AbstractWe have seen that the function of entrepreneurs is to reform or revolutionize the pattern of production by exploiting an invention or, more generally, an untried technological possibility for producing a new commodity or producing an old one in a new way, by opening up a new source of supply of materials or a new outlet for products, by reorganizing an industry and so on.

Joseph Schumpeter

Servitization is today a common theme among manufacturing companies, with the goal of better addressing the needs of their customers. Digitalization is one key enabler of servitization. One aspect of this concept can be provided through digital product-service platforms, which may facilitate the enrichment of a market offer, as well as keeping costs under control. Platforms are in general a well-established concept for manufacturing companies, as enablers of rich product offerings based on a few components. Less is known, however, about how the ambition to create digital product-service platforms interplays with the business model innovation needed as a result of the servitization efforts, along with processes and organization. This paper identifies a number of challenges that manufacturing companies may face when undertaking platform development for services, based on an empirical study made in the Swedish company Husqvarna Group.

Introduction

Today many traditional manufacturing companies desire to complement their product offerings with various services, a transition commonly referred to as servitization (Vandermerwe & Rada, 1988).

Extant literature notes many reasons why a bundle of products and services are of interest. It may, for example, facilitate a climb in the value chain (Noke & Hughes, 2010; Tongur & Engwall, 2014), be an opportunity for differentiation, or a response to increased global competition (Parida, Sjödin, Wincent, & Kohtamäki, 2014). It can also be a fruitful means to build long-term relationships with customers (Reinartz & Ulaga, 2008; Baines et al., 2013).

Digitalization can be a key enabler for servitization, as digital technologies facilitate the connection of products, services, process, and systems (Hsu, 2007). Information technology is already becoming an integral part of many products, as sensors, actuators, and connectivity are being added to them. Generated data can then be used to improve product functionality itself, or to advance productivity elsewhere in the value chain (Porter & Heppelmann, 2015). To prepare an organization for digital disruption however, can be a major challenge, as its implementation and use can demand complex changes and affect almost the entire organization (Bughin & Zeebroeck, 2017), as well as the business models applied (Kindström, 2010).

Traditional manufacturing companies will often face at least two critical issues when aiming to pursue a path towards digitalization. One is related to the use of platforms, which may either enable the servitization approach or be sold as new offerings. The other challenge is related to business models, and how these develop in line with platforms and servitization. This paper addresses two research questions. The first research question is as follows: how does business model innovation relate to digital product-service platform development in traditional manufacturing firms aiming for servitization? The other asks: how is the inter-relationship between business model innovation and digital platform development managed?

An empirical study investigating these questions was carried out at Husqvarna Group, a large Swedish manufacturing company with a strong product legacy, in which various digitalization and service offer initiatives have also grown in importance over the past years. Four different digital platform projects that have been developed in different contexts were studied. The empirical observations lead to several findings, one of which is that when digital platform development processes are not extensively developed, understanding of digitalization and the drive of individual persons and managers stand out as fundamental. The study also points to the importance of early business model innovation in platform development projects, in order to allow for focus on modules with the highest customer importance and values.

The paper is structured as follows. First, relevant theories are explored, which lead to the formulation of the above two research questions. Subsequently, the research setting and methods used are described. Thereafter, empirical results and an analysis of them are presented. Finally, the results are discussed, including implications for managers and suggestions for future research.

Exposition of Theory

This paper explores the intersection between servitization, platforms, and business models. The current section covers relevant theories concerning these phenomena. “Servitization” is a concept in which companies include an increasing share of services in their customer offerings. Digitalization has been pointed out as a key enabler for servitization (Rymaszewska et al., 2017), while a platform business approach stands out as an important feature of developing new services (Cenamor et al., 2017). With an increased focus on services follows also a need to review current business models (Kindström, 2010). The following section will explore how servitization, platforms, and business models are interrelated.

Servitization

The phenomenon under which manufacturing companies shift from a product-only approach to include a larger share of services is commonly referred to as “servitization” (Vandermerwe & Rada, 1988). A growing stream of research focusing on the development of new product-service combinations has proposed a number of concepts and definitions. Some commonly used are Integrated Product Service Offerings (IPSO) and Product Service Systems (PSS) (Park et al., 2012). One driver for a servitization approach is that it enables a stronger relationship with customers, which in turn can increase also sales of products over a longer period of time (Reinartz & Ulaga, 2008). Another motive for servitization is that bundles of products and services provide customers with more total value, and thereby offer an opportunity for suppliers to climb the value chain (Noke & Hughes, 2010; Tongur & Engwall, 2014). Integrated product service offerings may further be a way to keep their profit margins, as many companies are seeing increased competition for products (Oliva & Kallenberg, 2003; Parida et al., 2014; Gaiardelli et al., 2015). Services can also be a more stable source of profits, as they tend not to be as exposed to fluctuating business cycles as products (Raddats et al., 2016).

The services that companies desire to offer to the market may range from fairly simple ones, such as training or basic services for existing products, to very advanced ones, for example, when customers no longer buy the actual product, but pay for the result that this product creates. In order to create and deliver various services, companies need a set of capabilities that matches a new value proposition (Christensen et al., 2016). One factor identified that is reported as a key facilitator for servitization is digitalization (Coreynen et al., 2017; Rymaszewska et al., 2017), as this may also facilitate more advanced services based on products that become “intelligent” and “connected”, and through which access to data can enrich both the offerings and relationships to customers (Porter & Heppelmann, 2015). An increasing literature stream has also identified that a platform approach in servitization may be a way to leverage “the value of digital technologies based on modularity and IT enabled interaction” (Cenamor et al., 2017).

Platforms

The use of platforms have frequently been proposed in various contexts in the academic literature (Thomas et al., 2014). These are used in general to accomplish strategic goals and strengthen competitive advantage. Gawer and Cusumano (2014)state that there are two major variants of platforms: internal and external. The first category is specific for a company as a way to create many derivative products from a common structure. The use of product platforms have also long been a well-established concept among manufacturing companies (Sköld & Karlsson, 2013). Earlier research has illuminated product platforms from several perspectives, for example, that component re-use can increase with a platform strategy (Pasche et al., 2011), and that organizations should consider the combined use of product platforms and modularization in order to reap economies of scale and scope, and economies of substitution, respectively (Magnusson & Pasche, 2014).

Several authors have identified platforms as an interesting approach to enable and support various services (Eloranta & Turunen, 2016; Cenamor et al., 2017). Service enabling platforms have the potential to facilitate new service businesses that provide high quality services, and at the same time keep costs under control. This offers interesting opportunities to avoid getting caught in a “service paradox”, where revenues from services do not match investments made into these new offerings (Gebauer et al., 2005; Rabetino et al., 2017). At the same time, several authors point to the fact that related theory is lagging behind ( Pekkarinen & Ulkuniemi, 2008; Thomas et al., 2014; Cenamor et al., 2017; Raddats et al., 2019). A lack in understanding also persists regarding how platforms are created (Thomas et al., 2014), not only when it comes to what constitutes a service enabling platform, but also the actual process for how platforms are created.

A related challenge is transforming the business model, thus redefining the conceptual logic for how a business is built. Companies with ambitions to add an increasing share of services into their market offer portfolio, may need to redesign their current business model or add new business models to existing ones (Kindström, 2010; Björkdahl & Holmén, 2013)

Business models

All established business enterprises use some kind of business model, which is the representation of how value is created, delivered to the customer, and captured (Teece, 2010). With a servitization approach follows a need to alter traditional business models in order to match a new reality (Kindström & Kowalkowski, 2014). However, designing and implementing a new business model appears to be a substantial challenge for firms. It has even been underscored that business model innovation is far from an easy task (Beckett & Dalrymple, 2019), and that many who attempt to update their business model fail to do so (Christensen et al., 2016).

Manufacturing companies pursuing a servitization strategy need to handle both service innovation and technology innovation. This shift poses a business model dilemma (Tongur & Engwall, 2014). As highlighted by Björkdahl and Magnusson (2012), a certain amount of design autonomy is needed in order to allow for the necessary changes to current business models in use. On the other hand, there is a risk that a lack of integration in existing businesses may lead to difficulties of implementing a new business model, and potentially, also to overly divergent business model portfolios (Aversa et al., 2017), with a subsequent risk of increased costs and lack of synergies. This points to a critical dilemma in organizing a new business model design in established companies, which so far has not been thoroughly investigated empirically.

Research Questions

Servitization, as described above, continues to grow in importance for many manufacturing companies. As a consequence, digital platforms may therefore also grow in importance to enable ambitious companies to develop new service offerings. Platforms are in general a well-known concept among manufacturing companies, frequently used in product strategies. Yet how to develop digital platforms to support different services initiatives is not yet equally familiar to most companies. One complication of developing new service offerings is that these arguably often affect the currently applied business models. Companies thus need to understand how business model innovation should be managed in relation to digital platform development. Based on this, two research questions have been formulated:

RQ1: How does business model innovation relate to digital product-service platform development in traditional manufacturing firms aiming for servitization?

RQ2: How is the inter-relationship between business model innovation and digital platform development managed?

Research Setting and Methods Used

The case study company - Husqvarna Group

Husqvarna was founded in southern Sweden in 1689. Today it is a “group” organized into different divisions. The Husqvarna Group has throughout its history been able to successfully bring new and innovative products to the market, and currently holds a leading global market position for products like robotic lawn mowers, chainsaws, power cutters, and watering products. The Husqvarna Group has throughout its history been able to adapt early to new industry trends and market demands. One strong industry trend where Husqvarna is well positioned among its competitors is digitalization. The group has recently launched several initiatives with an explicit ambition to use new digital technologies to innovate their market offers to customers.

Methods used

The complex nature of the phenomenon researched in this study made an exploratory case study approach relevant (Yin, 1999). Case studies allow researchers to gain substantial depth in their research (Flyvbjerg, 2006), and thus offer opportunities for unveiling new insights in emerging areas of investigation where extant knowledge is limited.

Four projects from the company with several approaches to managing platforms and business model development were selected. This offers a possibility to compare the different approaches, while at the same time keeping a number of contextual factors constant. The decision to select four cases from a single company was also made out of convenience, as two of the three authors are employed by the company in question, and thus hold extensive knowledge about the way the investigated phenomena are dealt with inside the organization. Moreover, this enabled the researchers to have access to internal company documentation, as well as facilitated possibilities to interview key respondents in the firm.

The data presented in this study come from several sources. Interviews were made with senior managers holding key roles in four different projects, here referred to as Alfa, Beta, Gamma, and Delta. A total of 14 interviews were made with 11 different people, in which some of the respondents provided insights into several of the projects, rather than just a single project. The interviews were made at two different periods of time, approximately 12 months apart, in order to understand also how the projects developed over time.

Interview guides were developed prior to the interviews to make sure relevant questions were captured. The questions covered vital areas for this study, such as project scope and organization, platform issues, and business model aspects. A semi-structured interview approach was used during the interviews, thus allowing for minor modifications of questions, as well as the addition of follow-up questions when needed (Robson, 2002).

In addition to this, the researchers had access to an extensive post-project report from the Gamma project, as well as a substantial amount of project documentation from the Beta project. Two of the authors of this study are, in addition to their work in academia, also employed by Husqvarna Group. One of the authors was closely involved in the Beta project, and another was deeply involved in the Beta and Gamma projects.

Case Study Descriptions

Four digital platform projects were investigated: Alfa, Beta, Gamma and Delta. All these projects represent a type of project development that the company performed for the first time, and is relatively unaccustomed to.

Project Alfa

Project Alfa was developed within one Husqvarna Group company division, based on an idea from a small group of individuals who are directly responsible for various aftermarket and service offer initiatives. These individuals had identified the need for a solution that could support operational excellence in several aftermarket and service offer deliveries, based on some kind of platform to which various digital sources could be connected as different modules in a structured way. The user of the platform can then, for example, sign on to one platform instead of many to acquire information. A second rational for the need was to build a platform for registering and on-boarding multiple service offers, that is, for the platform to become an internal tool for service offer maintenance, control, and follow-up. Service offers in most cases differ from product sales in that they emerge in the aftermarket from contacts with customers. At this point, digital platforms may be needed to support service creation, in the delivery to customers as well as in the follow-up.

The project was anchored with management and then developed by a few internal resources, along with the help of an external partner. Project Alfa was not part of the product development fora within the division, and did not follow the product creation process or any similar structured process.

Project Beta

Project Beta passed through two phases during the timeframe of the research for this study. The first phase was, like in project Alfa, initiated within one Husqvarna Group company division by a small group of dedicated people who saw a need for some kind of platform to support a new service offering. The first version was developed by external suppliers and did not follow any internal company development guidelines. In the second phase, the initial idea and concept was taken as input for a new solution co-developed by two in-house company divisions, that targeted different customer groups from the divisions. Customers accessed the platform by installing a smart and connected module to their products. They were then able to monitor their product fleet on a number of business-critical elements. The platform in project Beta is able to support customer operations in a number of ways by offering its own business logic, but can also provide data to other business platforms through data export.

When the research for this study was concluded, project Beta was in the second phase initiated by the executive management team, based on an understanding that both digitalization and service offerings will be important for the company going forward. The scope of project Beta included both upgrading the technology used, as well as reviewing service functionality and design in order to accommodate requirements from two company divisions. A formal project structure was put in place, including a governance structure that included senior managers from both divisions, as well as a formal agreement between the divisions regarding how to divide the project’s cost.

Project Gamma

Project Gamma was developed as a platform that could be used to address the sharing economy. The intention was to facilitate easy access to Husqvarna products, based on a logistic flow where products would be stored in locations where potential customers passed by for other reasons, and could then rent products through a smart-phone based product service flow.

Project Gamma was developed outside the divisional structure of the company by an innovation lab at the corporate level. Project Gamma was also initiated by a small number of insightful individuals who early on had a vision and understood the potential of this platform. A project was formed with a few internal resources and external suppliers, and it did not follow any internal company project development flow

Project Delta

Project Delta is a platform that was initiated approximately at the same time as Alfa, Beta and Gamma as a platform to enable different service solutions, that is, to be a platform upon which several different offerings could be developed. The guiding idea was an understanding that some kind of common architecture will be needed, also for various kinds of service offerings, and that common governance for this architecture will be important not to end up with a scattered service offering platform landscape. With project Delta, the aim was that it should be possible to connect different data sources, reuse information, share components, and facilitate the combination of information into new solutions.

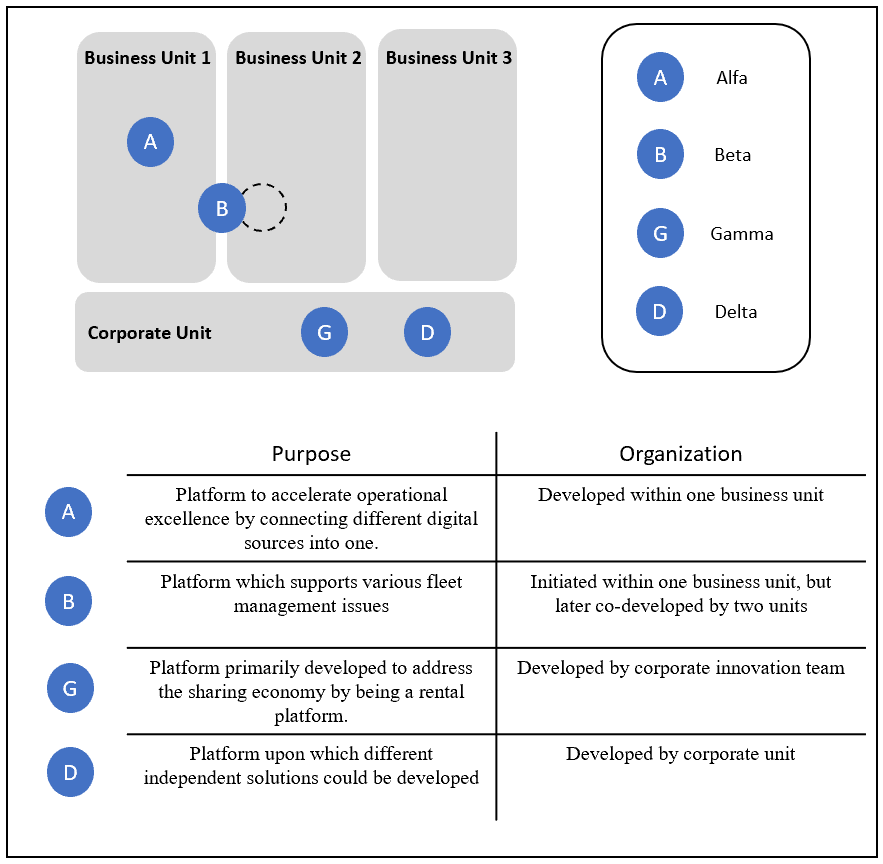

As seen from the above, the four investigated projects display substantial variation in how they were organized, and in particular how they were integrated with other parts of the company. A summary of the project objectives and organizational set-ups is presented in Figure 1.

Figure 1. Project organization, project purpose and organization

Results and Analysis

Project Alfa

Project Alfa was initiated by a small group of individuals within one business unit. This team was directly responsible for improving aftermarket processes and developing new service offerings. They realized that a digital platform would enable that task. The team assessed the business value of a platform before the project started, and had the necessary seniority to anchor the project. There were also given access to internal company funds that could be re-prioritized for development of Alfa. The team was not given any particular corporate development guidelines to follow, or shared services to use, and also used an external solution provider for the platform’s development.

Project Alfa became a lean project carried out with high speed. All major decisions were taken in a small group and were not restricted by guidelines and standard processes. It was early on decided to develop a minimum viable product (MVP) that could verify the value creation assumption parts of the business model, as well as prepare for further extensions to the platform in the future. There was also a common understanding within the team from the beginning that the platform would likely not be perfect from the outset.

The results of the interviews also identified several challenges in Project Alfa. One key challenge identified was a lack of development guidelines and shared technical components within the company that could be built upon. Another challenge identified was the difficulty of estimating total investment needs, as well as individual modules needed in the platform. One respondent expressed their approach, saying “you need to narrow the scope in order to invest the money where it is needed the most” (Director). Also, the lack of an existing formal and structured process of support and governance within the company, as compared to ones commonly used for product-based projects, was pointed out as a challenge from time to time.

Project Beta

Project Beta was, like project Alfa, initiated by a few insightful members of the aftersales department of a business unit, based on their understanding that there was an opportunity for a new service offering, for which the company needed a platform. Beta was also first developed by an external partner, thus it lacked Husqvarna Group corporate guidelines and support processes. The potential of Beta was identified by group management in the company and the project was assigned a budget and governance structure, this time with more seniority than product projects of similar size would have. Project Beta had a structure and anchoring that made it able to also handle scope changes in the middle of the project in a controlled way.

One major challenge in the project was to have consistent project participation throughout, from both partnering business units, as well as when the involved divisions needed to simultaneously handle other important business priorities. Several interview respondents commented that both divisions were not able to keep the same level of focus throughout the project, and that this dependied on the fact that some key resources needed to be assigned to other projects. Another challenge was that business modelling and Go-to-Market strategy were not part of the project. It was decided that both company divisions should be able to apply separate business model for the platform, and hence Go-to-Market and business model innovation were not included in the project at the start. Several respondents concluded that the project would have benefitted from an alternative approach, such that business model innovation would have taken place before the project started. One respondent expressed this saying, “I believe we should have used the opposite approach, first understand what we want to offer to our customers and how we should charge them.” (Director).

One reason mentioned was that early business modelling would have given important input to the platform design, and to the prioritization among modules and functions.

Project Gamma

Project Gamma was developed by a central team focusing on digitalization and innovation, which has worked on different digital transformation projects for the Husqvarna Group. This team supports all business units with various digital transformation initiatives, but is not directly responsible for any business activities.

The project was initiated based on the insight that some customer groups may prefer to rent well maintained high-quality products when needed, instead of purchasing, owning and storing them for occasional use. The assumption was also that easy, self-service access to the tools had a high value. In order to prototype this concept and validate related business models, the Gamma platform was needed.

The team behind project Gamma was able to develop a new innovative digital platform with high speed and an entrepreneurial mindset. Gamma developed a successful proof-of-concept (POC) platform, but the project lacked the funding to run a full-scale verification of the platform. Running a verification project with several installations would have been expensive, but necessary in order to understand all business model aspects of the platform more thoroughly. One respondent expressed this need in the following way: “it is first when you build the solution that you fully understand your idea.” (Director).

Project Delta

Project Delta was initiated to be a platform upon which a large variety of different service offerings could be developed. Again, the idea came from a few insightful individuals in the company who realized the potential for a platform upon which a large variety of service offerings could be developed, thus removing the need for every service offer initiative (like for example in projects Alfa, Beta, and Gamma) to start from scratch with enabling platforms. Delta offers a well-structured and well-governed platform upon which a large variety of digital offerings can be developed. While none of the other projects Alfa, Beta, nor Gamma used components from Delta in the beginning, over time they transformed their development to use more Delta modules. Currently more than 50% of the Delta project’s components are shared with the other projects. The benefits of building a single common base platform were deemed to be multiple. There are obviously costs which could then be shared, but it would also facilitate speed both in developing and scaling the market offer. Also, one common platform would create internal power within the company to facilitate transformation of internal structures and thus make it possible to create one seamless customer experience.

Some of the main challenges with Delta were that with an ambition for a common, cross-company platform comes a need for making shared priorities. This way the speed of individual offerings in the service projects may be affected, and these projects may then need to decide, in the interest of timely project execution, to develop something unique and tailored instead. This was expressed by one interviewee, who remarked that, “doing things together also means a lot of planning and prioritization and availability of resources … so it might impact speed and freedom in innovation to some extent” (Vice President).

The team behind Delta identified Gamma as having many similarities with a product platform, yet without being a traditional IoT platform. It could instead be defined as a digital product-service platform. This was defined by one interview respondent as follows: “This is more about a business platform to handle everything around the products; the user, the business models, traceability, documentation, content of different types, and of course other things like service management” (Vice President).

The following section relates the findings to the research questions and reviews key findings from the study.

RQ1: How does business model innovation relate to digital product-service platform development in traditional manufacturing firms aiming for servitization?

Product platforms have long been a well-established concept within the studied company. This study identifies an increased awareness of the growing need for digital product-service platforms, which can support various servitization ambitions. Earlier research has also identified that a platform approach can facilitate the enrichment of market offers, as well as keep costs under control (Cenamor et al., 2017). This research in this study sheds further light on how industrial companies should approach digital product-service platforms in terms of both scope definition and process. The importance of bringing business model aspects into projects early on, for example, when a company is employing new technology, has been pointed out earlier by scholars (Tongur & Engwall, 2014). Less is known, however, about the interplay between technological innovation, service innovation, and business innovation.

The case studies shown in this paper suggest that early business model assessment of a new platform is important in order to decide upon the right scope, and put focus on functionality that actually provides value for customers. In line with early business model assessment comes the finding of a need to start with a minimum viable platform that puts focus only on the most critical parts of the platform at first. This finding is consistent with previous literature suggesting that companies risk being caught in a servitization paradox if revenues from new offerings are not greater than the investments made to develop them (Gebauer et al., 2005). These case studies have also identified a possible dilemma in the digital product-service platform development process related to component re-use and platform incubation versus speed in development, as well as integration into business, respectively. The cases reveal that component re-use creates an opportunity to save costs in platform development, but possibly at the expense of uniquely tailored solutions and slower time to market. Also, a longer incubation time for new digital-product service platforms in a separate business development unit could benefit from verification of any assumptions made in platform design and scope. This may also, however, add to the costs and could delay integration with currently existing business units.

The observations in this research highlight that there was no process established for business model innovation in the observed cases and that ownership of development activities was also not fully defined. Instead, the entrepreneurial initiatives of a few individuals at an operational level became important in all of the studied projects, similar to the way corporate entrepreneurship has been argued to take place (Burgelman, 1983). This is somewhat surprising, as the systemic nature of platforms suggest that their introduction would actually benefit from a top-down approach to design and implementation.

Several project steering models were used for the platform projects observed in this study. None of the projects in this study followed an earlier established process for digital platform development as gated and controlled, the way of those the company commonly uses for new (physical) product development. Observations made in this analysis suggest that in the absence of a structured process and governance structure, individuals become very important as advocates for the platform’s needs, and as corporate entrepreneurs in its development. Earlier research shows that some degree of design autonomy may be beneficial when the designing process changes from existing business models, and may also imply a challenge when the innovation is to be later integrated with the business (Björkdahl & Magnusson, 2012). In a similar way, the digital platform projects Alfa and Gamma used their autonomy to develop innovative platforms, while Gamma later came to struggle with integrating itself into the business later.

The empirical observations of this study suggest it is more difficult to implement business model innovation the further away from the existing business that the new platform development is made. This is hardly surprising, as long-standing theory suggests that it is more difficult for substantially new business models to emerge in organizations that focus largely on existing market offers (Dougherty & Heller, 1994; Dougherty & Hardy, 1996). This points to a paradoxical situation that calls for new integration mechanisms that offer both enough autonomy for generating new business models, as well as a way to secure their “safe landing“ in a suitable part of the established organization. Potential solutions for this could for instance be the use of formal processes and roles in the established organization that have the explicit purpose of finding a suitable organizational home for the innovations developed. Another possible integration mechanism could be the use of performance measurement and management systems that explicitly address the pace, novelty, and amplitude of innovation in existing businesses, thereby inducing more demand for embracing innovations from other parts of the organization.

Discussion

This research has identified a digital product-service platform as being similar to a business platform, which handles various aspects around products and supports new services and business models. Earlier research has identified that a platform approach may be valuable to support servitization efforts (Cenamor et al., 2017). This study adds to that knowledge by analyzing how a digital product-service platform type is developed in industrial firms, based on a study of four cases in different settings in one company. One key finding is that definition project scope, through early business model value assessment of its most important functions, is critical, and that building a minimum viable platform at the outset stands out as a preferable approach. A possible dilemma for innovative companies could be that even though a platform approach provides a cost-saving opportunity, it may at the same time constrain speed and freedom in innovation. Another dilemma involves whether or not to incubate new business opportunities supported by digital product-service platforms using a separate business development function, or rather to aim for earlier integration of the platform into existing business units.

Another finding in this study is the importance of a few key individuals, the main innovators, for identifying the need for new types of platforms. Such a need, at least in the initial phase, was not sparked simply by an internal process or higher management decision in the company. This may be a surprising finding for manufacturing companies where product platforms have long been used as a way of achieving strategic goals (Sköld & Karlsson, 2007), and where a systemic, top-down approach appears highly rational and thus preferred. The finding that an “entrepreneurial spirit” on the level of individuals was a key driver behind the studied digital product-service platforms, suggests the need to find an organization form where the legacy strategy approach can co-exist with a more autonomous entrepreneurial spirit. Burgelman (1983)discussed the notion that companies need both “diversity and order in their strategic activities to maintain their viability”, and suggested a model for corporate entrepreneurship under which autonomous strategic behavior is allowed to co-exist with more traditionally induced strategic behavior. How revolutionary a new digital product-service platform might become could perhaps be discussed. Yet it is well known that even established organizations need to generate innovation and possess flexibility, which is believed to be more associated with entrepreneurship than corporate management (Stevenson & Jarillo, 2007). Takeaways from this study also show that individuals provided not only the idea spark for new platforms, but also managed to exploit the idea in the early versions of these platforms, and eventually proved their value.

Taken together, the findings in this study points to a paradoxical situation that calls for new integration mechanisms, offering both enough autonomy for the genesis of new business models, as well as to secure their “safe landing“ in the established parts of an organization. Potential solutions for this could, for instance, be the use of formal processes and roles in an established organization, with the explicit purpose of finding a suitable organizational home for the innovations developed. Another possible integration mechanism could be the use of performance measurement and management systems that explicitly address the pace, novelty, and amplitude of innovation in existing business processes, thereby inducing more demand for embracing innovations from other parts of the organization. A third viable alternative could be to allow new types of offerings to be brought to market by new or separate business units, instead of always trying to integrate all new business opportunities within already existing business units, the latter which may hold product-related priorities or lack service competence. This implies that potential synergies between the old and the new in a company would not be realized, but instead increases the need to create appropriate conditions for new product-service offers.

Corporate entrepreneurship is commonly described as how established companies are able to exploit new ideas that differ from their existing offerings, while leveraging existing assets and resources (Wolcott & Lippitz, 2007). This is much in line with how new service offers related to existing product offerings in the studied company. It also reveals an understanding of the need for agility when creating these new offers based on the studied projects. This was put in an especially pointed way by one respondent: “There are no alternatives in the digital world; you have to run faster than the competition”. (Director )

This study also points to the importance of aligning business model innovation with platform development. It helps to put focus on the most important modules of a platform, and ensures that these are developed to suit existing and future business needs.

Implications for Theory

Previous research offers a wealth of knowledge on the value of platforms in general (Gawer & Cusumano, 2014), and there is already an emerging understanding of the benefits that a platform approach may also provide in servitization efforts (Cenamor et al., 2017). This study enhances the existing literature by adding new insights both regarding the definition of digital product-service platforms, and also how these platforms may actually be developed in manufacturing firms. Earlier studies have reported that early business modelling is important for discontinuous technology development (Tongur & Engwall, 2014). This paper similarly suggests that this is important also in digital product-service platform development, as business model innovation may guide development efforts to the most important modules. The findings further identify a couple of dilemmas related to component reuse versus uniquely tailored solutions and time to market, as well as in using an incubation approach.

The apparent key role of individuals to understand and grasp opportunities with digital product-service platforms has not been pointed out in earlier research, and will undoubtedly continue to be a challenge to align digital product-service platform development with corporate entrepreneurship.

Implications for Practice

The findings point in a direction where companies should potentially facilitate new opportunities for corporate entrepreneurs to drive the innovation of digital product-service platforms, as these are not yet as mature as product platforms.

Manufacturing companies aiming to develop digital platforms to support their servitization efforts can most likely benefit from attending to business model innovation before, or during platform development. To develop platforms that can support a wide range of core needs, in addition to more peripheral ones, clearly appears to be a questionable strategy, as this will add unnecessary costs and is likely to delay the platform’s launch. Hence, companies should strive to develop minimum viable platforms, and then extend these platforms with necessary modules over time.

Conclusions

Digital product-service platforms may be quickly becoming an important facilitator for a variety of service offerings. These platforms aim to handle several aspects around the product and have more focus on supporting new business models than IoT. The context of a platform becomes important and hence makes it difficult to buy a turnkey solution on the market. This suggests that manufacturing companies should develop their own digital product-service platform or platforms, like in the studied company, but should also make sure to align their business model innovation with platform development, including how to integrate their platform or platforms with current business operations.

The entrepreneurial attitude of individuals who understand the complex drivers for a digital product-service platform, linking product data with services and business models, seem to be a most important asset, which companies should nurture and utilize for identifying a platform’s potential scope. Corporate entrepreneurship is an earlier concept that has been suggested to allow more autonomous strategic behavior to exist alongside of classical processes (Burgelman, 1983; Wolcott & Lippitz, 2007), and which seem to be an approach which could be successful also in platform development.

Limitations and Future Research

This study was performed by focusing on four digital platform projects within one company. Future research should expand into several areas. First of all, it is clear that future research needs to include more manufacturing companies in order to understand if the findings made in the paper are more generally valid across the sector. Secondly, future research should look into how manufacturing companies may develop processes for digital platform development that cut across traditional product development logic. A third area that is definitely worth further research is how to include business model innovation early on in the development process of a new digital platform.

References

Aversa, P., Haefliger, S., & Reza, D. G. 2017. Building a winning business model portfolio. MIT Sloan Management Review, 58(4): 47–54.

Baines, T., Lightfoot, H., Smart, P., & Fletcher, S. 2013. Servitization of the manufacturing firm: Exploring the operations practices and technologies that deliver advanced services. International Journal of Operations & Production Management, 34(1): 2–35.

Beckett, R. C., & Dalrymple, J. 2019. Business Model Architecture by Design. Technology Innovation Management Review. https://doi.org/10.22215/timreview/1252.

Björkdahl, J., & Holmén, M. 2013. Editorial: Business model innovation – the challenges ahead. International Journal of Product Development, 18(3/4): 213–225.

Björkdahl, J., & Magnusson, M. 2012. Managerial challenges when integrating ICTs in established products. International Journal of Learning and Intellectual Capital, 9(3): 307.

Bughin, J., & Zeebroeck, N. Van. 2017. The Best Response to Digital Disruption. MIT Sloan Management Review, 58(4): 80–86.

Burgelman, R. A. 1983. A Process Model of Internal Corporate Venturing in the Diversified Major Firm. Administrative Science Quarterly. https://doi.org/10.2307/2392619.

Cenamor, J., Rönnberg Sjödin, D., & Parida, V. 2017. Adopting a platform approach in servitization: Leveraging the value of digitalization. International Journal of Production Economics, 192: 54–65.

Christensen, C. M., Bartman, T., & van Bever, D. 2016. The Hard Truth about Business Model Innovation. Sloan Management Review, 58(1): 31–40.

Coreynen, W., Matthyssens, P., & Van Bockhaven, W. 2017. Boosting servitization through digitization: Pathways and dynamic resource configurations for manufacturers. Industrial Marketing Management, 60: 42–53.

Dougherty, D., & Hardy, C. 1996. Sustained product innovation in large, mature organizations: Overcoming innovation-to-organization problems. Academy of Management Journal. https://doi.org/10.2307/256994.

Dougherty, D., & Heller, T. 1994. The Illegitimacy of Successful Product Innovation in Established Firms. Organization Science. https://doi.org/10.1287/orsc.5.2.200.

Eloranta, V., & Turunen, T. 2016. Platforms in service-driven manufacturing: Leveraging complexity by connecting, sharing, and integrating. Industrial Marketing Management. https://doi.org/10.1016/j.indmarman.2015.10.003.

Flyvbjerg, B. 2006. Five misunderstandings about case-study research. Qualitative Inquiry. https://doi.org/10.1177/1077800405284363.

Gaiardelli, P., Martinez, V., & Cavalieri, S. 2015. The strategic transition to services: A dominant logic perspective and its implications for operations. Production Planning and Control, 26(14–15): 1165–1170.

Gawer, A., & Cusumano, M. A. 2014. Industry platforms and ecosystem innovation. Journal of Product Innovation Management, 31(3): 417–433.

Gebauer, H., Fleisch, E., & Friedli, T. 2005. Overcoming the service paradox in manufacturing companies. European Management Journal, 23(1): 14–26.

Hsu, C. 2007. Scaling with digital connection: Services innovation. Conference Proceedings - IEEE International Conference on Systems, Man and Cybernetics, 4057–4061.

Kindström, D. 2010. Towards a service-based business model - Key aspects for future competitive advantage. European Management Journal. https://doi.org/10.1016/j.emj.2010.07.002.

Kindström, D., & Kowalkowski, C. 2014. Service innovation in product-centric firms: a multidimensional business model perspective. Journal of Business & Industrial Marketing, 29(2): 96–111.

Magnusson, M., & Pasche, M. 2014. A contingency-based approach to the use of product platforms and modules in new product development. Journal of Product Innovation Management. https://doi.org/10.1111/jpim.12106.

Noke, H., & Hughes, M. 2010. Climbing the value chain: Strategies to create a new product development capability in mature SMEs. International Journal of Operations & Production Management, 30(2): 132–154.

Oliva, R., & Kallenberg, R. 2003. Managing the transition from products to services. International Journal of Service Industry Management. https://doi.org/10.1108/09564230310474138.

Parida, V., Sjödin, D. R., Wincent, J., & Kohtamäki, M. 2014. A survey study of the transitioning towards high-value industrial product-services. Procedia CIRP, 16: 176–180.

Park, Y., Geum, Y., & Lee, H. 2012. Toward integration of products and services: Taxonomy and typology. Journal of Engineering and Technology Management - JET-M. https://doi.org/10.1016/j.jengtecman.2012.08.002.

Pasche, M., Persson, M., & Löfsten, H. 2011. Effects of platforms on new product development projects. International Journal of Operations and Production Management. https://doi.org/10.1108/01443571111178475.

Pekkarinen, S., & Ulkuniemi, P. 2008. Modularity in developing business services by platform approach. The International Journal of Logistics Management. https://doi.org/10.1108/09574090810872613.

Porter, M. E., & Heppelmann, J. E. 2015. How smart, connected products are transforming companies. Harvard Business Review. https://doi.org/10.1017/CBO9781107415324.004.

Rabetino, R., Kohtamäki, M., & Gebauer, H. 2017. Strategy map of servitization. International Journal of Production Economics, 192: 144–156.

Raddats, C., Baines, T., Burton, J., Story, V. M., & Zolkiewski, J. 2016. Motivations for servitization: the impact of product complexity. International Journal of Operations and Production Management, 36(5). https://doi.org/10.1108/IJOPM-09-2014-0447.

Raddats, C., Kowalkowski, C., Benedettini, O., Burton, J., & Gebauer, H. 2019. Servitization: A contemporary thematic review of four major research streams. Industrial Marketing Management. https://doi.org/10.1016/j.indmarman.2019.03.015.

Reinartz, W., & Ulaga, W. 2008. How to Sell Services More Profitably How to Sell Services More Profitably The Idea in Brief The Idea in Practice. Harvard Business Review, 86(5): 1–9.

Robson, C. 2002. Real World Research: A Resource for Social Scientists and Practitioner-Researchers. Blackwell Publishing. https://doi.org/10.1016/j.jclinepi.2010.08.001.

Rymaszewska, A., Helo, P., & Gunasekaran, A. 2017. IoT powered servitization of manufacturing – an exploratory case study. International Journal of Production Economics, 192: 92–105.

Schumpeter, J. A. 2010. Capitalism, socialism and democracy. Capitalism, Socialism and Democracy. https://doi.org/10.4324/9780203857090.

Sköld, M., & Karlsson, C. 2013. Stratifying the development of product platforms: Requirements for resources, organization, and management styles. Journal of Product Innovation Management. https://doi.org/10.1111/jpim.12064.

Stevenson, H. H., & Jarillo, J. C. 2007. A paradigm of entrepreneurship: Entrepreneurial management. Entrepreneurship: Concepts, Theory and Perspective. https://doi.org/10.1007/978-3-540-48543-8_7.

Teece, D. J. 2010. Business models, business strategy and innovation. Long Range Planning, 43(2–3): 172–194.

Thomas, L. D. W., Autio, E., & Gann, D. M. 2014. Architectural Leverage: Putting Platforms in Context. Academy of Management Perspectives, 28(2): 198–219.

Tongur, S., & Engwall, M. 2014. The business model dilemma of technology shifts. Technovation, 34(9): 525–535.

Vandermerwe, S., & Rada, J. 1988. Servitization of business: Adding value by adding services. European Management Journal, 6(4): 314–324.

Wolcott, R. C., & Lippitz, M. J. 2007. The four models of corporate entrepreneurship. MIT Sloan Management Review.

Keywords: business model innovation, corporate entrepreneurship, digital platforms, servitization