the most successful and efficient examples of clustering (Boja, 2011). In these clusters the output is IT knowledge in the form of patents and innovative solutions, services, and products, mostly software as solutions or embedded in other products.

IT clusters can be classified as low-value and high-value based on the products and services produced by the constituent firms (Boja, 2011). Low-value clusters are involved mainly in outsourcing activities for large firms because they offer professionals at relatively low costs, provide various IT services for important companies that externalize different phases from the IT products lifecycle, customer support or quality assurance and testing processes. They depend entirely on a few worldwide IT companies for external input of technologies and financial support. High-value IT clusters develop innovative products and technologies. These clusters have active intra-cluster and extra-cluster interactions with a high absorptive capacity.

IT clusters have mainly horizontal relationships. In the IT industry, it is not a pre-requisite to be geographically close to the customer. Hence, a cluster may not have the entire chain of production. Each cluster is specialized in a particular technology or service, and acts either as a feeder or innovation hub for major firms or other clusters.

IT clusters around the world are organized in the following manner (Boja, 2011):

• Hub and spoke model, like the Seattle cluster in which Microsoft attracts other firms to provide IT services;

• Satellite platform model, found in both low-value and high-value IT clusters. Low value satellite platform model clusters can be found when multinational IT companies relocate their production sites to low-value IT clusters and state-centered or state-anchored IT clusters. Examples of high-value satellite platform model IT clusters are firms located around a) important research and university centers to benefit from their highly skilled specialists, b) laboratories for their innovation capabilities, and c) governments funded technology parks such as Research Triangle Park in North Carolina or the Cambridge Technology Cluster;

• State-centered or state-anchored IT clusters are found around governmental institutions, like aerospace complexes, military research labs, or state universities, that receive large budgets for research and development.

2.1.1 Success factors of IT Clusters

There are four important factors that contribute to the growth and success of IT clusters (Boja, 2011).

Base of qualified IT professionals. Since knowledge is the key input for IT products and services, a highly skilled workforce is critical for the birth, survival, and growth of an IT cluster. A strong higher education system that imparts high quality knowledge in the field of IT, and a network of research centres, both public and private, are prerequisites for creating a solid base of qualified IT professionals.

Availability of venture capital. Supportive institutions like venture capital and law firms play an extremely important role for location of start-up firms in knowledge-intensive industries (Kenney & Patton, 2005).

Clear financial regulations, incentives, facilities and opportunities provided by government.

Presence of functioning networks and partnerships. IT clusters typically require strong collaboration amongst cluster members in the form of sharing information, and competition.

3. Indian IT clusters

Indian IT clusters in their early stages were modeled as low value satellite platform structures. In their initial stages, the clusters had the following features:

1. Strong local entrepreneurship and innovation with connections to MNCs,

2. Increasing requirements of software development from MNCs driven by the information and communication technology (ICT) revolution,

3. Vertical disintegration of activities in developed country firms propelled by global competition that led to MNC companies outsourcing their work to countries with low cost work force,

4. Unbundling of R&D activities.

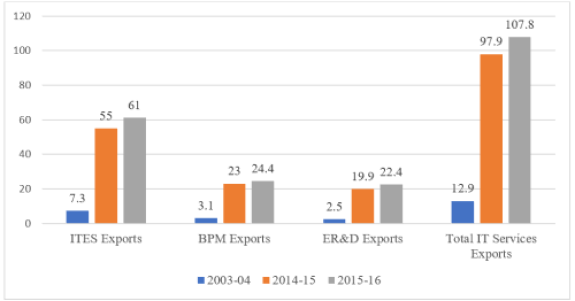

Figure 1. Indian IT industry Exports (USD)

Source: Rao & Balasubrahmanya, 2017 and Nasscom reports

Indian IT clusters have grown from a low value industry to a major player in the global ICT industry. The national output commands a 55% share of the global market for IT services. Fig 1. Captures the growth of IT industry exports in three sectors: ITES, Business Process Management (BPM), and Engineering and Research and Development (ER&D). An increase in BPM and ER&D activities indicates Indian IT clusters moving towards high-end value-added services. Another indicator of IT clusters moving up the value chain in India is the increasing number of US patents accumulated by Indian companies (Rao & Balasubrahmanya, 2017).

3.1 Success factors of Indian IT clusters

According to Rao and Balasubrahmanya (2017) and Khomiakova (2007), the major contributing success factors for growth in Indian IT clusters are:

1. Vast pool of low-cost and high-quality talent fluent in English language

2. Presence of premier educational and innovation-based research institutions

3. Historical concentration of innovative high-tech firms from diverse industries with IT needs

4. Temperate climate

5. Entrepreneurial culture

5. Connections between local entrepreneurs and MNCs

6. Supportive state and local government policies, establishment of Software Technology Parks of India [STPI]

7. Indian expatriates and returning Indians with education and experience abroad and connections to MNCs

8. Attractive work environment with acceptable level of social infrastructure to raise a family

9. IT firms with operational excellence that have gained cost, quality, and security leadership, as well as a global delivery model

10. Chance

3.2 Prominent IT clusters in India

The Indian IT industry is organized into seven prominent clusters: Bangalore, National Capital Region (NCR), Chennai, Hyderabad, Pune, Mumbai, and Kolkata.

Several firms that develop computer software and provide information technology (IT) services have emerged in and around Bangalore, a city located in India’s southern state of Karnataka. The Bangalore cluster is the largest in terms of sales and exports. It also houses the most technically advanced firms and is known as the Silicon Valley of India.

The Bangalore cluster has moved up the value chain of IT services from a low-value to intermediate-level super cluster and is now at the threshold level of becoming a high-value cluster. There is an increased level of both intra-cluster interaction within Bangalore and extra-cluster interaction between Bangalore and other clusters in India and abroad, due to diaspora and the influx of MNC affiliates, and the location of affiliates of Bangalore based Indian MNCs elsewhere (Rao & Balasubrahmanya, 2017).

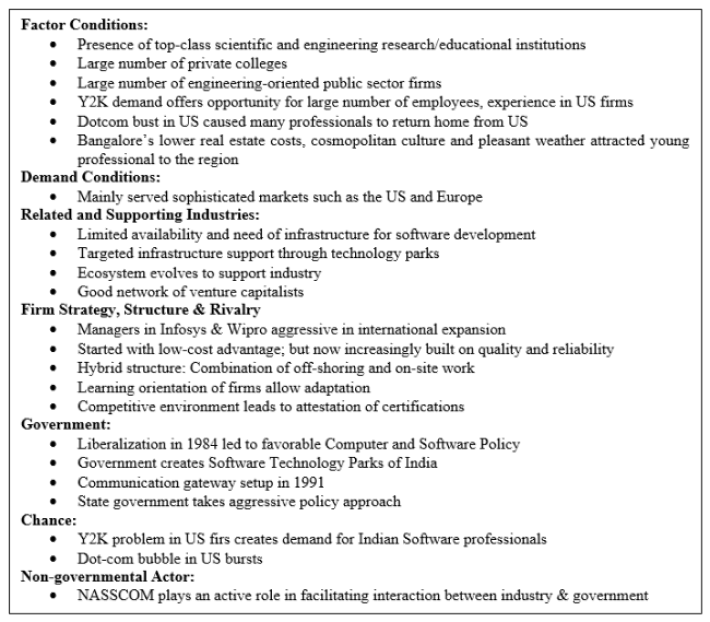

Anil Nair et al. (2007) explained the factors behind the recent growth and success of Bangalore as a globally competitive IT cluster. We look at this using Porter’s diamond model as follows:

Table 1. Factors contributing to success of Bangalore IT cluster

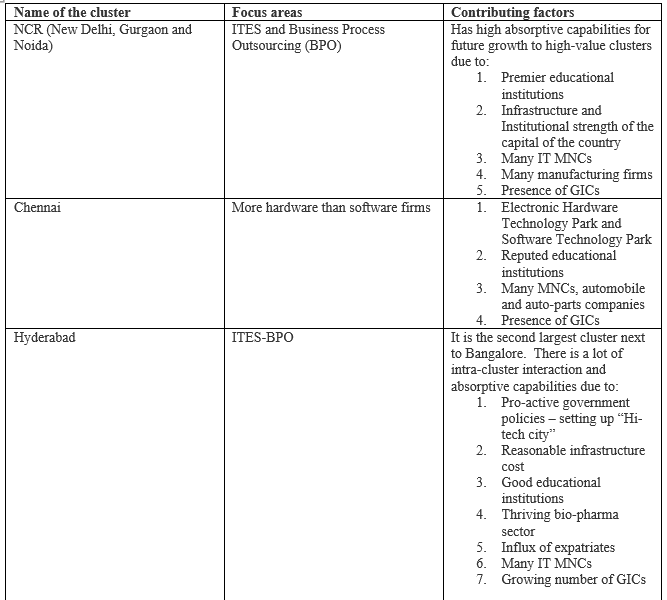

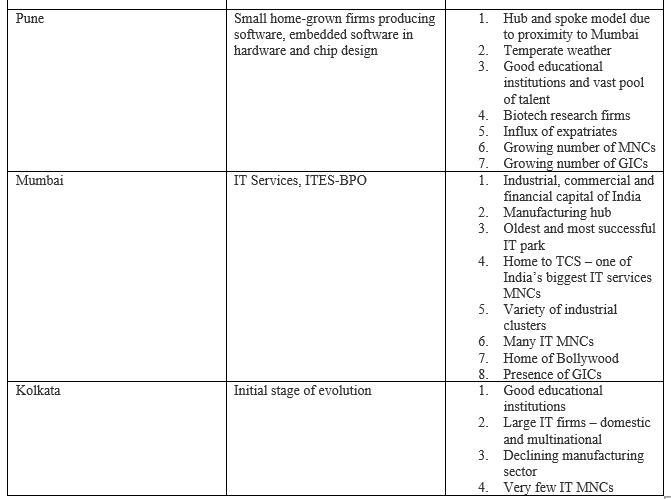

Ramachandran and Ray (2003) named the Indian states that are aspiring to develop IT clusters or have created IT clusters much later than Bangalore as later movers. The following table captures the focus areas, as well as the factors contributing to success in each of the remaining six late-mover clusters (Rao & Balasubrahmanya, 2017):

Table 2. Factors contributing to success of the remain six late-mover IT clusters

As can be seen from Table 2, Hyderabad is modeled as a state-anchored platform, NCR, and Chennai are modeled as satellite platforms, while Pune and Mumbai are modeled as hub and spoke platforms. Hyderabad, NCR, and Chennai are moving from low-value to intermediate level clusters in terms of quality of services produced, with many Global In-house Centers (GICs) serving ER&D, while Kolkata and Pune remain as low-value satellite model clusters. It does seem though, that Pune has the potential for increasing intra- and extra-cluster interactions in the future.

All seven clusters have educational and research bases, a supply of talent, diverse set of industries, and are located in and around large cities. These clusters are attractive places to work and raise a family with minimally expected amenities in the form of hospitals, schools, and other services (Rao & Balasubrahmanya, 2017). Most cities in India, including the above seven clusters, are plagued with infrastructural problems, such as traffic congestion, power outages, and rising housing costs (Rao & Balasubrahmanya, 2017). Not only that, India has a low score in application indicators, such as bandwidth per internet user, annual telecom investment, internet users per 100 people, access to wireless broadband, lack of high-speed connectivity, and others. (Rao & Balasubrahmanya, 2017).

4. The research gap and description of methodology used

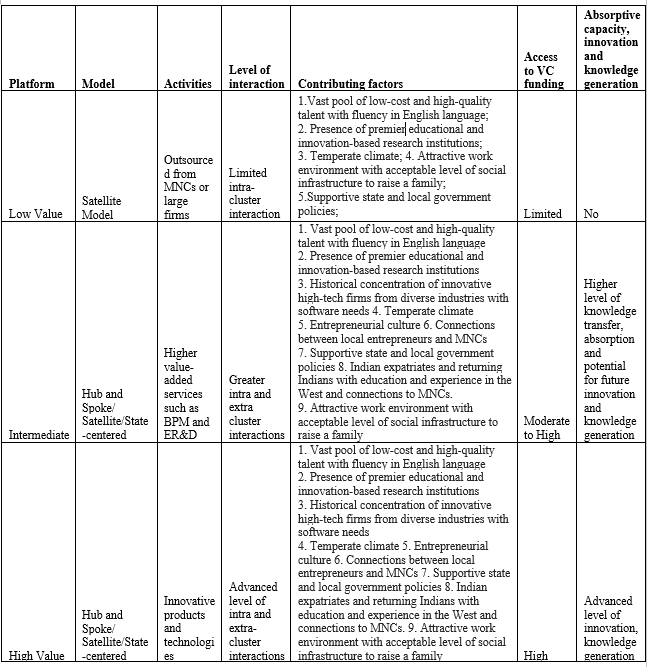

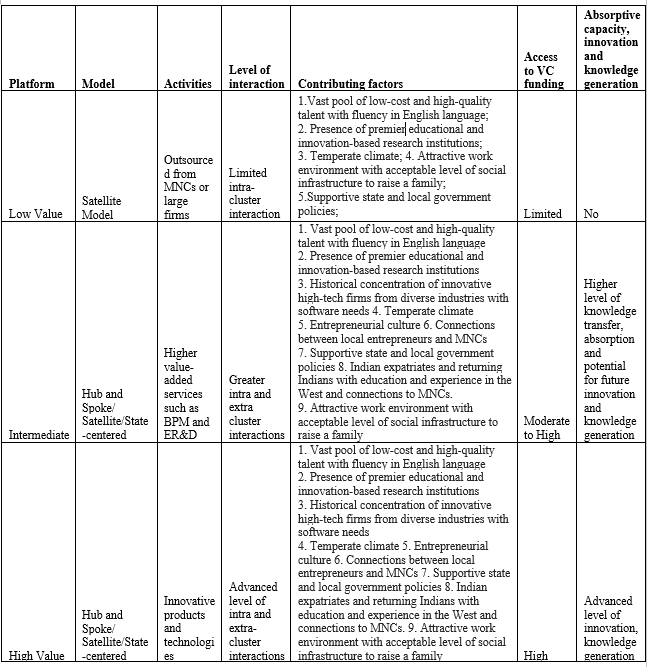

Table 3 presents a framework for explaining the models, activities, success factors, and performance of IT clusters based on the above literature. Indian low value clusters are mostly modeled on a satellite platform that derives most of its clientele and activities from work outsourced by large firms or MNCs. They all have moderately supportive governmental policies and limited economic resources. The intermediate level clusters in the form of Hub and Spoke, Satellite, or State Anchored platforms, have greater absorptive capacity, greater intra- and extra-cluster interactions, and provide higher value-added services, such as BPM and ER&D. There are more GICs in these clusters, and valuable networks with expatriates as well. This allows knowledge transfer, absorption, and potential for future innovation and knowledge generation.

These clusters contribute significantly to economic growth in India. High value clusters such as India’s Silicon Valley can be Hub and Spoke, Satellite, or State Anchored platforms. These have an advanced level of innovation, knowledge generation, intra- and extra-cluster interactions. These clusters are economic growth drivers that produce radically innovative, break-through technologies. So far, India does not have a high value IT cluster. Investment will follow ideas and growth. Therefore, venture capital investors are more active in the intermediate level and high value clusters.

Table 3. Nature, models, activities, success factors, and performance of IT clusters Title

So far, the literature has examined emergence, growth, and success of IT clusters. What are the factors that inhibit germination of all or some of the conditions mentioned in the above framework? No study has yet explored this important subject. Using a case study method, this research has explored if there are intrinsic conditions, contexts, and factors that impede the emergence and growth of an IT cluster. The use of a case study method aided this research because, “instead of relying solely on general knowledge of a problem domain, or making associations along generalized relationships between problem descriptors and conclusions, case-based reasoning is able to utilize specific knowledge of previously experienced, concrete problem situations (cases)” (Amodt & Plaza, 1994). In this specific research study, it allowed for a detailed and exhaustive investigation, using multiple sources of information, involving each of the essential elements and components of an innovation ecosystem, if they exist, that enable incubation of the factors in the aforementioned framework. Such a methodology is apt in this context because this is a relatively unexplored subject, and hence any finding can be further validated by replicating it in multiple cases to create a generalized theory.

Many studies (Nasscom reports; Rao et al. 2017; Khomaikova, 2007; Everest Group [3]) have identified Tier 2 and 3 cities as emerging IT clusters. Prominent among them are cities in Gujarat, Chandigarh, Coimbatore, Kochi, and Jaipur. The Gujarat IT cluster was chosen as the focus of this paper for two reasons. Firstly, Gujarat state contributes considerably to the country’s overall development as the third-largest state economy in India in terms of gross domestic product and per capita income [4]. According to a 2009 report on economic freedom by the Cato Institute, Gujarat is the second most free state in India [5]. In 2010, Forbes’ next decade list of the world's fastest growing cities included Ahmedabad, a major city in Gujarat, at number 3 after Chengdu and Chongqing from China [6].

Secondly, Gujarat has many enabling factors identified in the framework to help it become the next entrant in the IT industry, such as historical concentration of innovative high-tech firms from diverse industries with software needs, temperate climate, entrepreneurial culture, connections between local entrepreneurs and MNCs, supportive state and local government policies, and connections with the Indian diaspora. These factors will be discussed at greater length in the next section. However, despite all these favorable conditions, Gujarat has not yet been able to make a major mark in the IT industry. Therefore, the authors chose this state to conduct an in-depth case study analysis using multiple data sources. The authors applied our framework to Gujarat IT clusters to investigate the activities, model, and contributing factors as will be outlined in the following sections. The study involved primary data collection by way of surveys and secondary data sources including study of Gujarat IT policy and various other literature.

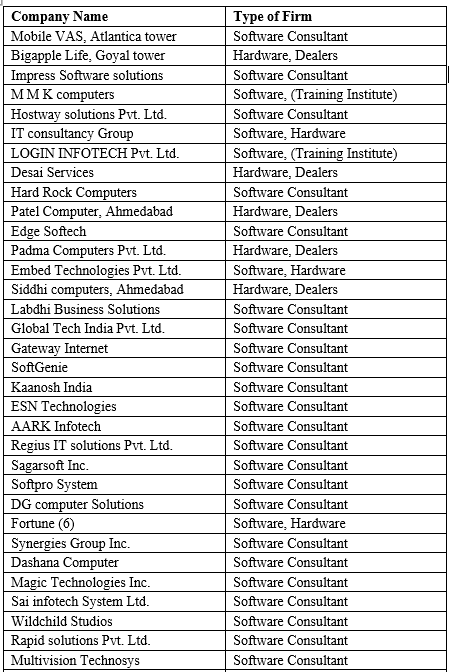

Primary data was collected by surveys through email, phone, and in person from 56 IT entrepreneurs, and 32 IT professionals working in private sector and government sector, both in and outside Gujarat. The questionnaire had both multiple choice and open-ended questions to compare IT clusters in terms of local government support, IT manpower, and facilities for IT employees at various locations. 147 people were approached for the survey, from which 96 responses were received, 88 of which were completed. The list of IT companies in Gujarat was obtained from a local telephone directory For those outside Gujarat, the respondents were through contacts of the IT professionals approached.

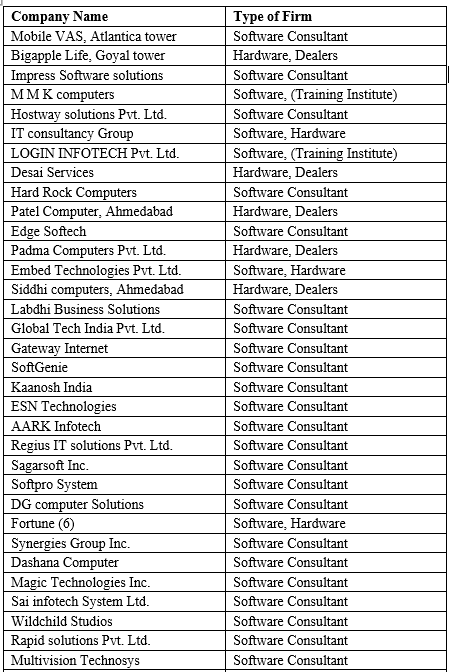

The questionnaire was validated and corrected for ambiguities by testing on a small sample before conducting the actual survey. Annexure 1 gives the list of respondents.

5. Application of the framework to the Gujarat case

5.1 Level of activities in IT sector

Although Gujarat is industrially more developed in comparison with other states, such as Karnataka, Andhra Pradesh, Maharashtra, the IT sector [7] in Gujarat has a negligible share of the total Indian IT industry. In FY 2015-16, the size of the Gujarat IT industry was estimated around US$ 1.1 billion, compared with the total Indian IT market of US$ 146 billion. IT exports from Gujarat are worth US$ 400 million, compared with the total Indian IT exports of US $107.8 billion (DIPP, Government of India, 2017). When we compare this data with the response we received from our survey participants, we found that 77% of the IT entrepreneurs surveyed said they did not achieve their business target. When asked for reasons, they said most of them are falling behind their targets in a big way because of a lack of capabilities.

All of the respondents said that they are not ready for the uncertainties they are facing in the external environment of the IT industry (attrition rate, recession, etc.). While IT entrepreneurs feel that they have the capabilities to carry out IT contract jobs, IT professionals (59% of respondents) believe the IT sector in Gujarat is still not ready to take on contract jobs. Most firms in Gujarat are service oriented (IT enabled services), with few innovation-oriented industries. Total investment in Gujarat IT firms is also low. The respondents felt that incoming large IT companies to Gujarat, Foreign Direct Investment (FDI) in IT, and government policies can create IT clusters in Gujarat. Hence, the Gujarat IT cluster qualifies currently as a low-value, satellite model cluster.

5.2 Contributing and impeding factors

5.2.1 The IT talent pool in Gujarat.

70% of IT entrepreneur respondents said their employees are Gujarati. It is well known that English is not a preferred language of communication amongst Gujarati; most Gujarat state board schools have Gujarati as the medium of instruction. Therefore, the IT talent in Gujarat are not fluent in English.

The primary survey also indicated (71% of respondents) that the IT curriculum needs a lot of improvement. 97% of respondents said there is a need to promote creativity, technical skills, and ideas, in the field of IT. The lack of requisite capabilities and competencies was also cited as a reason for non-achievement of business targets. The Gujarat IT talent pool is therefore not adequately skilled.

5.2.2 Presence of premier educational and innovation-based research institutions

Gujarat state has good educational infrastructure with premier institutes in management, fashion, design, infrastructure planning, and pharmaceuticals. However, academic institutions which support higher education such as PhDs in an IT field are fewer in Gujarat. Gujarat has 4.5% of the total undergraduate engineering seats in India, and only 3.4% of the total post-graduate engineering seats as per the figures published by the All India Council of Technical Education [8]. It has only five major engineering-focused universities showcased in the Vibrant Gujarat Summit.

5.2.3 Historical concentration of innovative high-tech firms from diverse industries with software needs

Gujarat is one of the most industrially progressive and developed states in India. According to IBEF, “Gujarat state contributes about a quarter to India’s goods exports and accounts for 5% of India’s FDI. It is the petroleum capital of India, world’s largest producer of processed diamonds, third largest manufacturer of denim, and also a leader in industrial sectors such as chemicals, petrochemicals, dairy, drugs and pharmaceuticals, cement and ceramics, gems and jewelry, textiles and engineering, with 106 product clusters, 800 large companies and over 450,000 micro, small, and medium enterprises. There are 42 ports, 18 domestic airports, one international airport, and 60 notified special economic zones (SEZs). Large scale investment is expected in Gujarat as part of the US$ 90 billion Delhi-Mumbai Industrial Corridor (DMIC)” [9].

5.2.4 Entrepreneurial culture

The Gujarat region has been known for its business activities since ancient times (Peck, 2015; Mehta, 1991). Many Gujaratis have developed a penchant for trading, finance and accounting, from generation to generation. In the Gujarat government, a spirit of free trade and entrepreneurism has continued down the line.

5.2.5 Gujarati diaspora and network

Gujaratis comprise around 33% of the Indian diaspora worldwide, and can be found in 129 of 190 countries listed as sovereign by the United Nations [10]. However, there are not many returning from abroad, specifically in IT sector.

5.2.6 Government policies

Out of 20 operational SEZs in Gujarat, only 5 of them are IT-focused [11]. In 2017-18, four states, namely, Telangana (14%), Karnataka (40%), Maharashtra (20%), and Tamil Nadu (10%), account for 84% of total exports from registered units with Software Technology Parks of India (STPIs). The share of Gujarat was a mere 0.71% [12].

The state government has been constantly introducing initiatives like global events like the Vibrant Gujarat Summit, workshops, conferences, and other activities to promote start-ups Gujarat topped the startup ecosystem ranking by DIPP 2018 [13], partly in response to supporting 4,000 innovative student startups under a Student Start up Innovation Policy (SSIP) program, which is set to upscale 500 student startups in the next five years [14]. However, the percentage IT start-ups amongst these are few and far between. This is largely because Gujarat has grown due to its traditional businesses, with little inclination to become part of India’s IT growth story [15].

All respondents to our survey, not surprisingly, felt that that Gujarat has insufficient IT infrastructure and fewer incentives for IT compared to AP and Karnataka. Das and Sagara (2016) have also observed that the early and successful states offer far more incentives as compared to late movers.

5.2.7 Attractive work environment with acceptable level of social infrastructure to raise a family

Although Gujarat presents a conducive environment to raise a family, it presents lifestyle restrictions. Gujarat is predominantly a vegetarian state. Even restaurants like McDonalds and Dominos were forced to serve only vegetarian food [16]. Singles [17] and families with non-vegetarian food preferences find it difficult to rent apartments. As well, Gujarat state prohibits consumption and sale of alcohol by law.

5.2.8 Sources of funding

The primary sources of funding are family and other sources, not venture capital. There is only one venture capital firm and one angel network in Gujarat.

6. Summary of key insights from the case study

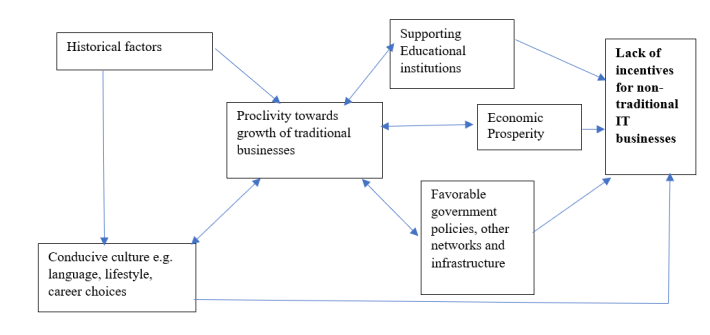

It is evident from the above, that Gujarat has a thriving entrepreneurial culture, proactive business-friendly government, a diverse set of successful and prominent industries, good amenities to raise a family, and a thriving economy. However, all the contributing factors are conducive for traditional businesses, rather than for IT businesses. Khomaikova (2007) in her research concluded that the big seven IT clusters in India are cities of consciously planned communities for making various targeted innovations. Gujarat is also a state that is consciously planned and suited for traditional, non-IT businesses. The following figure thus summarizes the quandary wherein Gujarat’s IT sector in particular, as well as other such similar prosperous regions in India currently find themselves.

Figure 2. What impedes the success of late mover IT clusters despite economically favorable environments?

7. Suggestions for future research

This paper has provided a new framework, not previously studied in Indian IT cluster research. It has addressed and answered an important question: What impedes the success of late mover IT clusters despite economically favorable environments? Recognizing and acknowledging this is the first step towards creating an environment that encourages the emergence and growth of IT clusters. This research study has been exploratory, and will require further investigation by replicating it in multiple additional cases to create a generalized theory. For future research, a quantitative, data driven, empirical investigation of similar cases can either validate or invalidate the framework identified in this study.

Aamodt, A. and Plaza, E. 1994. Case-Based Reasoning: Foundational Issues, Methodological Variations, and System Approaches. AI Communications. IOS Press, Vol. 7, 1: 39-59.

Basant, R. 2006. Bangalore Cluster: Evolution Growth and Challenges. Working Paper Series, 2005-06.

Boja, C. 2011. IT clusters as a special type of industrial clusters. Informatica Economica, 15(2): 184-193.

Carlos, M.-F., Jardon, R. N. 2016. Is collective efficiency in subsistence clusters a growth strategy? The case of the wood industry in Oberá, Argentina. International Journal of Emerging Markets, Vol 11, Issue 2: 232-255.

Chandra, R., and Rao, P. 2008. The role of MNEs in the development of high-tech industrial clusters: a comparative analysis of India's pharmaceutical, automative and software sectors. American Society for Competitiveness Nineteenth Annual Conference. Orlando, Florida.

Chuluunbaatara, E. Ottavia, Luh, D. and Kung, S. 2014. The Role of Cluster and Social Capital in Cultural and Creative Industries Development. Procedia - Social and Behavioral Sciences, 109, 552-557.

Das, K. and Sagara, H. 2016. State and the IT Industry in India. Ahmedabad: Gujarat Institute of Developmental Research.

Fallah, D. M. 2005. Technology Clusters and Innovation. Stevens Alliance for Technolgy Management, 9(4).

Kenny, M and Patton, D. 2005. Entrepreneurial Geographies: Support Networks in Three High-Tech Industries. Economic Geography, 81 (2): 201-228.

Khomiakova, T. 2007. Information Technology Clusters in India. Translation Review, 14(2).

Markusen, A. 1996. Sticky places in slippery space: A typology of industrial districts. Economic Geography: 293-313.

Nair, A. Ahlstrom, D. and Filer, L. 2007. Localized Advantage in a Global Economy: The Case of Bangalore. Thunderbird International Business Review. Vol. 49(5): 591–618.

Phambuka-Nsimbi, C. 2008. Creating competitive advantage in developing countries through business clusters: A literature review. African Journal of Business Management: 125-130.

Porter, M. E. 1990. The Competitive Advantage of Nations. Harvard Business Review.

Porter, M. E. 2000. Location, Competition, and Economic Development: Local Clusters in a Global Economy. Economic Development Quarterly.

Rao, P. M., and Balasubrahmanya, M. H. 2017. The rise of IT services clusters in India; A case of growth by replication. Telecommunications Policy: 90-105.

Steinle, C., and Schiele, H. 2002. When do indutries cluster? A proposal on how to assess an industry's propensity to concentrate at a single region or nation. Research Policy, 31: 848-859.

Sturgeon, T. J. 2003. What Really Goes on in Silicon Valley? Spatial Clustering and Dispersal in Modular Production Networks. IPC Working Paper Series.

Viederytė, R. 2018. Cluster life cycle types and driving factors. Regional Formation and Development Studies, 1 (24): 62-72.

All websites were accessed on December 19, 2019.

[7] The words sector and industry have been used interchangeably in the paper.

[10] “Global Gujaratis: Now in 129 Nations”. 2015. Economic Times. //economictimes.indiatimes.com/articleshow/45748322.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Appendix 1. List of Private Sector IT Firms Approached for the Study.