AbstractSo we have to be idealists, in a way — because then we wind up as the true, the real realists.

Viktor Frankl (1905-1997)

Platform-enabled services targeted to make everyday life easier have become increasingly available in recent decades, which in some cases challenge traditional ways of owning and working. However, comprehensive data-driven value creation opportunities, which are seamlessly connected to various needs in the everyday life of citizens or residents, are still largely untapped and unstudied. This article investigates value creation opportunities for holistic housing concepts with related ecosystems designed to combine the physical environment of residents along with a digital platform. The novelty of this study builds on a holistic understanding of value co-creation in housing, enabled by digital platforms at the ecosystem level. The empirical study focuses on a qualitative multi-case study of four holistic and resident-centric service concepts, which all include digital platforms. The main findings are concluded as follows: First, digital platforms enable various value creation opportunities in resident-centric housing concepts and related ecosystems. Second, exploring strategic choices regarding competitiveness, innovation, and growth revealed that digital platforms played various roles such as informative, supportive, integrative, or even embedded in novel housing as a service platform concepts, which call for totally new orchestration and business models across traditional industrial and ecosystem boundaries. Third, in light of the basic mechanisms for ensuring competitiveness and growth in data and a platform economy, we identify two main alternative strategic approaches. The findings serve both practitioners and researchers exploring opportunities of a platform economy, with a particular benefit for those in largely unstudied housing markets.

Introduction

Megatrends such as aging, urbanization, sustainability, digitalization, and communality are reflected in the diverse needs and expectations of housing. In addition, servitization and changing consumer habits constitute significant drivers of change in housing-related industries (Siltaloppi, 2015). Our homes and living environments have also become a part of our self-realization. In their daily lives, people look for new ways to acquire and co-produce the services they need, for instance enabled by a sharing economy and related platforms (Acquier et al., 2019). Meanwhile, housing residents are understood as playing active roles in value co-creation, while companies adopt networked and data-driven value creation logic (Lusch & Nambisan, 2015; Siltaloppi, 2015; Vargo & Lusch, 2016). These trends enable opportunities to challenge established value creation logic and industrial boundaries between construction and residential service businesses, by means of more demand-driven and agile service models enabled by digital platforms.

This also creates a huge challenge across industries, in both B2C and B2B markets. In construction and residential contexts, profound transformation in value creation and capture logic is required to align with servitization: First, a shift from transactional business models towards service- and customer-orientated business models (Siltaloppi, 2015; Xu et al., 2019; Mikkola et al., 2020); and second, a shift towards more networked and data-driven business models that build on the platform economy (Leminen et al., 2018; Maxwell, 2018; Woodhead et al., 2018; Xu et al., 2019; Lappalainen & Federley, 2020). The ongoing changes primarily relate to the expansion and diversification of the construction and real estate services industries, as new innovative service models and actors emerge alongside traditional actors and roles to challenge established operating and thinking patterns. The construction phase is crucial from the life cycle building perspective and related data-driven value creation opportunities. Yet, there remains a kind of ecosystem gap in terms of different actors, governance, and shared logic between construction and other life cycle phases of buildings, such as use, operation, maintenance and renovation (Xu et al., 2019; Mikkola et al., 2020). Further, research has still concentrated on firm-level service innovations, but not as much on the impact of changing business models on the operation and composition of business ecosystems (Petrulaitiene et al., 2017; Leminen et al., 2018; Lappalainen & Federley, 2020).

While data-driven value creation opportunities for a platform economy in residential housing contexts are largely untapped and unstudied, the purpose of this article is to examine what kind of value creation opportunities digital platforms enable in housing concepts and related ecosystems. This study adopts a service-dominant logic approach to the housing context (Vargo & Lusch, 2016). It offers a holistic view on housing, comprised of promoting multi-sided value creation and optimal integration of resources between actors. The study focuses on comprehensive housing concepts that combine physical, social, and digital solutions provided by a local service ecosystem. Digital solutions and platforms are developed to make service exchange and shared resources easily available for residents, but also to support further development and new value co-creation opportunities, for example, through network effects.

The paper adopts a networked and systemic perspective in particular to narrow the research gap highlighted in recent studies (Fehrer et al., 2018; Leminen et al., 2018). We define platform ecosystems theoretically according to “design” and “co-evolutionary” perspectives. We elaborate a conceptual platform design framework based on the literature (Parker et al., 2016; Täuscher & Laudien, 2018; Tura et al., 2018; Sorri et al., 2019; Hein et al., 2020; Isckia et al. 2020) and apply it for analyzing empirical findings from a multi-case study of holistic housing concepts. In the next section, we present the theoretical background, followed by the methodology and case descriptions of the empirical study. The article continues with a summary of the main findings and ends with a discussion and conclusion, including implications, limitations, and suggestions for further research.

Theoretical Background

Housing as a service platform - framed by service innovation concept of S-D logic

Driven by service-dominant (S-D) logic, “service innovation” can be defined as complex network- and information-centric value co-creation by resource re-bundling in novel ways among beneficiaries (Lusch & Nambisan, 2015). S-D logic and taking a broader view of service innovation have inspired scholars across disciplines to also examine more specific mechanisms of data-driven service innovation that have been enabled by advanced technologies (Lehrer et al., 2018; Kugler, 2020). However, in the housing context, the S-D logic approach to studying innovative service concepts still seems rather unknown, and with a particular lack of empirical research (Siltaloppi, 2015; Lappalainen & Federley, 2020).

Lusch and Nambisan (2015) suggested a tripartite service innovation framework, comprised of service platforms, value co-creation processes, and service ecosystems, which provide a relevant basis for this study. First, residents are understood to play an active role in value co-creation, when housing is seen as a mutual everyday activity and the value of housing is seen as multifaceted, experiential, and context dependent (Lusch & Nambisan, 2015; Vargo & Lusch, 2016). Companies enable and support residential activities. Thereby, the value proposition focuses on interactions among the residents, as well as between residents and companies. In residents’ (as customers’) experience, the value proposition may be fulfilled or unattained. At the same time, value creation in housing expands from the physical environment of individual homes to the key activities of a resident’s everyday life in the neighborhood, such as daily chores, mobility, and activities related to work, studies, and free time. Second, the built environment with everyday services and activities enabled through it are merged into one holistic service concept, where digital solutions make it easy to order, pay, and use the available facilities and services. This service platform, as defined by Lusch and Nambisan (2015), thus encompasses both tangible and intangible resources, and promoting mutual interaction between residents and with service providers. Hence, it facilitates the optimal integration of resources between actors (ibid.). Third, in comparison to the traditional real estate-focused model, networks of housing construction actors along with actors related to the actual residential phase of housing can expand into a local service ecosystem. The term “service ecosystem” has been defined as a complex, self-adjusting system of resource-integrating actors connected by shared institutional arrangements and mutual value creation (Vargo & Lusch, 2016; cf. Jacobides et al., 2018).

In their ecosystem literature review, Aarikka-Stenroos and Ritala (2017) identified two typical characteristics: co-evolution and broadening or blurring structural and sectoral boundaries. This is in accordance with our notion of housing construction and residential service industries, which have “evolved” separately – the construction industry being very established and dominated by large companies with traditional value chains, while residential service businesses are still in an emergent stage, particularly in Finland, where our empirical case study was located. However, digital platforms with IoT solutions that combine life cycle data from built environments, residential data, and public data from various service sectors enable novel value creation opportunities for both established actors and new entrants (Ikävalko et al., 2018; Leminen et al., 2018; cf. Xu et al., 2019; Mikkola et al., 2020). Nevertheless, there have been few studies on the specific perspective of innovating new, data-driven residential services that require the implementation of ecosystem-wide and even ecosystem-crossing collaborative actions.

Value co-creation in emergent business ecosystems enabled by digital platforms

In the rapidly growing data economy, the “platform ecosystem” concept has been widely adopted among researchers and practitioners. Platform ecosystems are created around technological platforms, typically owned or governed by platform leaders that connect multiple sides of markets, such as users, advertisers, developers, and content providers, to facilitate value co-creation (Gawer & Cusumano, 2014; Aarikka-Stenroos & Ritala, 2017; Hein et al., 2020). As this definition has been reflected upon, typically the research debate around platform ecosystems has focused on new eco-systemic value creation logic enabled by these digital platforms, instead of examining complex transformation across entire value chains and networks, along with a combination of conventional linear business logic with platform-based business models.

Platform ecosystems challenge traditional business logic, rules, and relationships between product and service owners, vendors, and users, and how they are generated in emerging ecosystems. Moreover, the roles of actors in platform ecosystems change or become more diverse, while new players become critical, such as developers, called “complementors”. This creates profound challenges to platform design and co-evolution, since a platform and its rules need to be designed in a way that enables fast growth by taking the advantage of a platform business and developing a sustainable and scalable combination of simultaneously different value creation logics and fair competition within an ecosystem (Ikävalko et al., 2018; Tura et al., 2018).

Tura and co-authors (2018) developed a conceptual platform design framework that highlights the four most crucial design choices to build the base for a sustainable platform business: platform architecture, value creation logic, governance, and platform competition. In the following, these are briefly defined, and linked with recent research in the platform ecosystem field from both design (Täuscher & Laudien, 2018; Sorri et al., 2019; Hein et al. 2020) and co-evolutionary perspectives (Isckia et al., 2020).

Platform architecture focuses on the actors, market, and fundamental structure of platforms. Necessary considerations include determining the main purpose, core interaction, and relevant market structures with key actors (users, providers, developers, managers, and owners) needed for value co-creation and capture by beneficiaries. The core interaction is defined as an exchange of value that attracts users to use the platform, and moreover that enables expansion beyond the original core interaction over time for competitiveness and growth (Parker et al., 2016). The openness of platform architecture refers to both technical and collaborative or contractual mechanisms that enable access and participation modes of key actor groups in value creation and innovation (see Governance) (Parker et al., 2016; Tura et al., 2018; Sorri et al., 2019; Hein et al., 2020). The level of openness seems to change along the platform development process, even though earlier architectural and strategic design choices play an important role in the platform ecosystem life cycle (Isckia et al., 2020).

The second element of value creation logic involves identifying actor roles for value to be created, and also how to achieve beneficiary commitments. Furthermore, it should be designed according to how network effects work and how they affect platform use. According to Parker and co-authors (2016), “network effects refer to the impact that number of users of a platform has on value created for each user”. These can be same-sided or cross-sided, as well as negative and positive. While enhancing scalability and defensibility, positive network effects serve as a fundamental source of value creation and competitiveness in platform businesses (Gawer & Cusumano, 2014; Parker et al., 2016; Hein et al., 2020). To capture value, a platform revenue model needs to be carefully developed for optimal and dynamic pricing (incl. other incentives) to serve various actors. Different mechanisms (for example, subsidies vs. monetization techniques) may be needed to boost the fast growth of actors and network effects in the beginning to gain critical mass, and then to enhance commitment and new value co-creation opportunities (Parker et al., 2016; Täuscher & Laudien, 2018).

Design choices on leadership, ownership, and related management practices for a platform affect governance effectiveness, and thus the longevity of the platform. Here, platform rules, with respect to, for example, (data) access, content creation, sharing, and trading constitute the main mechanisms defined as collaborative/contractual boundary resources (Sorri et al., 2019). Hein and co-authors (2020) referred to the following three alternative archetypes of ownership to balance control rights against the autonomy of ecosystem actors: a central platform owner, a consortium of partners, and a decentralized peer-to-peer network (Parker et al., 2016; De Reuver et al., 2018). Ownership status affects the development dynamics of an ecosystem in terms of how governance mechanisms, such as input and output control and decision rights, can be exploited (Tiwana, 2014; Hein et al., 2020). In addition to typical owner-based management models, alternatives such as licensing a platform or using open source solutions can be applied (for example, Parker & van Alstyne, 2009; Parker et al., 2016). Each (organizational) actor needs to make a strategic decision and negotiate its role in the emerging ecosystem, either as an owner or in alternative roles, for example, as a financer, coordinator, producer, facilitator, or developer (Valkokari et al., 2017; Hein et al., 2020). In practice, the roles materialize in various ways and with different combinations during a platform ecosystem’s life cycle.

Finally, the element of platform competition includes design considerations about the launch, competitiveness, renewal, and scalability of a platform. Competitiveness in a platform launch and diffusion are built by attracting, reaching, and maintaining critical mass (to tackle the chicken-egg-problem) and against incumbents or other new players (Parker et al., 2016; Tura et al., 2018). Here, two platform strategies are typical: first, focusing on increasing the number of users and interactions to reach economies of scale (depth), and second, investing in economies of scope (breadth) by bringing in new partners with services to the platform (Isckia et al., 2020). Scaling strategies are also essential platform growth mechanisms, and thus, design choices, such as platform openness, revenue models, and governance (technical and collaborative boundary resources) influence growth (Ibid). All of these main elements are strongly interlinked and thus have to be renewed in a systemic way to ensure innovation possibilities for different sides of a market. When a platform ecosystem’s complexity increases, more openness is necessary, along with calling for different governance mechanisms to balance value co-creation and value capture. Likewise, both competition and collaboration are needed within a co-evolving platform ecosystems against competitors (Letaifa, 2014; Cennamo & Santaló, 2019; Hein et al., 2020; Isckia et al., 2020).

Methodology

We chose the empirically qualitative multi-case study approach of Eisenhardt (1989) as particularly relevant for exploring dynamic and emerging phenomena and creating renewed conceptual frameworks. By applying purposeful sampling, we selected four pioneering residential service concepts as cases for the study. All four concepts have been developed and implemented in Finland. “Pioneering” was defined to refer to holistic resident-centric service solutions that promote sustainable and continuous renewal by utilizing scalability and personalization enabled by a platform economy. The selected cases aim to extend value co-creation beyond the capabilities provided by the physical built environment and transactions of tangible value objects. Further, diversity in terms of customer segments and differentiated value proposition with holistic service concept were sought. One selection criterion was that the concept is designed to merge both the physical environment of residents and a digital platform. This criterion excludes many separate digital services and platforms, developed for housing services, home-deliveries, and resource sharing. The requirement interrelates with the role of an “ecosystem orchestrator” that connects residents and service providers with their housing as a service platform concept. The “pioneering” criterion also resulted in a set of block-level cases that have been recently built and were still under construction during this empirical study. In two of the four cases, the residents had only lived in the building for a few months on average at the time of the data collection and had little experience of the holistic residential service concepts with joint facilities, services and digital platforms. To gain balanced data on all the selected cases for analysis, we did not gather data on residents’ experiences. This was a conscious methodological decision, which constitutes an essential limitation of this study on resident-centric service offerings and leaves it as a subject for further research.

Case descriptions and research question

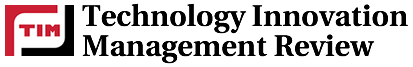

Table 1 presents basic information about the four empirical cases, and then we briefly describe selected housing as a service platform concepts in the following paragraphs.

Table 1. Background facts from empirical cases

In Case A the value proposition of their housing as a service platform concept emphasizes the well-being of residents, ease of everyday living, and opportunities to spend time with other residents. Shared spaces for the community within the block, services for people in various phases of life, and nice surroundings are seen as essential elements to support the overall well-being of residents of all ages. Examples of shared spaces in the block are a gym, a reading room, a sauna, a guest room, a playroom, and a study. There are also shared cars and bicycles, tools, and other equipment available for residents. Good opportunities are available for outdoor activities in the immediate surroundings. A coordinated service offering includes cleaning, meal deliveries, massage, and maintenance services. A service advisor is available for residents regarding daily issues and organizing activities, if needed. The costs of the advisor and maintaining the shared resources are covered by a fixed monthly fee for each apartment. Additional services operate on a paid per usage basis. Residents make reservations for shared spaces and order services through a digital service portal, which also serves as an information channel. The housing as a service platform concept was developed and is operated by a company that creates new solutions for housing and well-being. The company is part of a private company focusing on health and wellness services. As a part of the housing concept, the company preselects service providers and makes contracts with them. The company has a clear permanent role in the housing concept, and its aim is to scale up the concept.

A central idea of the housing as a service platform concept in Case B is to promote effortless everyday life in an urban environment. Building automation and services are designed to make it possible for residents to have more time for pleasant activities during the day, instead of time spent, for example, waiting for elevators and deliveries, collecting groceries, doing laundry, or traveling to other places for free-time activities. An extensive service offering from the shopping center in the same complex is easily accessible, and many local businesses provide deliveries directly to the apartments. The service offering is coordinated by the construction company, which is also the developer of the entire housing as a service platform concept. There are a variety of shared spaces available for residents, such as three available saunas, a gym, terrace, kitchen, and a lounge suitable for teleworking. Shared cars and bicycles are also available for residents. A service coordinator at the lobby advises residents, offers reception services, and assists residents with their errands. Shared spaces can be booked, services ordered, and information related to an apartment, or to the building provided through a web-based service platform. The residents pay a fixed monthly fee to the operator, while an extra fee is charged per use of services, including private bookings of shared spaces.

In Case C an underlying aim of their housing as a service platform concept is to promote equality, social equity, and responsibility. In their rental housing production, the company emphasizes communality and support services. The goal is to create a multi-generational communal living environment that provides affordable housing for all kinds of people. Shared spaces and resources include, for example, a living room, kitchen, laundry room, music room, woodworking workshop, gym, a computer, tools, and a car. The basic cost of residential services, including internet connection and shared spaces, are part of the rent, while an extra fee is charged for some usages, such as the shared car. Especially during the first years, when a housing coordinator was present at the block every working day, communal events were organized for residents, and residents were supported in organizing activities. The housing coordinator also advises residents in housing-related issues, as needed. The company that developed this holistic housing concept also operates it and manages the related digital platform.

In their housing as a service platform concept, Case D aims to provide ecological and high-quality living in homes that are more than merely the space of an individual apartment. The building with timber cladding is equipped with geothermal heating and solar panels. The apartments are equipped with air-conditioning and digital access control. All buildings in the neighborhood are newly built and situated close to a sports park, within a green environment. The residents have access to shared spaces, such as a teleworking space, greenhouse, spa and sauna, and shared resources, such as an electric car and bicycles. In contrast to the other cases we researched, the housing concept of Case D does not include a service advisor. Reserving shared spaces can be made through a digital portal, along with other services directly through individual service providers’ solutions. This holistic housing concept was developed by a construction company. They had initially negotiated with the service providers, but a model for future operation is still under development. Usage of shared spaces is included in the maintenance charge, while other services are paid per usage.

All four empirical cases represent pilot projects for the builders, which are contributing to the development of their housing as a service platform concept. The builders also took the role of main operator along the life cycle of the housing blocks and related service/platform ecosystem orchestration. However, the ecosystem model seems to be still in an emergent phase, particularly in the newest Case D. As seen from the case descriptions, even if the housing concepts have different value propositions and target markets, they all share the same idea of housing as a platform, which integrates similar physical, social, and digital elements for resident-centric service activities. Our interest is to further examine the role of digital platforms in these holistic residential service concepts and related alternative data-driven business opportunities. The research question we focus on is the following: What kind of value creation opportunities do digital platforms enable in housing concepts and related ecosystems?

Data Collection and Analysis

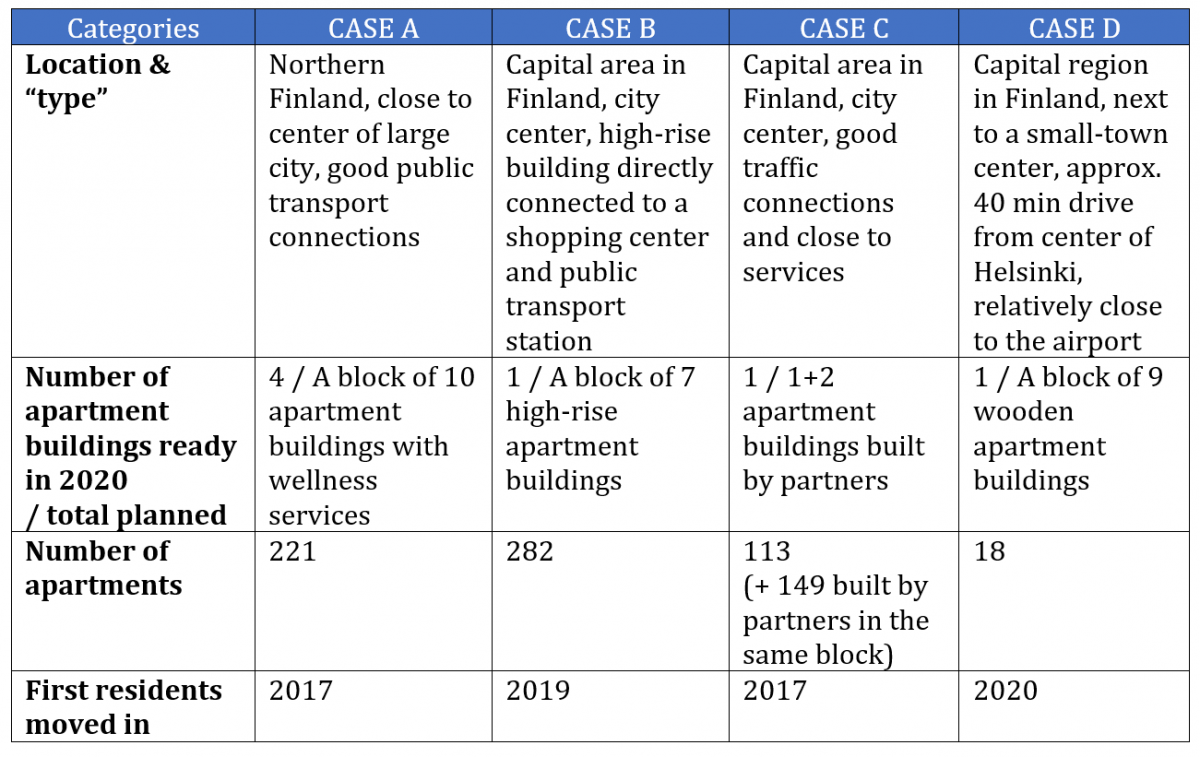

The main research methods for this study included a systematic analysis of public case-specific data, in addition to eight in-depth interviews of case representatives from 2017-2020 (see Table 2). Interviewees performed various roles in the different cases, such as facility manager, service and concept developer, managing director, and shareholder. Interviews topics covered future living, emerging demand and market structures in residential services, the development and future plans of customer-centric housing concepts, and related opportunities and challenges to utilizing data and platform economy in their business. The interviews took approximately 1-1.5 hours and were documented in research notes, and most of them were also recorded for subsequent analysis.

Table 2. Methodological steps

The research followed an iterative process of empirical and theoretical exploration, covering the main steps described in Table 2. Following Eisenhardt (1989), theoretical background and research questions provided a tentative conceptual framing, which we gradually elaborated further in the iterative interplay with empirical data analysis and previous conceptual frames. However, the literature and research questions should not be allowed to limit interpretations in qualitative content analysis of selecting, coding, and categorizing the data and further elaborating conceptualization. (Sekaran & Bougie, 2016. Accordingly, the first platform business frameworks of Täuscher and Laudien (2018) and Sorri et al. (2019) were applied to classify the main characteristics of selected platform-based holistic service concepts based on public data sources. Second, as the main knowledge gaps were identified, interviews were conducted and analyzed based on the main themes and the tentative conceptual frame for the platform design characteristics. Third, the qualitative single and cross-case analysis that we conducted called for further conceptual elaboration based on new theoretical sources. As a result, we selected the conceptual framework for platform design developed by Tura and co-authors (2018) and adjusted it for this study derived from insights from the recent literature (Parker et al., 2016; Täuscher & Laudien, 2018; Sorri et al., 2019; Ischia et al., 2020). In the synthesis phase, we specified the final empirical results and supplemented the comparative platform design framework. We were also able to test our interpretations and conclusions with the interviewees in terms of content validity (Kvale, 1996).

Findings

In all four cases, the pilot phase for data- and platform-based service solutions is under way. The basis for more advanced solutions is being developed in cooperation with the selected IT partner, service partners or network, and residents. Digital solutions and, more broadly, a digital platform economy have been recognized as enabling more resident-centric and cost-effective services based on mutual interaction. Likewise, various data collected from the residential block(s) and residents, can be enriched and re-utilized by considering data privacy and security issues.

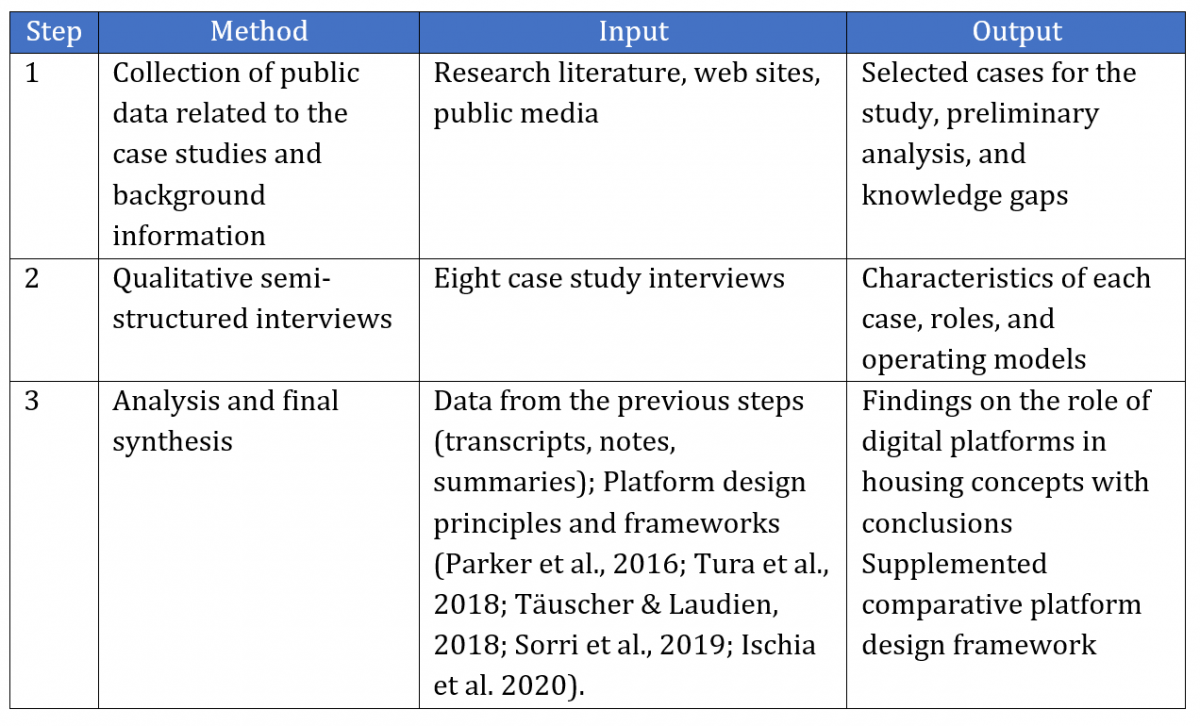

As seen in Table 3, the cases differ in the main choices of digital platform design, and thus also in the roles that the digital platform plays in the holistic housing concept and related value proposition. Currently, at its narrowest, a digital platform provides two-sided communication and a resource booking channel in cases C and D, while at its broadest, it serves for multi-sided value creation and capture through a combination of several core interaction layers in cases A and B. In the latter cases, mechanisms for network effects have been designed to improve the service experience.

Table 3. Summary of the main findings on platform characteristics

In all four cases that we studied, the platform revenue models are still in an emergent phase, particularly between the orchestrator and service providers as part of business model development, which is consistent with earlier platform business model studies (Täuscher & Laudien, 2018). However, cases differ on the level of platform openness in technical and collaborative boundary resources and related governance models (see Sorri et al., 2019). In the closed models adopted in cases A and C, access rights, data ownership, and use decisions are clearly defined and centralized by the main orchestrator, who is also the owner of the platform (see Hein et al., 2020). In the networked model, to which case B applies, residential service and digital platform capabilities are co-developed, while investments and risks are shared with carefully selected partners and the orchestrator. This enables agile solutions (for example, with APIs), while also calling for more sophisticated agreements between parties. Closed models seem to be typical entry strategies (Isckia et al., 2020), whereas case D chose the opposite approach in their digital portal, aiming to encourage bottom-up ownership of the operation model with digital platform by residents and local service providers.

However, as indicated in Table 3, critical design choices still must be made in case D if new value creation opportunities from the platform economy are the aim. Indeed, differences in design decisions, such as core interactions, mechanisms for network effects, platform openness, and governance models, are driven from differences in strategic choices regarding competitiveness, renewal, and growth. Platform competitiveness in this context reflects differences in the role or value that digital platforms currently play in holistic housing as a service platform concept now and for the future.

As Table 3 shows, cases vary substantially in their original strategic approaches, from so-called embedded in case A to informative and easily replaceable in case D. In addition, different innovation strategies have been adopted in the four cases, which also influence competitiveness, growth opportunities, and scalability. For example, in case A, data-based KPIs already guide agile and continuous service development as a result of a systematic innovation process, while future focus will be on opportunities for analytics and AI. In this way, it seems that the scalability of data-driven housing as a service platform concept and platform-based business model are becoming enabled. Case B adopted the so-called minimum viable product strategy combined with experimental co-development among network partners and residents. Instead of searching for scalability on the entire housing as a service platform concept level, modular scalability was seen as more relevant, even though the chosen service bundles might enable limited data- and platform-based business growth opportunities. Case C followed an incremental development approach, with a future focus on automatization and service extension. So far, Case C’s digital platform enables limited scalability in terms of depth and breadth (cf. Isckia et al., 2020). Nevertheless, if there will be opportunities for investment, future potential might be captured by enhancing integration in housing as a service platform concept.

Finally, for context-specific reasons, a new category was added in the conceptual frame of Tura and co-authors (2018) to define the role of the entire housing concept (including digital platforms) in the corporate strategy of the orchestrator. As seen from Table 3, cases vary from the core business focus to the living lab approach to new business opportunities, which also rationalizes the differences among cases in design decisions regarding digital platforms and related value co-creation opportunities in the future. All cases represent innovative project developments in housing, which take into account also the orchestrator role in the overall life cycle of the housing block and related service platform ecosystem (at least temporarily in case D). However, in case A, the orchestrator was an entrant in the housing market with a holistic housing concept, while in the other cases, the orchestrators were established players in their construction market segments. Case B represents a big builder company searching for new business opportunities, whereas case C and D are smaller players with limited resources. Case C focuses strongly on sustainability as a social enterprise and case D on living lab strategy for innovative housing concepts.

Conclusions and Discussions

The objective of the study was to examine, what kind of value creation opportunities digital platforms enable in holistic housing concepts and their related ecosystems. The theoretical structure was built by linking service-dominant logic with platform design and co-evolutionary approaches at an ecosystem level. In addition, recent research regarding urban living trends in residential housing contexts was presented to demonstrate related research gaps. We applied a qualitative multi-case study to reach our objective and narrow the identified research gaps. The study has several scientific and practical contributions, which are discussed and concluded as follows.

Scientific Contributions

While data-driven value creation opportunities of a platform economy in residential contexts are largely untapped and understudied, our empirical research showed that digital platforms enable various kinds of value creation opportunities in resident-centric housing concepts and related ecosystems. The empirical evidence indicated that the case studies shared the same innovative tripartite concept of housing as a service platform, with their unique value propositions and customer segments (Lusch & Nambisan, 2015). The specific analysis we conducted on the main digital platform design choices, based on the supplemented framework of Tura and co-authors (2018), revealed differences throughout the main, strongly interlinked elements, such as platform structure, value creation, governance, and competition. Aligning with the extant literature, our findings also indicate certain dependencies between design choices, enabling data, and platform-based value creation opportunities, and a particular need for systemic design with a developmental approach (Tura et al., 2018; Isckia et al., 2020). For the time being, the widespread uses and opportunities that a platform economy offer are significantly limited due to the scarce number of residents as potential users, especially in the newly built block sites A, B, and D (see Hein et al., 2020). The attractiveness of a multi-sided marketplace with dynamic network mechanisms, revenue models, and an overall governance model, enable a digital service exchange, resource sharing, and other smooth, smart, and sustainable living activities as integral parts of housing as a service platform. However, competitiveness and scalability in terms of depth and breadth will only be realized when: 1) there are enough resident users, 2) the platform is open to various service providers and application developers, and 3) new housing blocks are built in new locations (Parker et al., 2016; Hein et al., 2020; Isckia et al., 2020).

The study also brings new empirical understanding on alternative approaches to utilizing data with a platform economy for housing concepts. Our exploration of various strategic choices regarding competitiveness, innovation, and growth revealed that digital platforms can provide informative, supportive, integrative, or even embedded structures in novel housing as service platform concepts. However, to be competitive requires totally new orchestration and business models across traditional industrial and ecosystem boundaries, which is in line with previous studies (Ikävalko et al., 2018; Lappalainen & Federley, 2020). Not only new business opportunities arise, but also huge challenges can be faced when combining conventional linear business logic with platform-based business models, which are rather unstudied, particularly in residential contexts. The case studies we researched were all in still the pilot phase, which means critical design decisions were being made to guide future opportunities. However, earlier literature supports findings of continuous platform development with strategic and operative changes (Letaifa, 2014; Tura et al., 2018; Isckia et al., 2020). The findings of the pilot sites suggest that orchestrators have adopted various strategic approaches to growth and scalability.

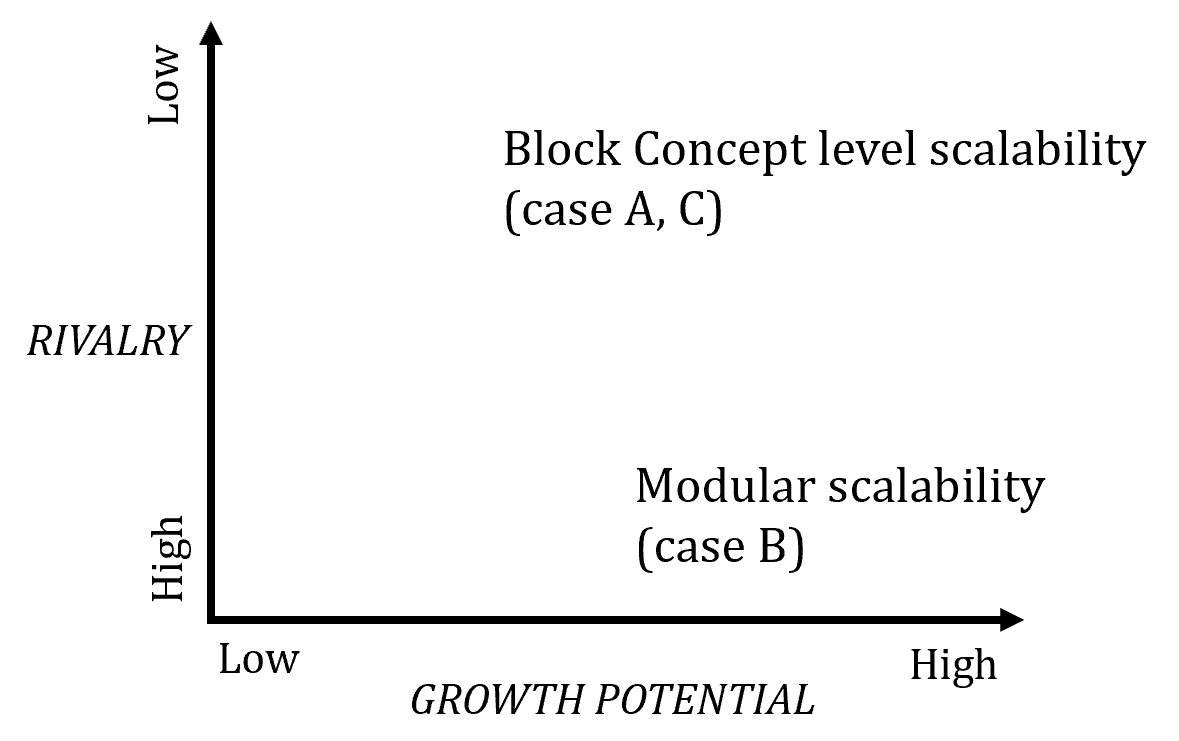

Thus, in light of basic mechanisms that ensure competitiveness and growth in data and a platform economy by scaling strategies focussed on depth and breadth (Isckia et al., 2020), the study proposes two main alternative strategic approaches: the block concept level of scalability and modular scalability. These are illustrated in Figure 1. Case D was excluded due to ongoing strategic elaboration in the early pilot phase, showed in the Findings Section.

Figure 1. Two main alternative growth approaches with empirical case illustrations

With the block concept level approach, it may be easier to build competitiveness against rivalries as a new entrant that has great growth potential boosted by mega trends. On the other hand, significant investments are called for in the long term (economically, technically, organizationally, institutionally) across traditional industrial and ecosystem boundaries. In addition, the results of our research suggest that the block-like housing concept is always modified locally (Lappalainen & Federley, 2020). The same considerations were made by Aquier and co-authors (2019), when they defined a “shared-infrastructure business model” as part of sharing economy business model configurations. They also highlighted new business opportunities for established companies and new entrants in contributing to and orchestrating local ecosystems. Further, their (re)positioning may “be shaped by local authorities to promote policies in line with their local economic, environmental, and social strategies” (Acquier et al., 2019). Moreover, in their IoT platform business model study, Leminen and co-authors (2018) presented relevant future scenarios even though IoT solutions have not yet played a dominant role in the holistic housing concepts studied. They illustrated the so-called platform business model in a smart city context, where platform leaders “act as a resource integrator offering context-sensitive, multipurpose services for customers together with their partners in a closed ecosystem” (Leminen et al., 2018).

The modular growth approach might instead be more agile and scalable in various housing contexts, as well as in international markets. Despite having attractive growth potential, the condition of rivalry is growing already and we assume it will become more significant with the smart living trend. From a resident’s perspective, housing services as a platform ecosystem are still very fragmented, while services that enable daily life benefits are being developed separately. As the empirical cases above illustrated, we found that interesting data-based service solutions can emerge by combining data and actors from, 1) the life cycle of the built environment, and 2) the daily lives of residents, and that this happens across traditional industry boundaries. However, this would require a shift from closed to more open data sharing and value creation logic (Isckia et al., 2020), which is also aligned with the so-called horizontal market business model defined by Leminen and co-authors (2018). Accordingly, it “opens up a customer- and service-oriented view and a range of service businesses that are based on … everyday life by connecting people, devices and things in the extended home environment with a context-sensitive and seamless user experience” (Leminen et al., 2018.

Finally, we demonstrated that the supplemented platform design framework of Tura and co-authors (2018) with four main elements and complementary sub-categories seems to provide a relevant analysis base also in housing contexts. Instead of their case study, the comparative multi-case study in this article required a more structured analysis, which also revealed strategic choices behind design choices.

Practical Contributions

The study brings a needed empirical understanding of data-driven value creation opportunities, enabled by digital platforms for companies operating in various phases of residential housing development together with expanding the market of smart and sustainable living. This multi-case study illustrates various innovative holistic housing concepts as pioneering examples of housing as a service platform and related ecosystem with diverse value creation opportunities and strategic approaches. By demonstrating the ongoing industrial transformation logic towards servitization and a platform economy, with their related challenges and opportunities, the study also challenges both established players and new entrants to rethink their future opportunities and threats beyond current established industries, to involve in the emerging smart and sustainable living market. The ecosystem approach serves all organizational ecosystem actors, particularly construction companies and property developers that are interested in taking the role as orchestrators and operators along the life cycle of residential or hybrid blocks as service platforms and ecosystems.

In showing empirical examples of various strategic approaches and providing evaluative frameworks (Table 3 and Figure 1), this study provides managerial support to analyze and compare critical platform design choices and elements when searching for new business opportunities. The study demonstrates how crucial strategic design decisions take place to establish a platform-based service ecosystem, and thus how critical it is to invest in systemic design and development from the very beginning. In addition, the study provides valuable empirical knowledge and pioneering examples for municipal urban planners and developers that play critical roles as enablers for piloting new innovative concepts and creating conditions for ecosystem actors to contribute to local vitality, sustainability, and well-being (Aquier et al., 2019; Lappalainen & Federley, 2020).

Limitations and Need for Further Research

The qualitative empirical multi-case study provided a rich basis to gain deeper understanding on data- and platform-based value creation opportunities in a fairly unstudied residential service context. The main limitation of the study is that it covers only four cases, all in Finland. Furthermore, even if the focus was on resident-centric concepts, interviews of the residents could not be conducted, since in two cases the residents had moved in quite recently. In addition, because the empirical cases were in the co-evolving pilot phase, many critical design decisions are forming, driven by the yet emerging domestic and international markets.

The empirical and theoretical findings are only tentative, with three main paths for further research. First, new empirical cases (also from other geographical locations) with deeper examination are needed regarding the main interconnected digital platform design elements, such as platform architecture, value creation logic, governance, and platform competition in housing contexts. This will both help increase knowledge and support companies as orchestrators in ongoing transformation to build capabilities at the ecosystem level for a platform economy. The perspectives, value expectations, and experiences of housing residents, along with new development ideas are necessary aspects that play a key role in value co-creation. These are captured in use and relate to future competitiveness and growth opportunities (see Lusch & Nambisan, 2015; Isckia et al., 2020). Moreover, taking a multi-actor perspective that also includes other ecosystem actors, such as service providers, content creators and application developers, as well as municipal urban planners, investors, builders and housing developers, is needed to enhance the ecosystem approach in terms of research, as well as urban development and business renewal.

Second, by adopting an expanded multi-actor approach, current cases may be able to contribute to interesting opportunities for a critical longitudinal study of the sustainability, scalability, and co-evolution of these housing as a service platform concepts, within their surrounding broader and dynamic service ecosystems. This would serve both practitioners and researchers in empirically exploring and conceptually re-structuring ecosystemic platform business model co-evolution and growth strategies in construction and housing markets (cf. Leminen et al., 2018).

Third, the supplemented conceptual platform design frame for comparative case studies seems to deepen the understanding of special industrial characteristics involving complex and dynamic value creation logic. Therefore, this housing market, and broadly smart and sustainable future living market has huge growth potential globally and is therefore interesting for further research. Particular interest should be focused on complex ongoing transformation where traditional linear, and slow asset-based business logic have to be combined with non-linear, agile and demand-driven business opportunities in a platform economy. The developed research design approach may also generally serve further studies in ecosystemic transformation towards platform economy across industries.

References

Aarikka-Stenroos, L., & Ritala, P. 2017. Network Management in the Era of Ecosystems: Systematic review and management framework. Industrial Marketing Management, 67: 23-36. DOI: https://doi.org/10.1016/j.indmarman.2017.08.010

Acquier, A., Carbone, V., & Massé, D. 2019. How to Create Value(s) in the Sharing Economy: Business Models, Scalability, and Sustainability. Technology Innovation Management Review, 9(2): 5-24. DOI: http://doi.org/10.22215/timreview/1215

Letaifa, B.S. 2014. The Uneasy Transition from Supply Chains to Ecosystems: The value-creation/value-capture dilemma. Management Decision, 52(2): 278-295. DOI: https://doi.org/10.1108/MD-06-2013-0329

Cennamo, C., & Santaló, J. 2019. Generativity Tension and Value Creation in Platform Ecosystems. Organization Science, 30(3): 617-641. DOI: https://doi.org/10.1287/orsc.2018.1270

De Reuver, M., Sørensen, C., & Basole, R.C. 2018. The Digital Platform: A research agenda. Journal of Information Technology, 33(2): 124-135. DOI: https://doi.org/10.1057/s41265-016-0033-3

Eisenhardt, K.M. 1989. Building Theories from Case Study Research. Academy of Management Review, 14(4): 532–551. DOI: https://doi.org/10.5465/amr.1989.4308385

Fehrer, J.A., Woratschek, H., & Brodie, R.J. 2018. A Systemic Logic for Platform Business Models. Journal of Service Management. 29(4): 546-568. DOI: https://doi.org/10.1108/JOSM-02-2017-0036

Gawer, A., & Cusumano, M.A. 2014. Industry Platforms and Ecosystem Innovation. Journal of Product Innovation Management 31(3): 417-433. DOI: 10.1111/jpim.12105

Hein, A., Schreieck, M., Riasanow, T., Soto Setzke, D., Wiesche, M., Böhm, M., & Krcmar, H. 2020. Digital Platform Ecosystems. Electronic Markets, 30:87-98. DOI: https://doi.org/10.1007/s12525-019-00377-4

Ikävalko, H., Turkama, P., & Smedlund, A. 2018. Value Creation in the Internet of Things: Mapping business models and ecosystem roles. Technology Innovation Management Review, 8(3): 5-15. DOI: http://doi.org/10.22215/timreview/1142

Isckia, T., De Reuver, M. & Lescop, D. 2020. Orchestrating Platform Ecosystems: The Interplay of Innovation and Business Development Subsystems. Journal of Innovation Economics & Management, 2020(2): 197-223. DOI: https://doi.org/10.3917/jie.032.0197

Jacobides, M., Cennamo, C. & Gawer, A. 2018. Towards a Theory of Ecosystems. Strategic Management Journal 39(8). DOI: https://doi.org/10.1002/smj.2904

Kvale S. 1996. Interviews: An Introduction to Qualitative Research Interviewing. Sage, Thousand Oaks, CA.

Lappalainen, I., & Federley, M. 2020. Korttelimaiset Asumisen Konseptit: Avaimia alusta- ja jakamistaloudesta sekä verkottumisesta? Yhdyskuntasuunnittelu, 58(4). DOI: https://doi.org/10.33357/ys.98064

Lehrer, C., Wieneke, A. vom Brocke, J., Jung, R., & Seidel, S. 2018. How Big Data Analytics Enables Service Innovation: Materiality, Affordance, and the Individualization of Service, Journal of Management Information Systems, 35(2): 424-460. DOI: 10.1080/07421222.2018.1451953

Leminen, S., Rajahonka, M., Westerlund, M., & Wendelin, R. 2018. The Future of the Internet of Things: toward heterarchical ecosystems and service business models, Journal of Business & Industrial Marketing. DOI: https://doi.org/10.1108/JBIM-10-2015-0206

Lusch, F.L., & Nambisan, S. 2015. Service Innovation: a service-dominant logic perspective. MIS Quarterly, 39(1): 155-175. DOI: https://www.jstor.org/stable/26628345

Maxwell, D.W. 2018. The Ecosystem Revolution: Co-ordinating Construction by Design. Proceedings of the 1st Annual Design Research Conference, Sydney. https://researchmgt.monash.edu/ws/portalfiles/portal/277377527/277377457.pdf [14.10.2021]

Mikkola, M., Lappalainen, I., & Federley, M. 2020. Innovating Data-Based Residential Services in Housing Ecosystems. The ISPIM Innovation Conference – Innovating Our Common Future, June, Berlin, Germany. Proceedings of LUT Scientific and Expertise Publications: ISBN 978-952-335-467-8.

Parker, G., & Van Alstyne, M.W. 2009. Six Challenges in Platform Licensing and Open Innovation. Communications & Strategies, 74. DOI: SSRN: https://ssrn.com/abstract=1559013

Parker, G., Van Alstyne, M.W., & Choudary, S.P. 2016. Platform Revolution. How networked markets are transforming the economy and how to make them work for you. W.W Norton & Company Ltd.

Petrulaitiene, V., Korba, P., Nenonen, S., Jylhä, T., & Junnila, S. 2018. From Walls to Experience - servitization of workplaces. Facilities. 36(9-10): 525-544. DOI: https://www.emerald.com/insight/content/doi/10.1108/F-07-2017-0072/full/html

Siltaloppi, J. 2015. Framing Service as Ideology and Practice: Cognitive underpinnings of service transformation in Finland’s residential sector. Aalto University publication series DOCTORAL DISSERTATIONS 186/2015. DOI: http://urn.fi/URN:ISBN:978-952-60-6516-8

Sekaran, U., & Bougie, R. 2016. Research Methods for Business: A Skill-building approach, 7th ed. John Wiley & Sons.

Sorri, K., Seppänen, M., Still, K., & Valkokari, K. 2019. Business Model Innovation with Platform Canvas. Journal of Business Models, 7(2): 1-13. DOI: https://doi.org/10.1109/cbi.2017.86

Tiwana, A. 2014. Platform Ecosystems: Aligning architecture, governance, and strategy. Burlington: Morgan Kaufmann.

Tura N., Kutvonen A., & Ritala, P. 2018. Platform Design Framework: conceptualisation and application, Technology Analysis & Strategic Management, 30(8): 881-894, DOI: 10.1080/09537325.2017.1390220.

Täuscher, C., & Laudien, S.M. 2018. Understanding Platform Business Models: A mixed methods study of marketplaces. European Management Journal, 36(3): 319-329. DOI: http://dx.doi.org/10.1016/j.emj.2017.06.005

Valkokari, K., Seppänen, M., Mäntylä, M., & Jylhä-Ollila, S. 2017. Orchestrating Innovation Ecosystems: A Qualitative Analysis of Ecosystem Positioning strategies. Technology Innovation Management Review, 7(3): 12-24. DOI: http://doi.org/10.22215/timreview/1061

Vargo, S.L., & Lusch, R.F. 2016. Institutions and Axioms: An extension and update of service-dominant logic. Journal of the Academy of Marketing Science, 44(1): 5-23. DOI: https://doi.org/10.1007/s11747-015-0456-3

Vargo, S.L., Wieland, H., & Akaka, M.A. 2015. Innovation through Institutionalization: A service ecosystems perspective. Industrial Marketing Management, 44: 63-72. DOI: https://doi.org/10.1016/j.indmarman.2014.10.008

Woodhead, R., Stephenson, P., & Morrey, D. 2018 Digital Construction: From point solutions to IoT ecosystem. Automation in Construction, 93: 35-46. DOI: https://doi.org/10.1016/j.autcon.2018.05.004

Xu, Y., Turunen, M., Mäntymäki, M., & Heikkilä, J. 2019. Platform-Based Business Models: Insights from an Emerging AI-Enabled Smart Building Ecosystem. Electronics 8(10): 1150. DOI: https://doi.org/10.3390/electronics8101150

Keywords: digital platforms, housing, platform design, platform ecosystems, S-D logic, value creation and capture