AbstractExperience without theory is blind, but theory without experience is mere intellectual play.

Immanuel Kant (1724–1804)

Philosopher

Action research holds great potential for helping bridge the gap between research and practice. By working closely together, researchers and practitioners can develop tangible customized solutions based on research findings. It becomes possible to go beyond generic best practices that might need adaptation for successful implementation and use, or that may not apply at all in some contexts. In this article, the mechanisms through which action research can create the desired change and impact in both industry and academia are illustrated by describing the relevance and contribution of the main steps of a longitudinal action research program in a Canadian manufacturing company. The authors share four guiding principles and six success factors that were revealed intuitively in the course of this multi-year research program. Their hope is to contribute to a better understanding of how it is possible to develop an adaptive action research methodology to increase the potential for research relevance and organizational change.

Introduction

The research–practice gap is a major missed opportunity for both academia and industry. On one hand, “theorists often write trivial theories” (Weick, 1989) as they are more concerned with methodological strictures than usefulness (Lindblom, 1987). On the other hand, no matter how relevant the work of theorists is, practitioners often disregard it as too theoretical to be applicable in their own precise situation. Rousseau (2006) refers to the research–practice gap as “the failure of organizations and managers to base practices on best available evidence”. It results in a combination of two limitations of traditional research:

- Difficulties experienced by researchers in translating research findings into tangible solutions in industry.

- The incapacity of managers in using research findings to improve their organizations.

The implication of practitioners in the research can help narrow this gap (Schein, 1999). This can be done through action research (Saunders et al., 2011). The goal of action research is not to test hypotheses or develop generalizable results (Hlady-Rispal, 2016; Saunders et al., 2011). Rather, it serves to deepen researchers’ understanding of complex human interactions and helps them develop new research propositions and conceptual frameworks to be tested and validated in future research (Saunders et al., 2011). In doing so, action research not only serves the research community but also builds bridges to close the research–practice gap by working on the two limitations mentioned above, as follows:

- Better translation of research findings into tangible solutions. Action research can have a powerful impact on the relevance of research and the transformation of organizations. By working in collaboration with practitioners on specific challenges they encounter, the proposed solutions are likely to be better adapted to the company’s needs and constraints, taking into account the mechanisms necessary for their successful implementation. In addition, their adoption rate is likely to be higher, as having participated in their development, the employees might feel more comfortable in implementing and using them.

- Better use of research findings by the managers. Action research involves the recipients of the research results directly in the research program itself. As participants of the research process, the managers become more familiar with the research language and more open to experiment with and even implement some new practices.

Although action research presents clear benefits to close the research–practice gap, there is little information available on how to design an action research intervention that can be truly beneficial for researchers and practitioners. The goal of this article is to provide a tangible example of how this can be done by sharing mechanisms of the design of a longitudinal action research program. This article describes the main steps of the action research program in a Canadian manufacturing company along with guiding principles and success factors that were used to make it a success by creating the desired change and impact in industry and academia.

The case company is briefly presented in the next section and followed by a summary of the methodology used in the action research project. Four guiding principles were developed based on the applied research experience and two decades of practitioner background of the senior research supervisor (the second author of this article) and were used to design a research project relevant for the case company. These guiding principles are described in the subsequent section of this article. What follows is a description of how these principles were applied over the course of the three-year case study and what were the success factors. The contributions of this article are discussed in the Conclusion.

Case Company

The case company is a specialized manufacturer providing customized and specialized products to a wide range of industries. Since its founding in 1950, the company has grown organically, namely through the acquisition of competitors. The founder was the company’s main driver of innovation for most of its history before retiring less than a decade ago. While he brought the entrepreneurial spirit, the second generation, which is still in charge, focused on operations and acquisitions. The third generation, which is currently joining the top management ranks, is trying to rejuvenate the company’s innovation capabilities. These efforts are in response to a steady decline in sales in well-established markets and product lines, which prompted the company to embark on a major rejuvenation journey. This journey included a revised and more explicit innovation strategy. In this context, the research team was solicited to support the innovation and product development team in several aspects of the development and implementation of innovation management processes, practices, and tools. It resulted in a three-phase longitudinal action research program (Lakiza, 2018).

Methodology

The research program on innovation management was performed over three phases, each with a one-year duration and a total of seven field researchers and one academic supervisor. Each of the seven research projects had a dual objective: 1) knowledge transfer from academia to industry and 2) knowledge development from the field back to the literature. For the research program to be truly fruitful in both regards, it had to be adaptive, both to the discovery made by the researchers and to the learning journey of the management team. Consequently, the orientation and focus of interest, variables and organizational dynamics of interest, literature background, research objectives, and management deliverables were all revisited between each research phase.

The examples illustrated in this article come from one of the three researchers of phase II, the first author of this article. This specific research project was on the relationship between the company’s organizational culture, its performance measurement systems, and its innovation capabilities. As part of the dual objective, the researcher also had the mandate of proposing key performance indicators (KPIs) to measure the success of the company’s innovation endeavours.

This research project was conducted by two practitioners: the supervisor and the researcher herself have 10 years of experience in change management. Hence, this research was driven by problems observed in the company under study during Phase I of the research program, with the main interest of achieving an in-depth understanding of complex organizational dynamics. The inductive, theory-building approach was chosen for this research program as it is more appropriate in such circumstances (Saunders et al., 2011). It implies an intimate understanding of the research context and a more flexible research structure (Saunders et al., 2011).

With a goal of developing new understanding based on field observations, the grounded theory research strategy was chosen as it is appropriate for an iterative interpretative process with the goal of making sense of data and raising it to a higher conceptual level (Saunders et al., 2011). This strategy can provide particularly rich results in a context where there is a desire to close the research–practice gap by testing different theoretical approaches in practice, observing their consequences, and adjusting the approach to the specific context of a case company.

An inductive approach with the goal of making sense of the data requires solid triangulation to corroborate research findings within a study (Bryman, 2016). Multiple sources of evidence are also required to build a robust case study with reliable outcomes (Saunders et al., 2011; Stake, 2000; Yin, 2013). For these reasons, seven data collection methods were used in this research project: a review of prior data, document review, interviews, workshops, a questionnaire, observations, and meetings. The use and relevance of each of the data collection methods are explained in the success factors section.

Qualitative field research such as this one involves continuous iteration between data collection and data analysis (Strauss & Corbin, 1998). Hence, there is no specific beginning to data analysis (Stake, 2000), which evolves continually informing the next data collection steps trough coding and memoing typical of the grounded research methodology (Holton, 2010).

Guiding Principles

When doing field research full time at a specific company, it can be difficult to know how to find the right balance between being a researcher and being part of the action. To do so, the researchers followed four guiding principles that were coined based on the combination of their previous research and industry experience: build trust, be part of the team, understand the system, and iterate. These principles helped the research stay on track with regards to both learning objectives: helping develop new theoretical knowledge useful for research and transferring relevant management knowledge to support the company in developing their innovation capabilities.

Build trust… to increase openness

The first and most important thing to do when joining a company as an action researcher is to build trust. Trust is what allows the researcher to witness a company’s reality from within, providing them with a richer data set than what is possible to obtain by traditional surveying techniques. When a relationship of trust is established with the company’s employees and other key stakeholders, they will elaborate more on the subjects of interest, thus answering crucial questions that the researcher did not know they had to ask. The employees will also feel more comfortable in providing genuine feedback on the researcher’s recommendations thus helping develop more appropriate solutions. Moreover, when the employees believe that they themselves contributed to the proposed solutions, they are more likely to fully collaborate in implementing and appropriating the solutions resulting from the research partnership. They might also be more open to knowledge transfer from academia that otherwise often has the reputation of being “too theoretical to work in the real world”.

Building trust takes time. Moreover, it takes time to understand organizational dynamics and their evolution (Hlady-Rispal, 2016). Thus, to capitalize on action research, it is better to take as much time as possible. Longitudinal research can help limit threats to the reliability of the research findings by reducing participant error and bias, as well as observer bias (Robson, 2002; Saunders et al., 2011). It also helps mitigate several threats to the validity of the research findings such as history, instrumentation, and maturation (Robson, 2002; Saunders et al., 2011).

Be part of the team… to understand the culture

A company’s culture has an important impact on the success of its projects and the suitability of any best practices (Brodeur et al., 2017; Katzenbach & Harshak, 2011; Katzenbach et al., 2019; Tellis et al., 2009). The culture is often more visible through its informal channels where one must pay attention to its “quiet, sometimes hidden, manifestations” (Schein, 2009). When people feel observed, their actions may be influenced by what they think the observer wants to see or what they believe will make them look better (Robson, 2002). The researcher must become part of the team to be able to access more genuine behaviours and data. Seeing candid interactions among stakeholders helps understand the paradigms that influence their actions (Katzenbach et al., 2019). It becomes possible to uncover deeper root causes of the various challenges an organization is facing. These challenges may be unexpected and different from existing literature knowledge.

An important added value of a researcher in a company is the perspective that they can provide to the company’s stakeholders who are too often blinded by the day-to-day operations. However, to keep this advantage, the researcher must be careful not to get themselves pulled into day-to-day emergencies.

Understand the system… to focus on the right change levers

Being part of the team also helps gain a more comprehensive understanding of the system and its pressures (Horowitz, 2014), which is paramount in order to fully grasp the issues and factors influencing the subject of study. A deeper understanding of challenges faced in industry provides an opportunity to go beyond best practices by developing fully customized tangible solutions while bringing back new knowledge to academia. More importantly, it can help reduce the chances of developing localized or short-term solutions at the expense of the bigger picture and the long-term goals.

Iterate… to bridge the gap between research and practice

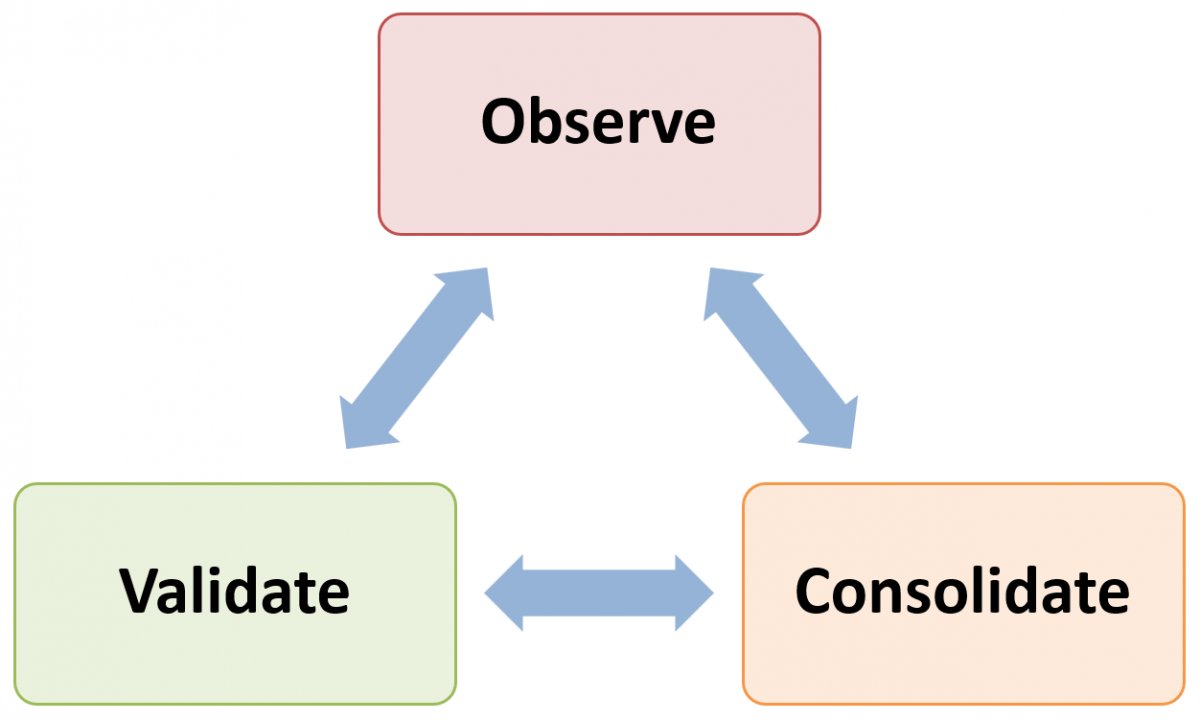

Qualitative field research is a highly iterative process (Strauss & Corbin, 1998). “Theory and practice flow in parallel with continuous literature review, data collection, and analysis and interpretation feeding one another” (Lakiza, 2018). This continuous interaction between knowledge transfer and knowledge development creates a true bilateral conversation between research and industry, thus helping bridge the gap between them. This iterative process, which has no precise beginning to data analysis (Stake, 2000), can be divided into three parts: observe, consolidate and validate (see Figure 1).

Figure 1. A continuous iterative process: observe, consolidate, validate

Putting the principles into action

Observing in action gives access to crucial information that might not be captured by regular research methods (Saunders et al., 2011). Field research provides plenty of opportunities to observe in formal and informal contexts. The informal observations made during lunch breaks or casual discussions among employees are particularly interesting as they may bring up perspectives that have no place in the company’s formal setting but may be crucial to the study (Katzenbach et al., 2019).

Action research provides access to a large amount of data that must be regularly consolidated in order to avoid getting lost. In addition to data analysis, consolidation implies raising the data to a higher conceptual level to help make sense of it (Holton, 2010). During the research, data consolidation helps regularly redirect the next steps based on how the project unfolds, to confirm or infirm various observations and to assess what else the researcher must learn through observation or literature. At the end of the research project, data conceptualization helps build frameworks and leads to new research propositions (Suddaby, 2006).

When collecting and consolidating data from the field, there is often a need to validate certain observations that could be interpreted differently. Validation can be done by returning to the literature for additional knowledge or by triangulating data through various data collection methods. In qualitative field research, triangulation is essential to achieve reliable results (Saunders et al., 2011; Stake, 2000; Yin, 2013).

Based on this case study and on the cumulative insights from their experience over the three years of the action research program, the authors propose a summary of the potential benefits of each guiding principle cited above, for both industry and research, in Table 1.

Table 1. Benefits of the guiding principles to industry and research

|

Principle |

Benefits to Industry |

Benefits to Research |

|

Build trust |

|

|

|

Understand the system |

Help stakeholders better connect to each other and understand how their work fits in the bigger picture |

Possibility to go beyond generic best practices, as a more holistic understanding of a specific context can help uncover new inhibiting/success factors |

|

Be part of the team |

Access to specialized knowledge |

Access to root causes and deeper issues related to a specific research topic |

|

Iterate (Observe – Consolidate – Validate) |

Progressively help stakeholders uncover their blind spots through validation |

|

|

Close the gap between research and practice through continuous interaction between knowledge transfer and knowledge development |

||

Six Success Factors for an Action Researcher to Implement a Relevant Methodology

Inductive action research has to be carefully implemented through an explicit research methodology, using multiple and complementary data collection and analysis methods. In this section, the main steps of the field research are shared, illustrating how each of the four guiding principles described in the previous section was applied, implemented, and adapted over time, as summarized in Table 2.

The researchers’ applied research and professional experience, as well as their open-minded and flexible attitude, played a crucial role in the successful deployment of this multi-faceted action research methodology. Such a methodology requires multiple adjustments to the responsiveness of the management team under study during the longitudinal project. In retrospect, the steps taken in this research project are grouped by six success factors (described below) that helped the action researchers put the odds on their side when faced with ambiguity and organizational complexity. These factors were derived from the researchers’ cumulative experience, both from prior research and change management experience, and from insights gained during this multi-year case study.

Table 2. Application of the guiding principles throughout the main case study steps

|

Case Study Steps |

Build Trust |

Understand the System |

Be Part of the Team |

Iterate |

|

Analysis of data collected during phase I |

|

|

|

|

|

Preliminary system mapping |

|

|

|

|

|

Project charter interviews |

|

|

|

|

|

Support in strategic planning workshop development |

|

|

|

|

|

Support of the fellow researchers’ projects |

|

|

|

|

|

Workshop on the stakeholders’ innovation KPI requirements |

|

|

|

|

|

System mapping workshop |

|

|

|

|

|

Innovation Quotient questionnaire |

|

|

|

|

|

Feedback discussions following a draft innovation KPIs proposal |

|

|

|

|

1. Be prepared and informed

This specific case study was part of phase II of the longitudinal field study in the case company. Therefore, before starting the research in the field, it was possible to access data and analysis from phase I as well as perform a preliminary literature review. A preliminary stakeholder mapping exercise inspired by FSG’s Guide to Actor Mapping (Gopal & Clarke, 2016) was also carried out with the goal to understand key stakeholder dynamics within the company as well as the company’s reality and positioning within its industry. This preparation helped the researcher start conversations, build trust, and more easily integrate various teams during the first weeks in the field.

2. Be clear and manage expectations

For a successful action research partnership with a company, clear expectations on the researcher’s role and mandate must be set and shared with the main stakeholders. To do so, a first draft of a project charter was developed and shared with the main stakeholders during individual interviews. Interviewing is a key tool for an action researcher as it “is the main road to multiple realities” (Stake, 2000) that might be invisible otherwise (Lakiza, 2018). It allows one “to find out from [people] those things we can’t observe” (Patton, 1987). The interviews started with an introduction of the researcher’s background to help build trust (Patton, 1987). The semi-structured interviews with open-ended questions were complemented with probing and follow-up questions to encourage the participants to elaborate (Denzin & Lincoln, 2008; Lakiza, 2018; Stake, 2000). This approach favoured open and free discussion (Esterberg, 2002; Kvale, 1996), which generated a rich initial data set and helped build trust. Moreover, a collection of interviews helps build a better holistic understanding of a system than what any one individual can observe (Stake, 2000).

3. Be involved with what matters to the company’s employees

To become part of the team, the researcher must seize opportunities and get involved with projects that might be beyond the research scope but that are important to the company’s key stakeholders. Visioning and strategic planning exercises were ongoing at the partner company and the VP of Engineering was interested in obtaining some help to align the process and develop strategic planning workshops with his directors and managers. In addition to contributing to trust building, developing and helping run these workshops and meetings was critical to the researcher’s understanding of the company’s culture by providing access to a more genuine work dynamic.

Throughout the 11 months on site, several other opportunities were taken to support the company’s projects, including the research projects of the two fellow phase II researchers. Special care was taken to not get drawn into the company’s day-to-day operations. When asked to do something beyond the research scope, the researcher always asked herself if she had specific knowledge and skills to contribute or is this something that would normally be done by a regular employee.

4. Be patient, work in small learning cycles

After two months of gathering data through interviews, meetings, and observation of the company’s daily life, it was time for a first big consolidation and validation exercise. For this purpose, a workshop on the stakeholders’ innovation KPI requirements was developed. During the workshop, a preliminary consolidation and analysis of some of the data collected so far were presented to see what resonated and how. Moreover, more detailed discussions were held during the workshop to better understand what kind of innovation KPIs can be useful to the employees in their given contexts. The exercise also helped bring the stakeholders onto the same page given that, during individual interviews, some incomplete and diverging perspectives had been noted.

This consolidation exercise raised many questions, sending the researcher for validation in the literature and for further observations through additional individual discussions. In the same time period, the development of ideas for innovation KPIs that might be relevant to the case company began. This process brought up the need to validate what is feasible in the company’s context given its existing systems as well as its various communication processes. A system mapping workshop was developed to better understand the formal and informal communication tools, methods, and processes linked to innovation with the key stakeholders. This exercise was not only useful to the researcher but also to the company’s stakeholders, most of whom do not have a good understanding of the system beyond their work group or department and do not fully understand how their everyday work fits in the bigger picture. The mapping exercise helped uncover structural problems they did not know they had.

5. Be flexible

After four months in the field, it was clear to the research group that the company’s organizational culture was not favourable to innovation. However, some of the key stakeholders strongly disagreed with this interpretation. As the research group believed that the company must address some of its cultural challenges to be able to improve its innovation management capabilities, it was necessary to validate the cultural assessment using an objective and proven tool. To do so, the researcher chose to administer the Innovation Quotient questionnaire developed by Rao and Weintraub (2013). This questionnaire assesses how innovative a company’s culture is based on six building blocks. Respondents of different departments and hierarchical levels were able to choose between two ways of taking the survey: self-administered online or interviewer-administered in person. The latter had the potential for follow-up questions and discussions contributing additional insights. The results were clear and supported the researchers’ initial assessment. This time, the stakeholders that initially strongly disagreed with this assessment were ready to face the facts. This helped them adjust their approach to improving innovation management at the company.

After five months, with enough understanding of the company’s context, it was time to prepare a first proposal of innovation KPIs. This provided enough time to gather feedback, to figure out what is more appropriate in the context, and to iterate with an improved proposal. The feedback was mostly gathered through individual interviews. Several work sessions with a few key stakeholders were held to better adapt some of the KPIs to the company’s needs and capabilities.

6. Be open to unexpected results

Several months later, the researcher finished her mandate, leaving the company with a proposal of five innovation KPIs fully customized to the company’s context and current needs. The proposed KPIs were different from what could have initially been expected and, more importantly, answered a different need than what was initially expressed by the company (Lakiza & Deschamps, 2018). While the original mandate asked for KPIs to measure the success of innovation endeavours, the company’s innovation processes were not mature enough to be measured and its culture was not open enough to accept such KPIs. The final KPIs had the goal of helping the company develop behaviours more favourable to innovation in order to ultimately increase the maturity of their innovation process, focusing on what they currently needed and what could help them move forward as opposed to providing tools that they were not ready to use (Lakiza & Deschamps, 2018). This result was unexpected, but very useful. It is a perfect illustration of how action research can help overcome the second limitation of traditional research (the incapacity of managers in using research findings to improve their organizations) and lead to better acceptance and use of research findings by the managers.

There was nothing on the importance of process maturity in the innovation performance measurement literature (Lakiza, 2018). This link would have been difficult to make if the researcher was not present full time at the company collaborating with a fellow researcher who did a process maturity assessment of that company’s innovation processes. Such an assessment was also not planned for in his initial research plans; its need came up through the iterative process. “To discover an unexpected connection is to discover a new set of implications” (Weick, 1989). This opens doors to a plethora of new questions and research potential. The link with process maturity had a substantial impact on the research referenced in this article and its conclusions, becoming an integral part of the conceptual framework and propositions issued from the research project (Lakiza, 2018). This shows how the action research project was useful in overcoming the first limitation of traditional research (difficulties experienced by researchers in translating research findings into tangible solutions in industry) by producing more relevant research findings both for practice and academia.

The iteration principle was also applied at a larger scale to the different phases of the longitudinal research. During each phase, the understanding of the company’s context and its real needs were deepened. The projects proposed for the next phase were adjusted accordingly. The work done during phase III was very different from what could have initially been forecasted based on phase I discussions. Indeed, the company’s real needs were different from those expressed by its stakeholders. In addition, the lack of innovation management knowledge led its managers to seek tools and processes that were either not appropriate for them or that they were not ready to use.

Conclusion

In social science, the systems under study are open rather than closed (Henshel, 1971) and the correspondence between concepts and observables is loose (Weick, 1989). Thus, the contribution of social science “does not lie in validated knowledge, but rather in the suggestion of relationships and connections that had previously not been suspected, relationships that change actions and perspectives” (Weick, 1989). The central contribution of this article is to illustrate, through a case study, how it is possible to achieve this through action research. The authors suggest that such impacts can be attained by applying the four guiding principles described herein and systematically adapting them over time using the six success factors described and illustrated in the case study above.

As presented in Table 1, action research can provide multiple benefits to industry and academia, bridging the gap between these two worlds that live in different paradigms and speak different languages. Based on the field experience described herein, it is concluded that the application of these four guiding principles can help make an action research project useful to both these worlds. Several examples of how they were applied throughout the action research project in the case company were illustrated in this article. The guiding principles are derived from the authors’ past and recent experience, and by no means are meant to be exhaustive. A comprehensive survey of what makes action research valuable, and how to better implement it and adapt the research methodology to the research context, would be of interest.

Moreover, this article provides insights to researchers and practitioners that would be tempted to learn more about and eventually apply longitudinal action research. It offers tangible recommendations for the implementation of the proposed guiding principles (see Table 2) in the form of steps and ways to behave and interact as a field researcher. In order to have an impactful research methodology that would provide value to academia and industry, the researchers must adapt and iterate as the case study unfolds. The authors discussed their methodology and, based on their cumulative experience, suggest six success factors, related to a general code of conduct to use Action Research properly: Be prepared, Be clear, Be involved, Be patient, Be flexible, and Be open.

The main limitation of this article is the fact that it is mainly based on the authors’ experience and insights gained from a case study, although the conclusions and recommendations are supported by many proponents of action research cited in this article. The authors consider this article as an exploratory phase of a systematic search for factors to be applied for impactful action research. It would be important to support the propositions herein with a more extensive literature review and additional field studies using action research methodology in multiple industrial contexts. This would help develop more robust and generic guiding principles, and potentially success factors adaptable to the specific action research objectives and the profile of the company under study.

Another limitation is that the article outlines the benefits of action research when properly applied, but neglects to discuss at length its risks, costs, and limitations. Besides the benefits of the application of these guiding principles and success factors, this approach has inherent additional costs that were not the subject of discussion in this article, such as a longer data collection and analysis process and a stronger implication of the researcher in the process, not only in terms of their time, but also in terms of personal involvement. Furthermore, action research is not for everyone: beyond the researcher’s experience and skills necessary to put in place the key success factors, the will and personal investment are significant. Moreover, it would be of interest to further explore the role of the researcher’s background and experience, and how to develop a researcher’s set of relevant skills.

The authors hope that this article can help bridge the research–practice gap by sharing tangible examples, success factors, and guiding principles that can help researchers design a productive action research project. Most importantly, the authors hope that this article and the practical experience and insights from the field that were shared will help make the value, the steps, and the success conditions of an action research project more tangible and accessible for researchers who want to try it. They also hope that the examples provided in this article can help companies see the benefits of working more with academia, notably through action research partnerships.

References

Brodeur, J., Deschamps, I., & Lakiza, V. 2017. NPD Implementation: Beyond Best Practices. Paper presented at the ISPIM Innovation Forum, Toronto, Canada, March 19–22, 2017.

Bryman, A. 2016. Integrating Quantitative and Qualitative Research: How Is It Done? Qualitative Research, 6(1): 97-113.

https://doi.org/10.1177/1468794106058877

Denzin, N. K., & Lincoln, Y. S. 2008. The Landscape of Qualitative Research. Thousand Oaks, CA: SAGE.

Esterberg, K. G. 2002. Qualitative Methods in Social Research. Boston, MA: McGraw-Hill.

Gopal, S., & Clarke, T. 2016. Guide to Actor Mapping. Boston, MA: FSG.

https://www.fsg.org/tools-and-resources/guide-actor-mapping

Henshel, R. L. 1971. Sociology and Prediction. The American Sociologist, 6(3): 213–220.

https://www.jstor.org/stable/27701765

Hlady-Rispal, M. 2016. Une stratégie de recherche en gestion. Revue Française de Gestion, 41(253): 251–266.

http://doi.org/10.3166/rfg.253.251-266

Holton, J. A. 2010. The Coding Process and Its Challenges. The Grounded Theory Review, 9(1): 265–289.

Horowitz, M. 2014. The Dance of We: The Mindful Use of Love and Power in Human Systems. Amherst, MA: Synthesis Center Incorporated.

Katzenbach, J., & Harshak, A. 2011. Stop Blaming Your Culture. strategy+business, 62: 35–42.

Katzenbach, J., Thomas, J., & Anderson, G. 2019. The Critical Few: Energize Your Company’s Culture by Choosing What Really Matters. Oakland, CA: Berrett-Koehler Publishers.

Kvale, S. 1996. InterViews: An Introduction to Qualitative Research Interviewing. Thousand Oaks, CA: SAGE Publications.

Lakiza, V. 2018. Relationships Between Performance Measurement Systems, Intrapreneurial Culture and Innovation Capabilities: A Longitudinal Field Case Study. Master’s dissertation. Montreal: Polytechnique Montreal.

Lakiza, V., & Deschamps, I. 2018. How to Develop Innovation KPIs in an Execution-Oriented Company. Technology Innovation Management Review, 8(7): 14–30.

http://doi.org/10.22215/timreview/1168

Lindblom, C. E. 1987. Alternatives to Validity: Some Thoughts Suggested By Campbell’s Guidelines. Knowledge, 8(3): 509–520.

https://doi.org/10.1177/107554708700800305

Patton, M. Q. 1987. How to Use Qualitative Methods in Evaluation. Thousand Oaks, CA: SAGE.

Rao, J., & Weintraub, J. 2013. How Innovative Is Your Company’s Culture? MIT Sloan Management Review, 54(3): 29–37.

Robson, C. 2002. Real World Research (2nd ed.). Oxford: Blackwell Publishing.

Rousseau, D. M. 2006. Is There Such a Thing as “Evidence-Based Management”? Academy of Management Review, 31(2): 256–269.

https://doi.org/10.5465/amr.2006.20208679

Saunders, M. N., Lewis, P., & Thornhill, A. 2011. Research Methods for Business Students (5th ed.). Delhi: Pearson Education India.

Schein, E. H. 1999. Process Consultation Revisited: Building the Helping Relationship. Boston, MA: Addison-Wesley.

Schein, E. H. 2009. The Corporate Culture Survival Guide (2nd ed.). Hoboken, NJ: John Wiley & Sons.

Stake, R. E. 2000. The Art of Case Study Research: Perspectives on Practice (2nd ed.). Thousand Oaks, CA: SAGE.

Strauss, A., & Corbin, J. 1998. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory (2nd ed.). Thousand Oaks, CA: SAGE.

Suddaby, R. 2006. From the Editors: What Grounded Theory Is Not. Academy of Management Journal, 49(4): 633–642.

https://doi.org/10.5465/amj.2006.22083020

Tellis, G. J., Prabhu, J. C., & Chandy, R. K. 2009. Radical Innovation Across Nations: The Preeminence of Corporate Culture. Journal of Marketing, 73(1): 3–23.

https://doi.org/10.1509/jmkg.73.1.003

Weick, K. E. 1989. Theory Construction as Disciplined Imagination. Academy of Management Review, 14(4): 516–531.

https://doi.org/10.5465/amr.1989.4308376

Yin, R. K. 2013. Case Study Research: Design and Methods (5th ed.). Thousand Oaks, CA: SAGE.

Keywords: action research, guiding principles, Innovation management, research practice gap, success factors