AbstractThe living lab forces each company to make a product market ready.

A company representative from the eHealth accelerator

Through this study, we seek to understand the impact of the use of the living lab approach on product and business development in an eHealth accelerator. In the case accelerator, 20 startups developed innovative products atop the European FIWARE Future Internet technology platform. The novel design element of the case accelerator was the use of the living lab approach that was included for the purpose of engaging end users in the development and testing of new product prototypes. Our main result is that the living lab approach provided added value to participating companies and resulted in changes in their product development and marketing strategies. Overall, the case accelerator and the use of the living lab approach had a significant impact on the development, growth, and market success of the companies. Based on the results of the case accelerator, we propose the generic accelerator model presented by Pauwels and co-authors in 2016 to be extended with a new design element, the living lab approach.

Introduction

This article contributes to the research of new business development within accelerator programs using the living lab approach in the particular field of eHealth. Although the accelerator phenomenon originating from the United States is rather new, it has been recognized nationally and internationally as a key contributor to the success of business startups (Dempwolf et al., 2014). Due to its relatively short history, research on the impact of accelerators on new businesses is scarce, and systematic information is thin and fragmented (Cohen & Hochberg, 2014; Hallen et al., 2016; Hathaway, 2016; Hoffman & Radojevich-Kelley, 2012). Pauwels and co-authors (2016) have conducted pioneering accelerator research, synthesizing a generic accelerator model from 13 case accelerators. However, research regarding a novel element, the living lab approach, within an accelerator is missing. Hence, this article offers new knowledge and a different viewpoint to this topic, further developing the generic accelerator model.

Our case accelerator is the European multi-phase accelerator FICHe (Future Internet CHallenge eHealth). FICHe was one of the 16 accelerators in the FIWARE Accelerator Programme that was a part of the 6-year €450 million Future Internet Public-Private Partnership Programme (FI-PPP) launched by the European Commission in 2011. The aim of the FI-PPP programme was to speed up the development and adoption of Future Internet technologies in Europe. This included the development of Future Internet technology platform called FIWARE. The FIWARE Accelerator Programme then challenged European small and medium-sized enterprises (SMEs) and startups to develop innovative applications and businesses on selected industry sectors using the FIWARE technology (EC, 2018; FIWARE, 2016).

The purpose of this study is to understand the impact of the living lab approach on product and business development in FICHe. We focus especially on the third and final phase of FICHe, which used the living lab approach to engage end users in product and business development through field trials conducted according to the living lab approach. In FICHe, the living lab approach referred to multi-stakeholder participation, in particular end-user involvement in the development of eHealth solutions from idea to market-ready prototype that were tested in an authentic use environment with end users. In FICHe, the term “end user” referred to the members of the intended target group of a particular eHealth solution, such as patients, consumers, doctors, nurses, and clinicians. The term “customer” referred to the target organization to which a particular eHealth solution was planned to be sold, such as hospitals and clinics. The research data have been collected from the 20 companies (finalists) that were selected for the final phase of the accelerator, out of the 80 companies selected for the first phase through an open call. At the end, the 20 companies delivered market-ready eHealth solution tested with end users in living labs.

The article is organized as follows. First, we overview related work in the research literature. Then, we present the research design, the case accelerator, and the method used to collect and analyze the research data. Then, we report our empirical findings on the living lab approach, propose a new accelerator model extended with the living lab element, and discuss the case accelerator’s impact on business development. Finally, we conclude the article with our responses to the research questions, and we provide final remarks.

Related Research

Accelerators

Accelerators have become a common component of regional growth infrastructure, playing a key role in scaling up growth-oriented startups (Hathaway, 2016). After the “Internet bubble” burst in 2000, the burden and risk of investing in nascent firms was left to angel investors, as venture capitalists (VC) were reluctant to fund them anymore. Due to this, many new ventures had difficulties in raising funding to launch their business. This led to the birth of new investment firms known as accelerators (Hoffman & Radojevich-Kelley, 2012). The first accelerator, Y Combinator, was founded in 2005 in the USA, followed by Techstars in 2007. Also in 2007, the first European accelerator, SeedCamp, was set up in the United Kingdom.

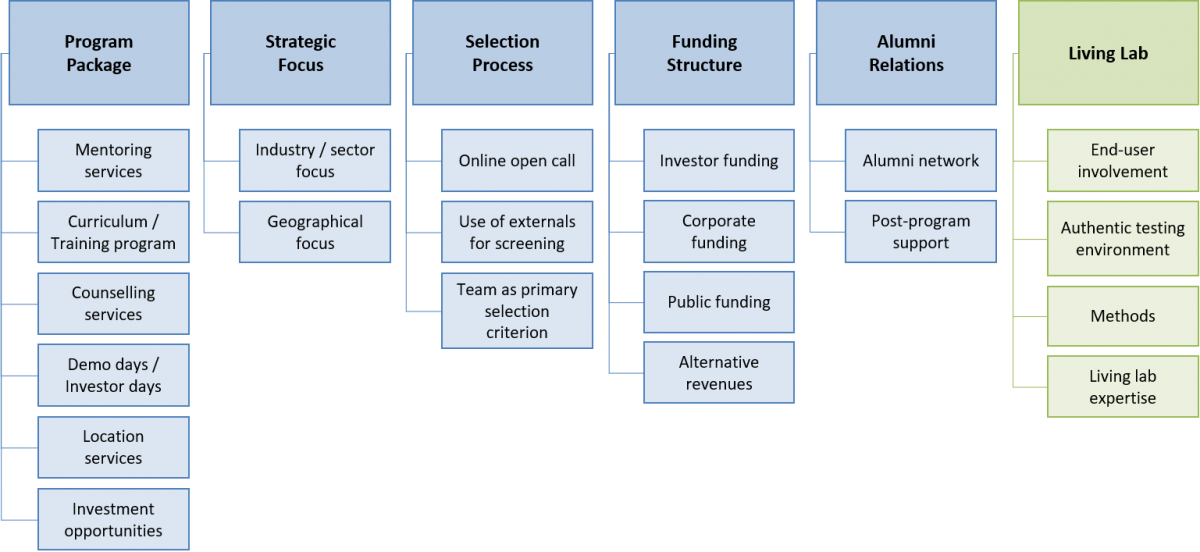

Accelerators aim to help startups to further develop their initial business idea, identify customer segments, and build the team during the formation stage of the venture. Building on research by Zott and Amit (2010) and studying 13 different accelerators, Pauwels and co-authors (2016) proposed a generic accelerator model that comprises five design elements and three design themes. The five design elements, as described below, are they key building blocks of the accelerator model:

- Program package: the services offered to startups

- Strategic focus: a choice regarding industry, sector, or geographical focus

- Selection process: how the SMEs are selected by the accelerator

- Funding structure: investor, corporate, public, or alternative resources

- Alumni relations: the accelerator’s relationships with its alumni

The design themes reflect three ways of orchestrating and connecting the design elements (Zott & Amit, 2010) within a particular accelerator:

- Ecosystem builder: develops an ecosystem of customers and stakeholders around the accelerated company

- Deal-flow maker: identifies promising investment opportunities for business angels, venture capitalists, or corporates

- Welfare stimulator: promotes startup activity and boosts economic growth, within either a specific region or a technological domain. The welfare accelerator’s stakeholders usually include government agencies.

Moreover, accelerators characteristically set up programs of limited duration that select startups in batches through open calls and end with a demo day where startups introduce and pitch their solutions to investors. Accelerators typically provide seed funding, training, mentorship, and networking opportunities with peer startups, mentors, and investors (Cohen & Hochberg, 2014; Dempwolf et al., 2014; Hathaway, 2016; Hoffman & Radojevich-Kelley, 2012). The most commonly mentioned benefits of accelerators are networking opportunities and mentorship (Cohen, 2013; Hoffman & Radojevich-Kelley, 2012).

In recent years, the number of new accelerators has been growing rapidly, and they have increasingly focused towards specific industries such as health. The first health accelerator, Rock Health, emerged in 2011 (Apodaca, 2013; Cohen & Hochberg, 2014). By 2017, over 7,000 startups have been accelerated in over 600 programs and they have collectively raised over $29,000 million USD of funding (Christiansen, 2017). However, according to a report by the California Health Care Foundation (Apodaca, 2013), the fast and iterative accelerator approach that has been successful in the Internet sector, is not necessarily a proper model for the complex and entrenched healthcare field. The report suggests that healthcare startups would benefit from services such as direct interaction with customers to gain understanding of the real operating environments, testing of products with experienced clinicians and medical staff, and tailored programs given that health technology startups have wide range of needs depending on their stage of development (Apodaca, 2013). Hence, the living lab approach, which builds on end-user involvement, was identified as potentially appropriate for an eHealth accelerator.

Living labs and new product development

The living lab approach has emerged from user innovation (von Hippel, 1976, 2009), open innovation (Chesbrough, 2003), and related paradigms, the most recent trend being the shift to open innovation 2.0 (OI2), which emphasizes experimentation and prototyping in quadruple-helix settings, enabling easy and fast access to co-creation spaces geographically or thematically (European Commission, 2016). The living lab can be seen as a methodology that emphasizes end-user involvement and multi-stakeholder participation in the development of services and products. The approach is positioned in between user-centered design and participatory design (Dell’Era & Landoni, 2014). This research era is rather new, and still no coherent, widely recognized definition exists (Dell’Era & Landoni, 2014; Leminen et al., 2012; Westerlund et al., 2018). Schuurman (2015) views the living lab as a specific approach that offers a structured approach to open innovation and that has been used specifically by startups and SMEs. The five key elements that are essential in a living lab are: active user involvement (empowering end users to thoroughly impact the innovation process), a real-life setting (testing and experimenting), multi-stakeholder participation (involvement of end users and other stakeholders), a multi-method approach (different methods and tools), and co-creation (iterations of design cycles with different sets of stakeholders) (ENoLL, 2019; Robles et al., 2015).

Living labs are driven by two main factors: involving users in the early stages of the innovation process and experimentation in real-world settings that aim to provide structure to user participation (Almirall & Wareham, 2008). Therefore, living lab projects are a specific case of open innovation where companies open up their innovation processes to users or customers (Schuurman et al., 2013), which can be linked to the user innovation paradigm originally presented by von Hippel (1976). The living lab approach has been seen as particularly beneficial in the development of new products or services as the design process allows users to interact with the new products and services in their daily lives (Bergvall-Kåreborn & Ståhlbröst, 2009; Dell’Era & Landoni, 2014). Thus, end-user feedback and experience through, for example, user testing, can bring up novel insights and issues that the product or service developer has not necessarily been aware of (Anttiroiko, 2016; Haukipuro et al., 2014, 2016; Ståhlbröst, 2013). The earlier the users are involved, the more beneficial it may prove to be; for example, development costs can be saved when living lab testing is conducted in the early phase of the development, when adjustments and corrections based on user feedback are still possible to make cost-efficiently.

Research Design

The case study research approach aims to create understanding of the dynamics of a contemporary phenomenon in context. It is suitable for description and deduction, in particular when seeking answers to “how” and “why” questions (Yin, 1994). One advantage of the case study approach is that it helps to create deeper understanding of specific instances of a phenomenon (Santos & Eisenhardt, 2004). In this study, a multiple case study approach was applied, so that each of the 20 companies is regarded as an individual case. Multiple case research begins with data and ends with theory, includes a priori defined research questions, clearly designated populations to be investigated and from which to draw observations as well as to construct definition and measure them with triangulation. The ultimate aim of the multiple case study is to develop theory by dismantling and re-assembling the research objects at a higher level of abstraction (Santos & Eisenhardt, 2004). One benefit of the multiple case study is that it enables data analysis within each case and across different situations. The multiple case study aims to understand the similarities and differences between the cases and therefore identify important influences (Gustafsson, 2017). In this study, the findings are based on multiple data sources such as interviews, surveys, and documents gathered from the 20 companies participating in the FICHe accelerator. Due to the time period and multiple phases of the accelerator, the data comprised a large entity that was systematically analyzed and organized in accordance with selected research themes and questions. The interpretation of the data, triangulation, and connections were compiled, and the conclusions were drawn from the basis of key findings.

Case accelerator: FICHe

The objective of the FIWARE Accelerator Programme was to boost the adaptation of FIWARE technologies among application developers encouraging entrepreneurs, SMEs and startups to develop innovative solutions based on the FIWARE technology (FIWARE, 2016). The Accelerator Programme comprised 16 different accelerators focused on eight industrial sectors. FICHe was the only accelerator focusing on eHealth with €6.24 million of total funding. While most accelerators had multiple programs, a few, including FICHe, had only one program comprising a three-phase funnel model where, after each phase, half of the companies were selected to continue to the next phase. All accelerators offered funding, coaching and mentorship, business and FIWARE training, as well as networking opportunities. FICHe differed from other accelerators in that, at the end of the accelerator process, there was a living lab phase that involved testing and validation of prototypes with end users. This was due to two key reasons. In FICHe, the health sector influenced the selection of the living lab approach as, for example, the Spanish consortium partners considered that validating the solutions in a real environment such as hospitals with professionals and end users (patients) was crucial for the development of successful eHealth solutions. Furthermore, one of the aims of FI-PPP was user involvement due to which, for example, the European Network of Living Labs (ENoLL) promoted living labs to be included in FIWARE accelerator programme (Ballon, 2013; Rucic & Kivilehto, 2011).

Figure 1 depicts the phasing and services of FICHe. The initial selection of companies was conducted through an open call that received 308 applications from over 30 countries in Europe. An independent review committee selected the 80 highest-potential proposals complying with the requirements of the open call. The two main selection criteria were the market opportunity of the proposed eHealth solution and the quality of the team. After the first and the second phases, the review committee selected the companies that would advance to the next phase. FICHe ended with a demo day where the companies introduced their solutions to investors and key stakeholders. Thus, the overall outcome were 20 market-ready prototypes of new and innovative eHealth solutions built atop the FIWARE technology. The main objectives of the three phases of the accelerator (Figure 1) were as follows:

- Phase 1 (80 companies): support SMEs and startups in maturing their idea into a business model, €15,000 funding

- Phase 2 (40 companies): support SMEs and startups in building proof of concepts (PoCs) based on the FIWARE technology, €50,000 funding

- Phase 3 (20 companies, “finalists”): support SMEs and startups in turning their PoC into a working prototype, create go-to-market strategy, and test the prototype in living labs, €152,000 funding.

Figure 1. The phasing and services of the FICHe accelerator.

The services provided by FICHe included living lab services, business and technology training, networking, and mentoring. The overall goal of the living lab was to enable testing of eHealth prototypes in real environments with end users in Phase 3. In the first two phases, companies were encouraged to utilize three different living labs of distinct focus areas – business to business, healthcare, and consumer markets – to engage end users in the development of the companies’ solutions. Bootcamps were organised to train companies on maturing eHealth solution ideas into business models, and on the living lab concept. Training on user research focused on user involvement methods, setting up a well-organized living lab, and engaging end users in testing. For example, the bootcamp organized in Oulu, Finland, included a workshop where company representatives engaged in feedback discussions with different types of end users (n=11) regarding their eHealth solution ideas. A living lab platform and end-user involvement tool called PATIO (Anttiroiko, 2016; Haukipuro et al., 2014, 2016), was used to invite consumers to the workshop. PATIO was made available to other bootcamps and FICHe companies, as well, and it was used for collecting end-user feedback on PoCs through online surveys. In Phase 2, the companies’ needs for support regarding the implementation of living labs were identified, and companies prepared plans for the upcoming living lab activity to be conducted in Phase 3. With the guidance of the FICHe mentors, the 20 finalists documented the execution and results of living lab activities.

Data collection and analysis

Table 1 describes the primary and secondary research data used in this study. Our primary research data consist of in-depth interviews of company representatives, several questionnaires conducted in different phases during and after FICHe, and a variety of documents provided by companies. In-depth interviews are optimal for documenting individuals’ personal histories, perspectives, and experiences, particularly when sensitive topics are being explored (Mack et al., 2005). Secondary data comprises project documents, project reports, and surveys used as supporting material. Based on the data, we seek to address the following two research questions:

RQ1: What was the experienced impact of the FICHe accelerator on the development of new businesses by the participating companies?

RQ2: How did the participant companies experience the impact of the living lab, in particular end-user involvement, during the FICHe accelerator (i) on the development of their eHealth solutions, and (ii) on market access?

Table 1. Description of research data

|

Primary Research Data |

When |

n |

Type |

Used to Assess |

|

Living lab planning survey |

Phase 2 |

20 |

Questionnaire |

Living lab impact |

|

Living lab planning one-on-one discussion |

Phase 2 |

20 |

Interviews with key company personnel |

Living lab impact |

|

Phase 3 plan |

Phase 3 |

20 |

Document provided by company |

Business & living lab impact |

|

Living lab reports |

Phase 3 |

20 |

Report provided by company |

Living lab impact |

|

Go-to-market strategy |

Phase 3 |

20 |

Document provided by company |

Business impact |

|

Business model |

Phase 3 |

20 |

Document provided by company |

Business impact |

|

FICHe impact survey |

After Phase 3 |

20 |

Questionnaire |

Business & living lab impact |

|

Follow-up survey |

1 year after FICHe |

9 |

Questionnaire |

Current business & living lab status of finalists |

|

Secondary Research Data |

When |

n |

Type |

Used to Assess |

|

FICHe application forms |

Phase 1 |

20 |

Open call application of company |

Basic information of companies |

|

FI-IMPACT business survey |

Phase 1 |

20 |

Questionnaire |

Basic information of companies |

|

FICHe project reports |

Phases 1–3 |

10 |

Reports provided by FICHe project |

Business & living lab impact |

|

Desk follow-up study |

1 year after FICHe |

11 |

Questionnaire |

Current status of finalists |

The collected data were evaluated and analyzed for patterns and linkages. Following the principles of the multiple case analysis method, cases were treated as separate instances of the focal phenomenon, which allows replication, aiming to create as close a match between data and theory as possible (Santos & Eisenhardt, 2004). The data analysis was continued following a deductive approach so that concepts were searched from the data under the pre-defined themes. The concepts were then grouped to categories and named.

The key data of the 20 finalist companies are presented in Appendix 1. They were mostly (80%) startups with a relatively small team of application developers or service providers. Among the solutions, 60% were based on a completely new (disruptive) approach whereas 40% were improvements to an existing solution (incremental). The main target market (90%) was business to business (B2B) and, in the beginning of the FICHe, 70% of the companies aimed at a global market.

Findings

Companies’ expectations and needs regarding the use of living labs were collected with the “living labs planning survey”. Additionally, the interviews of the company representatives during an eHealth event were conducted as one-on-one discussions. At the beginning of Phase 3, companies submitted their plans for the upcoming living lab activity.

Our analysis shows that the finalists did not have a clear plan or knowledge about user involvement methods at the mid-stage of the accelerator. For instance, they were not aware of available living labs or methods to involve end users in testing. Almost all finalists needed guidance to set up a living lab and conduct user studies. Similar findings were obtained from the one-on-one discussions with company representatives. Planning documents provided by the companies in Phase 3 varied a lot in terms of the maturity of their intended use of living labs. To summarize, most finalists were not familiar with the living lab approach and thus needed strong support, guidance, and training from FICHe in planning and implementing the testing of their prototypes in a living lab.

Implementation of living labs

The living lab reports of the finalists documented the implementation and outcome of their living lab testing. The reports showed that companies conducted several tests (1–6) in their living labs. All finalists were offered an opportunity to exploit some of the three living labs provided by FICHe in the Netherlands, Spain, and Finland. However, based on the reports, most companies used local living labs residing in public or private clinics or hospitals, for example. The duration of living lab testing varied from few weeks up to nine months. In addition, the methodology used in the living labs differed mainly due to the varying nature of the companies’ prototypes. Therefore, the living lab testing of some technical hospital solutions was reminiscent of clinical testing. End users were involved in all living labs; observations, interviews of users and professionals, focus group discussions, and surveys were among the most common user involvement methods.

As an example of a living lab implementation, company 58 reported their living lab activities as follows. First, they made a baseline measurement, which consisted of four observation periods in a care institution where their solution was used. Second, they organized two focus group discussions, one for patients and another for care personnel. Third, they conducted user tests of their prototype with ten users. Fourth, they conducted desk research with input from domain experts. Based on the feedback received from focus group discussions and user testing, the company modified their prototype, changed its design, adjusted the application, and refined their solution to meet the criteria of the care facility and markets.

After the last phase, the finalists completed the FICHe impact survey to provide feedback on various issues, including the benefits of the program, the living lab activity, impact on business, the value of the FIWARE technology, and overall progress during the accelerator. Sixteen of the 20 finalists confirmed that FICHe has contributed to the reinforcement of the company to successfully access international funding and markets. Funding, promotion and visibility, contacts (especially investors), opportunities to test in the living labs, and mentoring in refining the strategy, focus, or business model were among the most often-mentioned forms of FICHe contribution. However, two companies stated that FICHe had not made any contribution, and two companies expected FICHe’s contribution to be possibly realized only after the end of the accelerator.

“Thanks to the living labs we could test and validate the technology and we could get international contacts.” (Company 79)

When asked how FICHe accelerator has contributed to the development, the finalists’ responses varied considerably, but some consistencies were found. Mentoring and coaching were mentioned in many answers, as they had been helpful in creating business models. Funding and the living lab activities were also mentioned in several answers.

“At the end of the programme we have validated our business model and our product. We have our product working in an important hospital, having a good reference makes it easier to find customers, and we have more knowledge after the living lab.” (Company 29)

“[Because of the] focus on the living lab, we now have a product that is tested and new revenue stream models in different markets.” (Company 22)

Fourteen out of the 20 finalists reported that the involvement of end users had brought up untapped opportunities that had resulted in new business. For example, companies stated that they had obtained new development ideas from users, leading to new features in their solutions. New contacts, marketing of the solution, and greater visibility were also mentioned as positive effects of end-user involvement. Some companies also found a new market niche through the living lab activity:

“We have found processes in the hospital that we didn’t think about before, where our product can be applied, which will bring us new opportunities in the near future.” (Company 29)

According to the findings, all 20 finalists reported that the impact of the living lab had been significant to the development of their eHealth solutions. In particular, the companies improved their solutions based on end-user feedback in form of adjustments, changes, and new features. The use of the living lab resulted in better solutions, thereby increasing the reliability and usability of the solutions. Additionally, living lab testing informed one company that the market for their solution was different than they had initially thought.

“It has helped us to detect problems on our solution and fix technical bugs. We have learned a lot about the public health sector and its technology.” (Company 5)

Based on the findings, nearly all companies planned to use living lab and involve end users in the future. All 20 finalists appreciated the overall value of end-user involvement as an essential part of current and future development. They clearly regarded the living lab activities conducted during FICHe as beneficial. Only one of the 20 finalists stated that they were not interested in living labs in the future, but still planned to include “end-user interviews” in their future operations.

“The living lab [user testing and refinement] is essential in any development process. We will be continuing to do this in the future.” (Company 53)

“…we plan to do more living lab trials before extending our platform for new scenarios. Living labs provide the opportunity to tune your product for the user.” (Company 65)

“The user feedback has been the most valuable asset in our living lab and has guided our product development iterations.” (Company 46)

Overall, end user feedback was highly valued among the companies. One of the 20 finalists found that end-user involvement helped them to find the right business model and target group. The fixed scheduling of the living lab activity forced the companies to focus on relevant development actions to come up with a prototype that was mature enough for user testing.

“The living lab forces each company to make a product market ready.” (Company 14)

“FICHe has been ‘a pressure cooker’ in terms of developing our product and making it market ready.” (Company 58)

“In our case, providing us with a living lab environment to run a pilot has been the most appreciated benefit. This is the first requirement that an e-Health startup should accomplish in order to access international markets.” (Company 39)

Some finalists stated that the living lab phase should have been longer as, according to them, setting up and implementing the living lab was time-consuming. Overall, the companies felt that they received a lot of guidance, training, and help when it they were needed.

Follow-up survey

The 20 finalists were invited to complete a follow-up survey about a year after the conclusion of FICHe. The purpose of the survey was to report their status in terms of business activity, the number of employees and customers, current markets, and especially the living lab concept. The companies were asked whether they had continued the living lab activities started during FICHe, and, retrospectively, how they considered the impact of the living lab on their market access and product or service development. In total, nine responses were received to the follow-up survey, and all of these companies are still active in business. Five respondents employed less than ten people, two employed 11–29 people, one employed 30–49 people, and one employed 50–100 people. Three respondents had less than ten customers, two had 10–49, one had 500–1000, and one had more than 1,000 customers. There were no significant changes in their target markets: all nine companies still operated in Europe, three of them also operated in America, and one of them also operated in Asia. One company operated only in a regional/national market. Three companies had expanded remarkably through acquisitions and private funding after FICHe, whereas other companies had mainly continued with the same organizational structure and team. However, most of them saw high growth potential in the near future.

Seven of the nine companies reported having continued living lab and end-user involvement activities after FICHe, for example “to seek further validation of the solution” and “to assess the impact”. One company even had established its own living lab for end-user testing. The two companies who did not continue living lab activities attributed it to a lack of funding. The companies were asked to assess the impact of living lab testing on market access and product/service development of their eHealth solution on a five-point Likert-type scale (1=no impact, 5=high impact). Regarding market access, three companies felt the impact was neutral, while four companies found living labs to have some impact. The impact on product/service development was found to be much stronger; five companies reporting high impact and three companies reported some impact. Retrospective feedback on the benefits of the living lab activities conducted during FICHe was highly positive:

“[The living lab] provides a unique opportunity to perform user-centered design activities, thus increasing the likelihood of having a final result that the target customers/users will adopt.” (Company 22)

“...some of the [end-user] feedback was of such a fundamental nature that it necessitated the radical change of some of the design principles. Without the living lab, we’d still be under the impression that our design was perfect.” (Company 58)

Finally, a desk follow-up study was conducted to verify the status of the 11 companies that did not respond to the follow-up survey. Based on the companies’ websites and other online sources, all of them were still active in eHealth markets in 2018.

Discussion

This case study on the FICHe eHealth accelerator provides new insight to the scientific discussion on new business development within accelerator programs. The characteristics of the accelerators described in prior research (e.g., Cohen & Hochberg, 2014; Dempwolf et al., 2014; Hoffman & Radojevich-Kelley, 2012) apply to FICHe. The main design themes and elements of the accelerator model proposed by Pauwels and co-authors (2016) apply also to FICHe. Based on our research, the impact of the living lab approach in FICHe was substantial enough that we propose it to be added as a new design element to the generic accelerator model of Pauwels and co-authors (2016), as illustrated in Figure 2. The living lab approach in FICHe enabled the development of mature, market-ready solutions tested and verified with authentic end users. As we already discussed in related work, such a direct interaction with customers/end users for the purpose of gaining understanding of the real operating environments and testing of products has been suggested by Apodaca (2013).

Figure 2. The accelerator model (adapted from Pauwels et al., 2016) extended to include the living lab element.

According to the categorization of Pauwels and co-authors (2016), the design theme of FICHe was the “welfare stimulator”. The primary objective of FICHe was to promote the use of FIWARE technology and stimulate European startup activity and economic growth. The main stakeholders in the welfare stimulator typically are government agencies, as was the case also in FICHe.

The first design element, “program package”, included the following services in FICHe: mentoring, training, direct funding, and demo days. In FICHe, the second design element, “strategic focus”, was European eHealth markets and the specific required FIWARE technology. The third design element, “selection process”, comprised an online open call, an external review committee, and the key selection criteria of eHealth and team. The fourth design element in FICHe, “funding structure”, was the EU Seventh Framework Programme funding. The fifth design element, alumni relations, included the FIWARE community in FICHe.

The new, sixth design element, “living lab”, contains end-user involvement, authentic testing environments, various methods, and living lab expertise, which are the essential elements of a living lab (ENoLL, 2016; Robles et al., 2015). The inclusion of the new design element is inspired by the findings of this study, which explicitly show the usefulness of the living lab approach in the development of new products and services, thus supporting the prior research of other researchers (Almirall & Wareham, 2008; ENoLL, 2016; Leminen et al., 2012; Schuurman et al., 2013; Ståhlbröst, 2013; Robles et al., 2015). Our study also adds to the previous research in the form of new knowledge on the applicability of the living lab approach and elements (ENoLL, 2016; Robles et al., 2015; Ståhlbröst, 2008) in the new context of accelerator programs. Our findings show that a living lab is an applicable and significant design element within accelerator programs, yielding promising results in improving companies’ market access, supporting the development of new, user validated, and desirable products, and creating recognized references for small companies. The main benefits for companies of using the living lab approach as a part of accelerator are summarized as follows:

- To improve business strategy and find the right business model and target groups.

- To gain understanding of customer needs and their use environment.

- To increase a B2B network and gain visibility.

- To obtain a valuable reference of a customer case in an authentic context.

- To accelerate product and business development.

- To receive feedback from authentic users in the early phases of product development.

- To improve a product and obtain new development ideas or features.

- To learn how to deploy end-user involvement as an essential part of product development.

Impact on business development

The changes in the sizes of the teams (jobs created) and market focus were followed during FICHe from the business development point of view. These indicators were chosen because most companies had not yet entered the market hence the number of customers was not yet available. At the beginning of FICHe, the teams of the 20 finalists were relatively small. At the end of FICHe, almost all teams had grown and altogether 150 new jobs were created. We also followed the amount of private and public funding collected by the finalists during FICHe.

Besides funding, the 20 finalists highly valued the expansion of their networks, support received from the mentors, and feedback received from authentic end users in living labs. Networking with other companies and potential partners, and connections provided with the FICHe consortium were valuable. The finalists expanded their networks considerably by establishing close collaborations with each other, obtained good insight about European startups, and established new connections to investor forums and eHealth entrepreneurs across Europe. Participating in large business and networking events as well as media presence were considered as important ways to facilitate a company’s market entry. The support and guidance from mentors were also highly appreciated, especially the support on growth processes, setting up a living lab, and sharing knowledge of eHealth and funding opportunities had a great impact on the companies. As discussed above, living lab testing facilitated the development of new business by identifying new customers and partnerships through interest and visibility gained with living lab activities.

FICHe also boosted the acceleration of the overall business development process of the finalists, brought the team members closer together, and fostered the visibility of the eHealth solutions. By being part of FICHe interactions with customers/end users to gain understanding of the real operating environments and testing of products (Apodaca, 2013), companies gained significant growth – while participating in FICHe, the most successful companies raised over €6 million of private funding. Moreover, some companies received, for example, public funding from the European Commission’s Horizon2020 SME instrument. FICHe itself provided essential seed funding that allowed the startups to get off the ground. FICHe increased the reliability and business potential of the finalists in the eyes of the investors. However, not all companies were ready for or interested in investor rounds but preferred the strategy of achieving new growth by increasing the number of paying consumers (patients) and new healthcare customers (clinics/hospitals). In every phase, companies were able to continuously revise their business models, which allowed them to generate a validated business hypothesis. FICHe supported companies by linking them to SME instrument funding, which helped them to fund the development of the missing key parts of the solutions needed for international funding and markets. In addition, two finalists were acquired by a global corporation, one during and another after FICHe, and one finalist merged with a high-end technology supplier company.

As for international markets, the living lab approach enabled the finalists to test and validate their technology and business models and get in touch with international contacts. According to the companies, the importance of testing and validation was so great that it should be the first objective for an eHealth startup before entering international markets. For companies closer to the market entry, the timing of the living lab testing was perfect and boosted final development, market entry planning, and early customer validation. Most companies typically fell behind on their product development schedule – not because they were slow but because they kept on adding new features – but FICHe kept them in pace, encouraging them to develop a rapid prototype and validate the solution with authentic end users. The finalists focused more on European markets instead of local markets: different coaching sessions, business webinars and events as well as pitch deck consultants sharpened their views on business opportunities beyond domestic markets.

Fourteen of the 20 finalists identified untapped business opportunities while participating in FICHe. For instance, the companies gathered new development ideas with patients and therapists, developed additional features to their solutions, leveraged rapid prototyping to start cooperation with other health service providers, found new markets for health monitoring by adjusting the solutions to new scenarios, won larger projects with several hospitals, and identified new hospital processes that they had not considered for their products before, thus creating new opportunities for the near future.

The follow-up survey complemented with the desk follow-up study shows that the finalists were still active on the market about a year after the conclusion of FICHe, intending to expand, and most of them continuing to use the well-proven practices of living labs and user involvement in the future development of their solutions. Retrospectively, most finalists valued the impact of the living lab approach as average or high for the development of their solutions as well as for the market access, which is remarkable from the point of view of indicating the usefulness of the living lab approach in the new business development within an accelerator. Thus, the program has wide-reaching economic impact yielding several companies with hundreds of employees.

Conclusions

This article explored new business development with accelerator programs in the form of a case study of the FICHe eHealth accelerator. FICHe differs from a typical accelerator in a way that there were specific elements such as the focus on eHealth solutions, the requirement to use the specific FIWARE technology, and the living lab approach, which in practice meant that end users were engaged in the development of the eHealth solutions from the early phase until the end of the accelerator. The 20 finalists benefitted most from the end-user involvement as the living lab testing was performed in the last phase of FICHe.

The results show that the 20 finalists gained significant growth. With the FICHe funding and services, the finalists created a significant number of new jobs, acquired several new customers and partnerships, and raised additional public and private funding. The combination of funding, coaching, and tangible outputs have contributed to the acceleration of the development of the companies’ eHealth solutions. Due to FICHe, the companies also focused more strongly on the European market instead of a regional market. For companies closer to the market entry, the timing of the living lab activity was perfect and boosted the final development and early customer validation (Väinämö, 2016).

Based on the findings, all the 20 finalists valued the outcome of the living lab activity as highly significant. The living lab testing was regarded as an essential part of product development, in particular as an effective way to make the solutions market-ready. Moreover, the living lab activity was recognized as a valuable reference for companies’ future marketing and sales, as it offered feedback from customers who had deployed the solution. In some cases, the living lab approach has merged into a company’s sales strategy as an established new practice of first setting up a living lab with a new customer and then expanding the solution to the whole organization. The finalists experienced the living lab phase as very useful for the further development of their eHealth solutions. Therefore, almost all finalists expressed their willingness to continue living lab activities in their product and solution development, as according to them, it will allow to improve further their capabilities with the help of real usage environments and advice from professionals and patients. They reported having learned during the living lab phase how to co-create with users, to understand end-user needs, and how to refine their solutions on the basis of user feedback. Some companies also found new target groups for their solutions through the knowledge gained during the living lab activity. Living labs allowed some companies to contact their target end-user group for the first time, which they valued greatly. In several cases, testing with end users revealed issues that had not been detected earlier in the development of the solutions. To conclude, the living lab approach brought significant positive impact on the development of new businesses within the FICHe eHealth accelerator program. Therefore, we propose the generic accelerator model of Pauwels and co-authors (2016) to be extended with the addition of the living lab element.

Acknowledgements

We would like to thank the FICHe accelerator consortium and the participant companies for their contributions.

The research was conducted in the FICHe accelerator project funded by the EU Commission and the FP7 program.

References

Almirall, E., & Wareham, J. 2008. Living Labs and Open Innovation: Roles and Applicability. The Electronic Journal for Virtual Organizations and Networks, 10(3): 21–46.

Anttiroiko, A.-V. 2016. City-as-a-Platform: The Rise of Participatory Innovation Platforms in Finnish Cities. Sustainability, 8(9): 2–31.

https://doi.org/10.3390/su8090922

Apodaca, A. 2013. Greenhouse Effect: How Accelerators Are Seeding Digital Health Innovation. Oakland, CA: California Healthcare Foundation.

Ballon, P. 2013. Living Labs and SMEs in FI-PPP: Some Views & Experiences from iMinds. Paper presented at Open Living Lab Days, August 27–30, 2013, Manchester, United Kingdom.

Bergvall-Kåreborn, B., & Ståhlbröst, A. 2009. Living Lab: An Open and Citizen-Centric Approach for Innovation. International Journal of Innovation and Regional Development, 1(4): 356–370.

https://doi.org/10.1504/IJIRD.2009.022727

Chesbrough, H. 2003. Open Innovation: The New Imperative for Creating and Profiting from Technology. Boston, MA: Harvard Business School Press.

Cohen, S. 2013. What Do Accelerators Do? Insights from Incubators and Angels. Innovations, 8(3-4): 19–25.

https://doi.org/10.1162/INOV_a_00184

Cohen, S., & Hochberg, Y. 2014. Accelerating Startups: The Seed Accelerator Phenomenon. SSRN, March 30, 2014.

http://doi.org/10.2139/ssrn.2418000

Christiansen, J. 2017. Seed Accelerators. Seed-DB. Accessed February 20, 2019:

http://www.seed-db.com/accelerators

Dell’Era, C., & Landoni, P. 2014. Living Lab: A Methodology between User-Centred Design and Participatory Design. Creativity and Innovation Management, 23(2): 137–154.

http://doi.org/10.1111/caim.12061

Dempwolf, C. S., Auer J., & D’Ippolito, M. 2014. Innovation Accelerators: Defining Characteristics Among Startup Assistance Organizations: Report of SBA Office of Advocacy. Washington, DC: U.S. Small Business Administration.

ENoLL. 2016. Introducing ENoLL and Its Living Lab Community. European Network of Living Labs (ENoLL). Accessed March 14, 2019:

https://issuu.com/enoll/docs/enoll-print

ENoLL. 2019. About Us. European Network of Living Labs (ENoLL). Accessed March 14, 2019:

https://enoll.org/about-us/

European Commission. 2016. The Open Innovation Yearbook 2016. Luxembourg: European Commission (EC).

European Commission. 2018. The Future Internet platform FIWARE. Luxembourg: European Commission (EC). Accessed March 14, 2019:

https://ec.europa.eu/digital-single-market/en/future-internet-public-pri...

FIWARE. 2016. FIWARE Accelerator Programme. FIWARE. Accessed March 14, 2019:

https://www.fiware.org/community/fiware-accelerator-programme/

FIWARE. 2017. FIWARE Catalogue. FIWARE. Accessed March 14, 2019:

https://www.fiware.org/developers/catalogue/

Gustafsson, J. 2017. Single Case Studies vs. Multiple Case Studies: A Comparative Study. Dissertation. Halmstad, Sweden: Halmstad University School of Business.

http://urn.kb.se/resolve?urn=urn:nbn:se:hh:diva-33017

Hallen, B. L., Bingham, C. B., & Cohen, S. 2016. Do Accelerators Accelerate? If So, How? The Impact of Intensive Learning from Others on New Venture Development. SSRN, January 23, 2016.

http://doi.org/10.2139/ssrn.2719810

Haukipuro, L., Väinämö, S., & Arhippainen, L. 2014. Living Lab as One-Stop-Shop in the Development of Public Services. Interdisciplinary Studies Journal: A Special Issue on Smart Cities, 3(4): 157–162.

Haukipuro, L., Pakanen, M., & Väinämö, S. 2016. Online User Community for Efficient Citizen Participation. In Proceedings of the 20th International Academic Mindtrek Conference (ACM): 78–85. New York, NY: Academic Mindtrek.

http://doi.org/10.1145/2994310.2994341

Hathaway, I. 2016. Accelerating Growth: Startup Accelerator Programs in the United States. Advanced Industries Series, 81. Washington DC: The Brooking Institution.

https://www.brookings.edu/research/accelerating-growth-startup-accelerat...

Hoffman, D. L., & Radojevich-Kelley, N. 2012. Analysis of Accelerator Companies: An Exploratory Case Study of Their Programs, Processes, and Early Results. Small Business Institute Journal, 8(2): 54–70.

Leminen, S., Westerlund, M., & Nyström, A.-G. 2012. Living Labs as Open-Innovation Networks. Technology Innovation Management Review, 2(9): 6–11.

https://doi.org/10.22215/timreview/602

Mack, N., Woodsong, C., MacQueen, K. M., Guest, G., & Namey, E. 2005. Qualitative Research Methods: A Data Collector’s Field Guide. Durham, NC: FHI 360.

Pauwels, C., Clarysse, B., Wright, M., & Van Hove, J. 2016. Understanding a New Generation Incubation Model: The Accelerator. Technovation, 50–51:13–24.

https://doi.org/10.1016/j.technovation.2015.09.003

Robles, A., Hirvikoski, T., Schuurman, D., & Stokes, L. (Eds). 2015. Introducing ENoLL and its Living Lab Community. Brussels: European Network of Living Labs (ENoLL).

https://issuu.com/enoll/docs/enoll-print

Rucic, H., & Kivilehto, A. 2011. Future Internet SME Engagement and Living Labs. Presentation given at the ERRIN ICT Working Group Meeting. Accessed March 14, 2019:

https://www.slideshare.net/openlivinglabs/future-internet-sme-engagement...

Santos, F., & Eisenhardt, K. 2004. Multiple Case Study. In M. S. Lewis-Beck, A. Bryman, & T. F. Liao (Eds.), The SAGE Encyclopedia of Social Science Research Methods: 685–686. Thousand Oaks, CA: SAGE Publications Ltd.

https://doi.org/10.4135/9781412950589.n596

Schuurman, D., De Marez, L., & Ballon, P. 2013. Open Innovation Processes in Living Lab Innovation Systems: Insights from the LeYLab. Technology Innovation Management Review, 3(1): 28–36.

https://doi.org/10.22215/timreview/743

Schuurman, D. 2015. Bridging the Gap between Open and User Innovation? Exploring the Value of Living Labs as a Means to Structure User Contribution and Manage Distributed Innovation. Doctoral dissertation, Ghent University, Belgium.

Ståhlbröst, A. 2008. Forming Future IT – The Living Lab Way of User Involvement. PhD thesis. Luleå, Sweden: Department of Business Administration and Social Sciences, Luleå University of Technology.

Ståhlbröst, A. 2013. A Living Lab as a Service: Creating Value for Micro-enterprises through Collaboration and Innovation. Technology Innovation Management Review, 3(11): 37–42.

https://doi.org/10.22215/timreview/744

Von Hippel, E. 1976. The Dominant Role of Users in the Scientific Instrument Innovation Process. Research Policy, 5(3): 212–239.

https://doi.org/10.1016/0048-7333(76)90028-7

Von Hippel, E. 2009. Democratizing Innovation: The Evolving Phenomenon of User Innovation. International Journal of Innovation Science, 1(1): 29–40.

https://doi.org/10.1260/175722209787951224

Väinämö, S. 2016. FICHe Project Final Report. Brussels: European Commission, CORDIS Community Research and Development Information Service.

Westerlund, M., Leminen, S., & Rajahonka, M. 2018. A Topic Modelling Analysis of Living Labs Research. Technology Innovation Management Review, 8(7): 40–51.

http://doi.org/10.22215/timreview/1170

Yin, R. K. 1994. Case Study Research: Design and Methods. Thousand Oaks, CA: SAGE Publications Ltd.

Zott, C., & Amit, R. 2010. Business Model Design: An Activity System Perspective. Long Range Planning, 43(2-3): 216–226.

https://doi.org/10.1016/j.lrp.2009.07.004

Appendix 1. The 20 FICHe finalists

|

ID |

Team Size |

Years of Operation |

Description of Solution |

Business |

Target Market |

|

17 |

2–5 |

2–5 |

An online image analysis system for detection of osteoarthritis on X-ray images |

B2B |

Global |

|

22 |

5–10 |

5–10 |

A wearable electromyography (EMG) muscle band-aid and a mobile application |

B2B |

Global |

|

23 |

2–5 |

2–5 |

Web-based diagnostic support software for viewing interactive anatomic and pathologic imagery |

B2B |

Global |

|

24 |

5–10 |

2–5 |

A multilingual service for matching international patients with healthcare practitioners |

B2B/B2C |

Global |

|

28 |

2–5 |

<2 |

A multi-platform diabetes management ecosystem |

B2B |

National |

|

29 |

5–10 |

<2 |

Biometric software for patient identification |

B2B |

Global |

|

39 |

2–5 |

<2 |

A tool to streamline the referrals of cancer patients to clinical trials |

B2B |

Global |

|

43 |

2–5 |

<2 |

A miniaturized respiratory monitor based on EMG |

B2B |

Global |

|

44 |

5–10 |

2–5 |

A multi-device platform for the care of elderly people |

B2B |

Global |

|

46 |

2–5 |

<2 |

A gamified software platform to deliver physical and cognitive therapy |

B2B |

Global |

|

47 |

5–10 |

2–5 |

A system for locating patients in hospital |

B2B |

Global |

|

53 |

2–5 |

<2 |

Virtual environments for the treatment of anxiety disorders |

B2B |

Global |

|

57 |

2–5 |

<2 |

A technology-enabled medical nutrition therapy |

B2B/B2C |

Europe, Middle East, & Africa (EMEA) |

|

58 |

5–10 |

5–10 |

An incontinence care system |

B2B |

National |

|

64 |

2–5 |

<2 |

A 3D printing orthotics service for children with special needs |

B2B |

National |

|

67 |

2–5 |

2–5 |

A mobile health platform specifically designed for people with breast cancer |

B2B |

Global |

|

71 |

2–5 |

<2 |

A deep learning platform to detect degenerative brain disease in 3D-MRI |

B2B |

EMEA |

|

76 |

2–5 |

<2 |

A remote collaboration solution for medical professionals |

B2B |

EMEA |

|

77 |

<2 |

2–5 |

An online mindfulness platform to promote wellbeing |

B2B |

Global |

|

79 |

2–5 |

2–5 |

A mobile application for the treatment of eating disorders |

B2B |

Global |

Keywords: accelerator, case study, ehealth, Living lab, Open innovation, SME, startup